IDEX Corp (IEX) Q1 Earnings: Adjusted EPS Beats, Sales Dip Amid Market Challenges

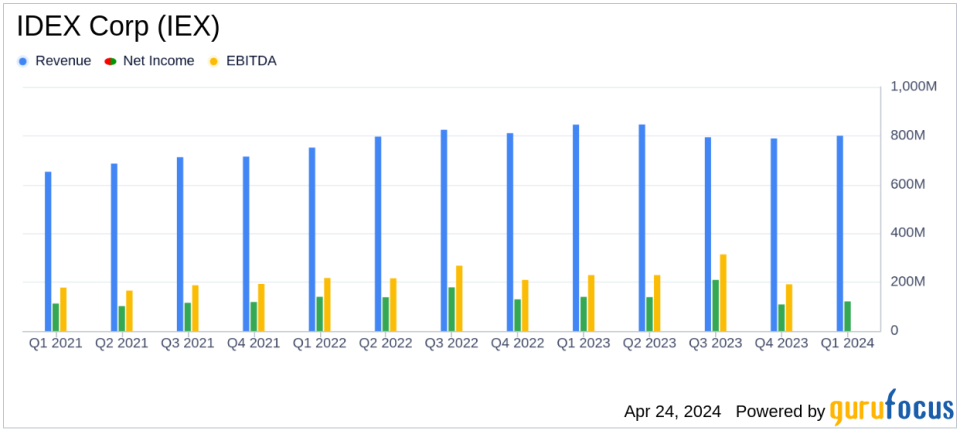

Reported Revenue: $800.5 million, a decrease of 5% year-over-year, falling short of the estimated $807.02 million.

Net Income: $121.4 million, down 13% compared to the previous year, below the estimated $134.97 million.

Diluted EPS: Reported at $1.60, down from $1.84 year-over-year, falling short of the estimated $1.76.

Adjusted Diluted EPS: $1.88, surpassing the first quarter expectations but not specified against the estimate.

Free Cash Flow: Increased by 13% to $137 million, indicating strong cash generation efficiency.

Gross Margin: Decreased slightly by 60 basis points to 44.6%, reflecting higher costs partially offset by pricing strategies.

Full Year Outlook: Projects GAAP diluted EPS in the range of $7.13 to $7.43 and adjusted diluted EPS from $8.15 to $8.45, confirming full-year guidance.

On April 23, 2024, IDEX Corp (NYSE:IEX) disclosed its financial outcomes for the first quarter ended March 31, 2024, through an 8-K filing. The company reported a decline in sales and earnings per share (EPS) but managed to exceed the adjusted EPS expectations set by analysts. The detailed earnings report reveals both the resilience and the challenges faced by the company in a fluctuating economic environment.

Company Overview

IDEX Corp, headquartered in Lake Forest, Illinois, operates globally, providing essential products such as pumps, flow meters, and other fluidic systems across various industries. With over 7,000 employees and manufacturing facilities in more than 20 countries, IDEX continues to play a pivotal role in the industrial, fire and safety, life science, and water sectors. In 2023, the company generated revenues amounting to approximately $3.3 billion.

Financial Performance Highlights

The first quarter saw IDEX achieving net sales of $800.5 million, a decrease of 5.3% from $845.4 million in the previous year. This decline was primarily due to a 6% drop in organic sales, largely influenced by lower volumes in the Health & Science Technologies segment. Despite the sales downturn, IDEX reported a strong operating cash flow of $156.6 million, up from $147.9 million in the prior year, and an increase in free cash flow to $136.6 million, marking a 13% improvement.

The company's net income for the quarter stood at $121.4 million, down from $139.8 million year-over-year, translating to a diluted EPS of $1.60, which is a decrease from $1.84 in the first quarter of 2023. However, the adjusted diluted EPS was $1.88, surpassing the analyst estimate of $1.76, highlighting effective cost management and operational efficiencies.

Segment Analysis

The Fluid & Metering Technologies segment experienced a slight decline in sales but saw an improvement in its adjusted EBITDA margin due to favorable operational productivity. The Health & Science Technologies segment faced significant challenges with a 13% drop in organic net sales, affected by market slowdowns and inventory adjustments. Conversely, the Fire & Safety/Diversified Products segment reported a modest increase in sales and an improved adjusted EBITDA margin, benefiting from effective price management and cost controls.

Strategic Initiatives and Outlook

Eric D. Ashleman, CEO of IDEX, emphasized the company's strategic focus on driving growth through operational excellence and targeted acquisitions. For the full year 2024, IDEX expects organic sales growth to range between 0% and 2%, with a GAAP diluted EPS forecast between $7.13 and $7.43, and an adjusted EPS of $8.15 to $8.45.

The company's proactive management and strategic initiatives are aimed at navigating the current economic pressures while seeking growth opportunities in high-potential markets. This balanced approach is intended to safeguard profitability and shareholder value in the face of ongoing global economic uncertainties.

Conclusion

While IDEX faces challenges such as reduced sales volumes and market variability, its strong cash flow performance and the ability to exceed adjusted EPS expectations highlight its resilience. The company remains focused on leveraging its diverse industrial base and strategic acquisitions to drive future growth, maintaining its commitment to delivering long-term value to its stakeholders.

For more detailed financial information and future updates on IDEX Corp, investors and interested parties are encouraged to view the full earnings report and follow upcoming analyses on GuruFocus.com.

Explore the complete 8-K earnings release (here) from IDEX Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance