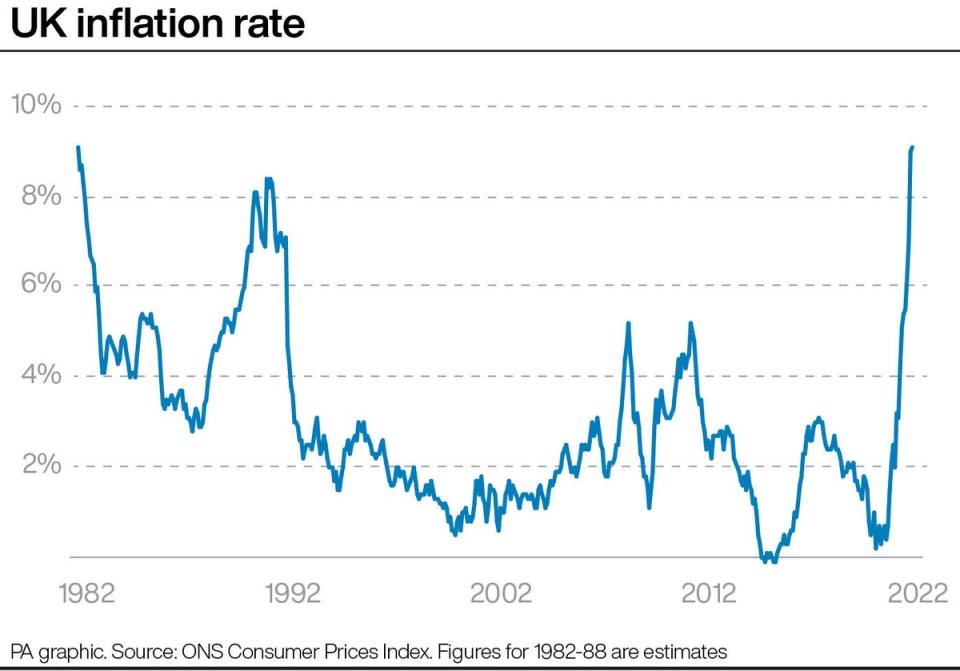

Inflation at new 40 year high of 9.1% - economy on ‘knife edge’

The Bank of England has no choice but to ratchet up interest rates, business leaders and economists warned today as the latest surge in inflation left the economy on “a knife edge” and in clear danger of recession.

Last week the Bank put rates up to a nine-year high of 1.25%. They will go to at least 3% by the end of the year, the City expects, causing pain to borrowers as the Bank tries to rein in runaway inflation.

Today the Office for National Statistics said inflation rose from 9% a year in April to 9.1% in May – the highest since March 1982.

Economists say it will go to 10% or perhaps 11% before it begins to fall.

Supermarkets report that shoppers are switching to the cheapest brands, while charities say many people are already skipping meals.

Myron Jobson at interactive investor, said: “Runaway inflation puts further pressure on the Bank of England to take bolder action to rein in spiralling prices. Any hopes that the BoE will ease up on the pace of interest rate hikes are likely to be dashed. This is despite concerns about the impact higher interest rates will have on the cost borrowing and mortgage rates.”

David Bharier at the British Chambers of Commerce said: “Inflation is set to continue upwards, with a further rise in the energy price cap yet to come, leaving businesses with mounting economic uncertainty, alongside labour shortages.”

There are calls for tax rises to be delayed and VAT on business energy bills to be cut to 5%.

Bharier, who says the UK is on a knife edge, added: “This inflationary surge sits alongside a poor economic outlook and unless the Government acts with urgency to encourage businesses to invest, the chances of a recession will only increase."

For some goods, notably food and fuel, there are fears that inflation will go far higher than present levels.

Paul Dales at Capital Economics said: “With the influence of the increases in agricultural commodity prices yet to feed in full into prices on the supermarket shelves, we think that food price inflation will rise above 10% in September. Inflation is not yet close to its peak.”

Ian Stewart, chief economist at Deloitte, said: “Base interest rates of 1.25% remain by historic standards very low. Significant rate rises lie ahead; we expect base rates to more than double in the next six months. The Bank of England is presiding over what seems likely to be the sharpest tightening of monetary policy since the 1980s. It is touch and go as to whether the Bank will be able to curb inflation without triggering a recession.”

Yahoo Finance

Yahoo Finance