IHH reports highest ever quarterly revenue in Q1 2024, with double-digit growth across key metrics, on outstanding performance across all markets

KUALA LUMPUR, Malaysia and SINGAPORE, May 29, 2024 (GLOBE NEWSWIRE) --

Revenue at RM6.0 billion mark for the first time

Outstanding growth momentum: revenue up 16%, EBITDA up 19%

Core profit or PATMI (ex EI) up 22%; Lower headline PATMI due to high base in previous period (Q1 2023) which included one-off gain from sale of non-core asset IMU

“We carried strong growth momentum into Q1 2024, with quarterly revenue hitting the RM6.0 billion mark for the first time. This outstanding performance cut across all our core markets as we took in more patients and provided more complex treatments. This drove core profit, or PATMI (ex EI), higher, even as headline profit was lower because the high base in Q1 2023 included a one-off gain from the sale of IMU. |

|

We continue to focus on providing patients with cutting edge care; for instance, the recent official opening of the region’s first private proton therapy care centre in Singapore further reinforces our position as Asia’s leading Centre of Excellence in comprehensive cancer care. |

|

Overall, we expect favourable tailwinds from secular trends in the countries we operate in, which will underpin our longer-term growth. As we push on with our growth strategy aligned with our “ACE” framework, we are confident that we can generate sustained and sustainable value for all.” |

|

Dr Prem Kumar Nair |

GROUP RESULTS – FINANCIAL HIGHLIGHTS1 | |||

| |||

Q1 2024 key metrics (Y-o-Y) change | |||

Revenue | EBITDA | PATMI (ex EI) | PATMI |

|

|

|

|

RM6.0b | RM1.4b | RM402.8m | RM768.0m |

|

|

|

|

+16% | +19% | +22% | -45% |

|

|

|

|

Q1 2024: Outstanding core performance

Highest ever quarterly revenue; revenue and EBITDA saw double-digit growth from sustained patient volume and taking on more acute, complex cases.

PATMI excluding exceptional items (“PATMI (ex EI)”) was up 22% on the strong operational performance. Excluding effects of MFRS 129, PATMI (ex EI) increased 30%.

The lower headline PATMI was primarily due to the high base in Q1 2023, which recorded one-off gains of RM862.0 million from the sale of International Medical University (“IMU”).

Balance sheet remained strong: net cash generated from operating activities at RM831.3 million; overall cash balance at RM2.2 billion.

Post Q1 2024,

Shareholders approved all resolutions tabled at the 14th Annual General Meeting on 28 May 2024.

IHH officially opened the Mount Elizabeth Proton Therapy Centre in Singapore – it is the first private healthcare provider in Asia to offer proton therapy, providing patients unprecedented access to this advanced and highly specialised cancer treatment.

_______________

1 The Group’s headline performance includes the application of the MFRS 129 accounting standard (Financial Reporting in Hyperinflationary Economies) relating to its entities in Türkiye.

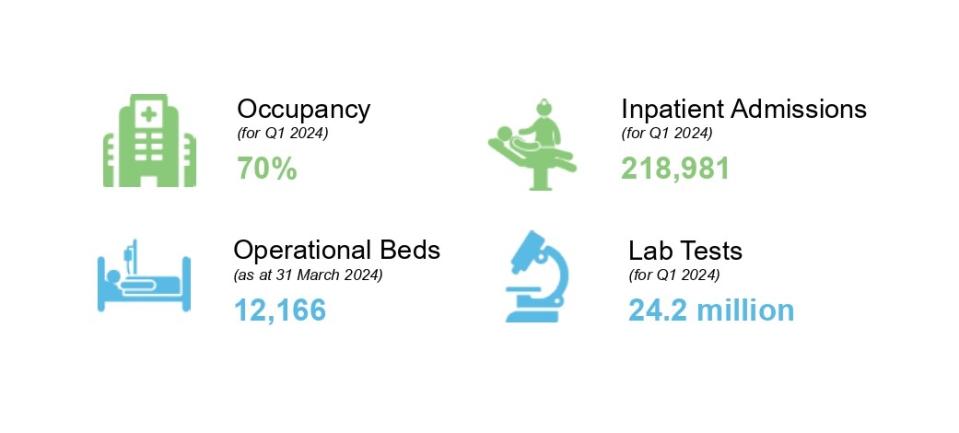

GROUP OPERATIONAL SUMMARY

(FOR QUARTER ENDED 31 MARCH 2024)

GROUP OUTLOOK

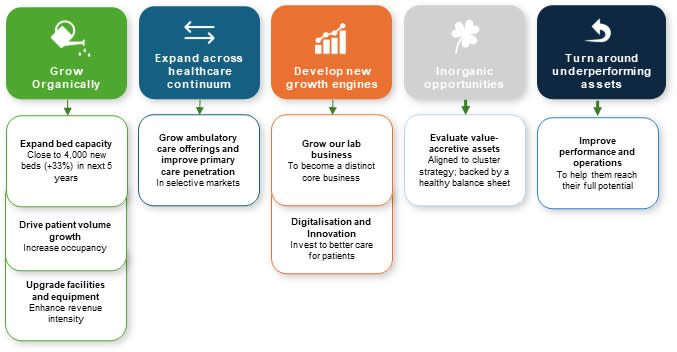

The ACE framework will continue to guide IHH’s growth across five strategic priorities:

The Group is confident of its growth trajectory and will anchor on its ACE framework to deliver against its five strategic priorities, notably aiming to add close to 4,000 new beds in the next five years.

Overall, the Group expects continued revenue growth fuelled by healthcare megatrends, and will focus on driving profitability and sustaining healthy ROE while maintaining prudent capital management and mitigating inflationary and interest rates pressures.

ABOUT IHH HEALTHCARE BERHAD (“IHH”)

A world-leading integrated healthcare provider, IHH believes that making a difference starts with our aspiration to Care. For Good.

Our team of more than 70,000 people commit to deliver greater good to our patients, people, the public and planet, as we live our purpose each day to touch lives and transform care.

Through our portfolio of trusted brands – Acibadem, Mount Elizabeth, Prince Court, Gleneagles, Fortis, Pantai and Parkway – we offer our patients comprehensive and personalised care ranging from primary to quaternary, and even ancillary services such as laboratory, diagnostics, imaging and rehabilitation.

With our scale and reach in 10 countries, we continue to raise the bar in healthcare in our key markets of Malaysia, Singapore, Türkiye, India, Greater China (including Hong Kong) and beyond.

In partnership with our stakeholders, we will co-create a sustainable future for all as we work towards our vision to become the world’s most trusted healthcare services network.

More information can be found at www.ihhhealthcare.com.

For more information or to speak to an IHH spokesperson, please contact:

Penelope Koh | Melissa Sim |

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/64646fb7-254b-48fa-b344-ec63104857b5

https://www.globenewswire.com/NewsRoom/AttachmentNg/e410f5a6-c19d-4137-a716-ada874079530

Yahoo Finance

Yahoo Finance