Innospec (IOSP) Shares Up 24% in Six Months: What's Driving It?

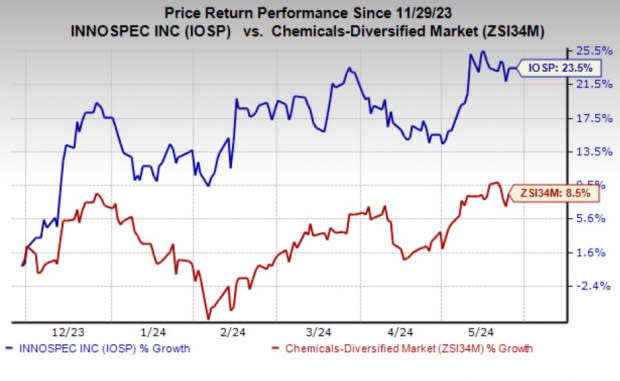

Innospec Inc.’s IOSP shares have gained 23.5% in the past six months. The company also outperformed the industry’s rise of 8.5% and topped the S&P 500’s nearly 15.8% rise over the same period.

Image Source: Zacks Investment Research

Let’s take a look at the factors driving the stock’s price appreciation.

Strategic Expansion and QGP Acquisition Fuel Optimism

Innospec, currently carrying a Zacks Rank #3 (Hold), is reaping significant benefits from the Performance Chemicals segment and strategic growth initiatives. The company is committed to advancing technology development and enhancing margins to drive organic growth across its diversified business portfolio.

In the first quarter, Innospec reported adjusted earnings per share of $1.75, up from $1.38 a year ago and exceeding the Zacks Consensus Estimate of $1.64. Although revenues registered a 2% decline to $500.2 million from the previous year’s tally and fell short of the Zacks Consensus Estimate of $508 million, the company experienced consistent strong performance in the Performance Chemicals segment. The segment's operating income more than doubled year-over-year due to increased sales and improved gross margins.

The acquisition of QGP Quimica Geral in Brazil enhances IOSP’s global presence and manufacturing capabilities, along with customer service in South America. QGP's specialty chemistry expertise, especially in growth markets like Agriculture, complements Innospec's existing portfolio. This move aligns with Innospec's M&A strategy, strengthening the Performance Chemicals segment and establishing a manufacturing base in South America. Innospec highlighted its debt-free balance sheet following the takeover, which positions the company well for future M&A activities, shareholder returns and strategic organic growth investments.

Innospec, during its first-quarter call, stated a broad array of technology-driven organic opportunities across its business segments. These factors are expected to continue driving growth and margin improvement. With significant flexibility and balance sheet strength, Innospec is well-positioned for potential dividend growth, stock buybacks, mergers and acquisitions and further organic investments.

Innospec Inc. Price and Consensus

Innospec Inc. price-consensus-chart | Innospec Inc. Quote

Stocks to Consider

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS, sporting a Zacks Rank #1 (Strong Buy), and ATI Inc. ATI and Ecolab Inc. ECL, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CRS’ earnings beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company’s shares have soared 139% in the past year.

ATI’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, with the earnings surprise being 8.34%, on average. The company’s shares have surged 72.9% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59, indicating a year-over-year rise of 26.5%. The Zacks Consensus Estimate for ECL’s current-year earnings has been going up in the past 30 days. ECL beat the consensus estimate in each of the last four quarters, with the earnings surprise being 1.3%, on average. The stock has rallied nearly 40.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance