Can You Imagine How Elated EverQuote's (NASDAQ:EVER) Shareholders Feel About Its 616% Share Price Gain?

For many, the main point of investing in the stock market is to achieve spectacular returns. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, the EverQuote, Inc. (NASDAQ:EVER) share price is up a whopping 616% in the last year, a handsome return in a single year. In more good news, the share price has risen 12% in thirty days. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

It really delights us to see such great share price performance for investors.

View our latest analysis for EverQuote

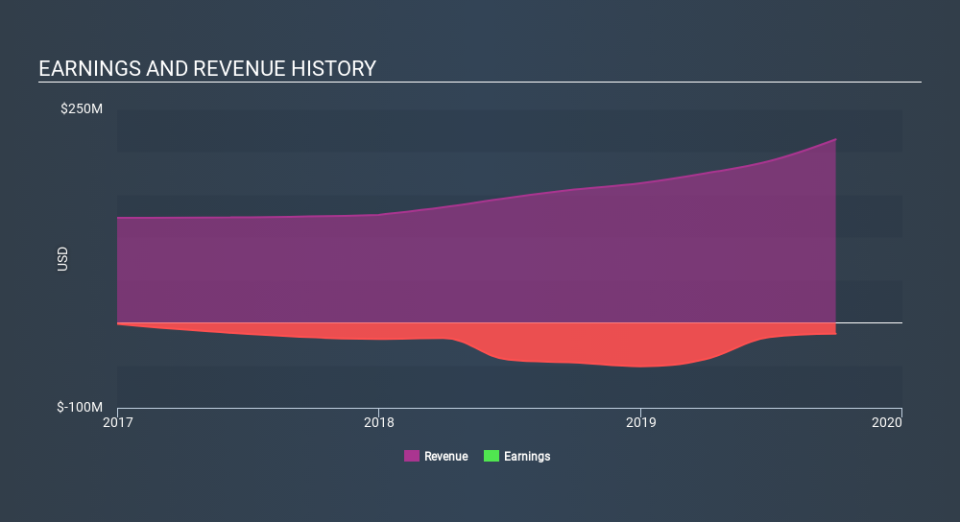

EverQuote isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year EverQuote saw its revenue grow by 38%. That's a fairly respectable growth rate. But the market is even more excited about it, with the price apparently bound for the moon, up 616% in one of earth's orbits. We're always cautious when the share price is up so much, but there's certainly enough revenue growth to justify taking a closer look at EverQuote.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for EverQuote in this interactive graph of future profit estimates.

A Different Perspective

EverQuote boasts a total shareholder return of 616% for the last year. That's better than the more recent three month gain of 35%, implying that share price has plateaued recently. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with EverQuote (including 1 which is is a bit unpleasant) .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance