Indian Exchange Growth Companies With Up To 39% Insider Ownership

Despite a flat performance over the last week, the Indian market has shown robust growth, rising 45% in the past 12 months with earnings forecasted to grow by 16% annually. In this context, stocks of growth companies with high insider ownership can be particularly appealing as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.5% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 37.8% | 22.7% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

Chalet Hotels (NSEI:CHALET) | 13.1% | 27.6% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.2% |

We'll examine a selection from our screener results.

Astral

Simply Wall St Growth Rating: ★★★★★☆

Overview: Astral Limited operates in the manufacturing and marketing of pipes, water tanks, and adhesives and sealants, serving both Indian and international markets with a market cap of approximately ₹640.80 billion.

Operations: The company generates revenue primarily from two segments: plumbing (₹41.42 billion) and paints and adhesives (₹14.99 billion).

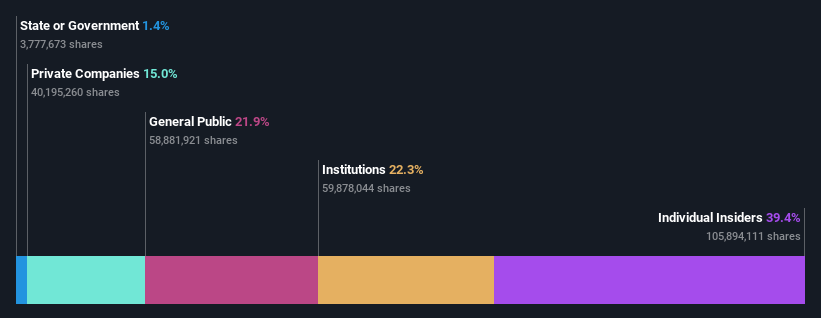

Insider Ownership: 39.4%

Astral Limited, a growth-oriented company with high insider ownership in India, demonstrates robust fundamentals despite some challenges. Recent financials show a year-over-year increase in quarterly sales to INR 16.25 billion and annual sales reaching INR 56.41 billion, with corresponding revenue growths. However, net income slightly declined this quarter to INR 1.82 billion from INR 2.06 billion previously. The company's earnings are expected to grow significantly at an annual rate of 23%, outpacing the Indian market's average of 15.9%. Insider activities have been moderate with more purchases than sales over the past three months, although not in substantial volumes.

Unlock comprehensive insights into our analysis of Astral stock in this growth report.

Our valuation report unveils the possibility Astral's shares may be trading at a premium.

Info Edge (India)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited, with a market cap of approximately ₹857.75 billion, operates as an online classifieds company focusing on recruitment, matrimony, real estate, and education across India and internationally.

Operations: The company generates revenue primarily through Recruitment Solutions (₹18.80 billion) and 99acres for Real Estate (₹3.51 billion).

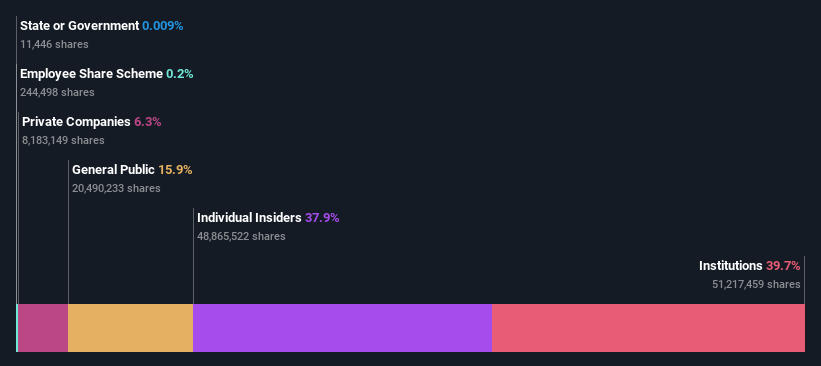

Insider Ownership: 37.9%

Info Edge (India) Limited has turned profitable this year, with substantial growth in quarterly and annual financial metrics. The company's earnings are expected to increase by 24.34% annually, outperforming the Indian market forecast of 15.9%. Despite a low forecasted return on equity of 5.9% in three years and unstable dividend records, insider transactions show more buying than selling over the past three months, reflecting continued confidence from insiders amidst recent profitability.

Titagarh Rail Systems

Simply Wall St Growth Rating: ★★★★★☆

Overview: Titagarh Rail Systems Limited is a company that manufactures and sells freight and passenger rail systems both in India and internationally, with a market capitalization of approximately ₹217.92 billion.

Operations: The company generates revenue from two primary segments: Passenger Rail Systems, which brought in ₹4.36 billion, and Freight Rail Systems (including shipbuilding, bridges, and defense), which accounted for ₹34.18 billion.

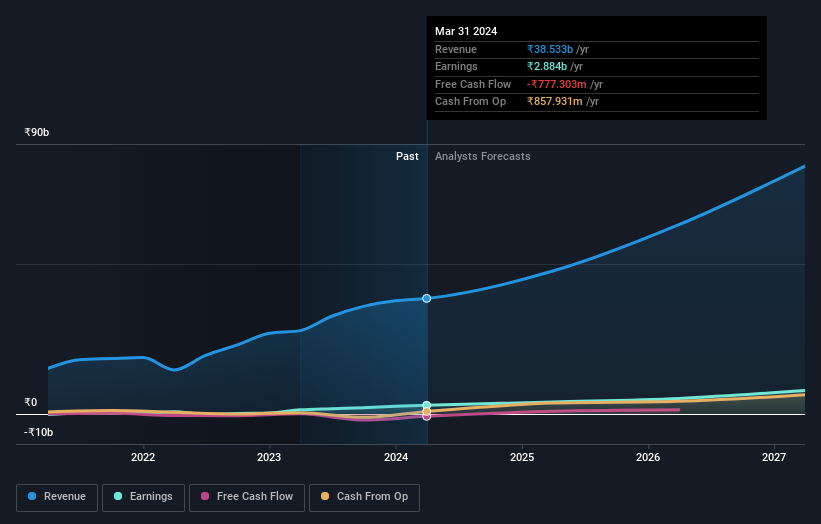

Insider Ownership: 24.3%

Titagarh Rail Systems Limited, a growth-oriented company with significant insider ownership, has demonstrated robust financial performance with a substantial increase in annual revenue to INR 38.93 billion and net income to INR 2.86 billion. The company's earnings are projected to grow by 29.9% annually, outpacing the Indian market average. Recently, it inaugurated a new engineering center in Bangalore to enhance its product development capabilities in rail systems, aligning with India's innovation initiatives. Despite high share price volatility and low forecasted return on equity of 19.2%, the firm shows promising growth prospects and active engagement in strategic expansions.

Key Takeaways

Discover the full array of 84 Fast Growing Indian Companies With High Insider Ownership right here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:ASTRALNSEI:NAUKRI NSEI:TITAGARH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance