Increases to CEO Compensation Might Be Put On Hold For Now at Western Digital Corporation (NASDAQ:WDC)

The underwhelming share price performance of Western Digital Corporation (NASDAQ:WDC) in the past three years would have disappointed many shareholders. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 16 November 2022. They could also influence management through voting on resolutions such as executive remuneration. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

See our latest analysis for Western Digital

Comparing Western Digital Corporation's CEO Compensation With The Industry

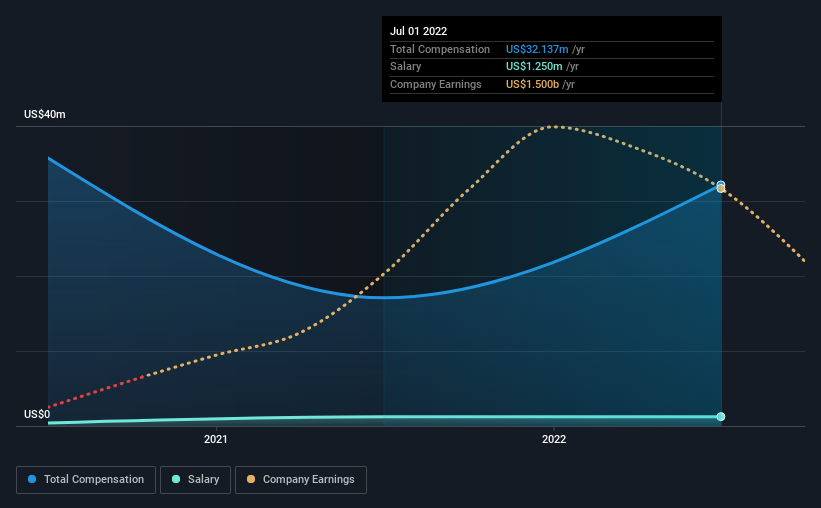

According to our data, Western Digital Corporation has a market capitalization of US$11b, and paid its CEO total annual compensation worth US$32m over the year to July 2022. That's a notable increase of 88% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.3m.

In comparison with other companies in the industry with market capitalizations over US$8.0b, the reported median total CEO compensation was US$19m. Accordingly, our analysis reveals that Western Digital Corporation pays David Goeckeler north of the industry median. Moreover, David Goeckeler also holds US$5.4m worth of Western Digital stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2022 | 2021 | Proportion (2022) |

Salary | US$1.3m | US$1.3m | 4% |

Other | US$31m | US$16m | 96% |

Total Compensation | US$32m | US$17m | 100% |

On an industry level, roughly 16% of total compensation represents salary and 84% is other remuneration. Western Digital has chosen to walk a path less trodden, opting to compensate its CEO with less of a traditional salary and more non-salary rewards over the last year. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Western Digital Corporation's Growth Numbers

Over the past three years, Western Digital Corporation has seen its earnings per share (EPS) grow by 110% per year. In the last year, its revenue is down 3.1%.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Western Digital Corporation Been A Good Investment?

The return of -31% over three years would not have pleased Western Digital Corporation shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Western Digital primarily uses non-salary benefits to reward its CEO. Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Western Digital (of which 1 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance