Insider-Owned Growth Companies To Watch In June 2024

As global markets exhibit mixed signals with the S&P 500 and Nasdaq reaching new highs amidst narrow advances and subdued inflation data, investors continue to navigate through a complex economic landscape. In such an environment, growth companies with high insider ownership can offer unique investment appeal, potentially aligning management interests closely with shareholder values.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Medley (TSE:4480) | 34% | 28.7% |

Gaming Innovation Group (OB:GIG) | 13.2% | 36.2% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.9% | 84.1% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 79.3% |

Let's explore several standout options from the results in the screener.

Bittium Oyj

Simply Wall St Growth Rating: ★★★★☆☆

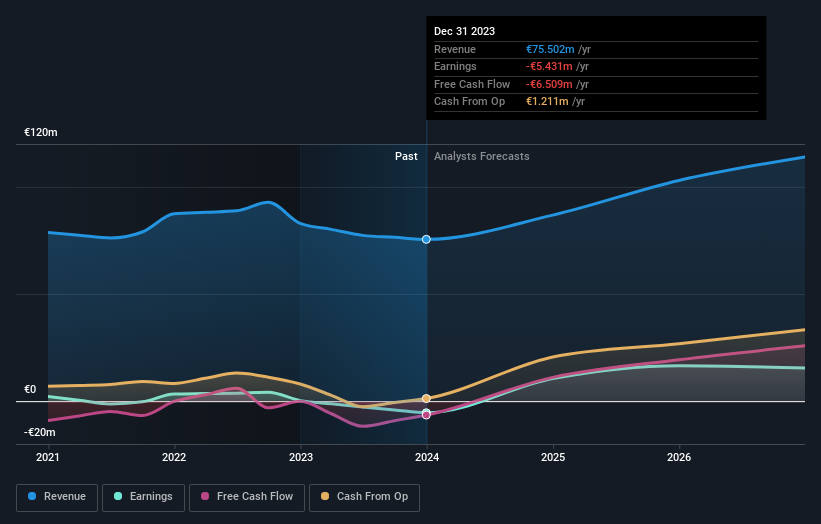

Overview: Bittium Oyj, based in Finland with operations also in Germany and the United States, specializes in communications and connectivity solutions, healthcare technology products and services, as well as biosignal measuring and monitoring, with a market capitalization of approximately €295.24 million.

Operations: The company generates €75.50 million from its Wireless Business segment.

Insider Ownership: 12.6%

Revenue Growth Forecast: 12.9% p.a.

Bittium Oyj, priced 25.4% below its estimated fair value, is poised for significant growth with earnings forecasted to increase by 39.53% annually. Despite a highly volatile share price recently, the company's revenue is expected to outpace the Finnish market with a 12.9% annual increase. However, its projected Return on Equity of 13.5% in three years remains modest. Recent executive changes and a reduced dividend highlight some operational adjustments but also underline ongoing strategic shifts within the management structure.

Dive into the specifics of Bittium Oyj here with our thorough growth forecast report.

Our expertly prepared valuation report Bittium Oyj implies its share price may be too high.

KEBODA TECHNOLOGY

Simply Wall St Growth Rating: ★★★★★★

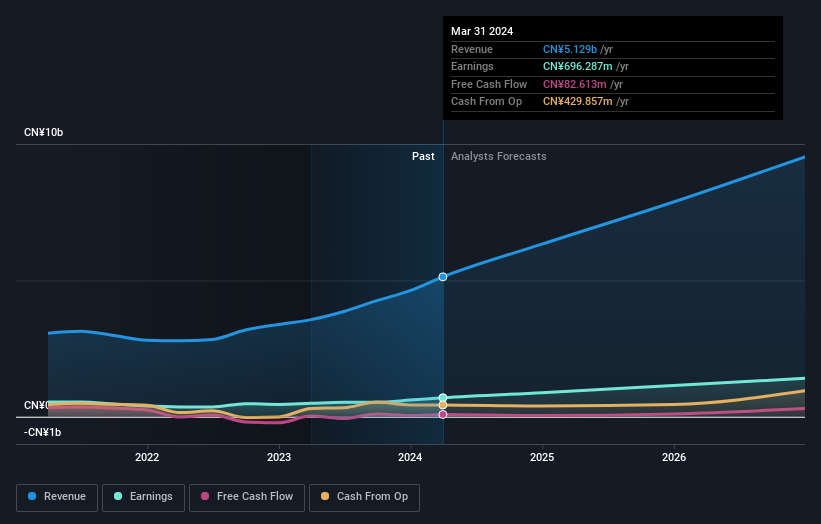

Overview: KEBODA TECHNOLOGY Co., Ltd. specializes in manufacturing and selling automotive electronics and related products for the automotive industry in China, with a market capitalization of CN¥27.05 billion.

Operations: The company primarily generates revenue from the manufacture and sale of automotive electronics for the automotive industry in China.

Insider Ownership: 12.8%

Revenue Growth Forecast: 22.1% p.a.

KEBODA TECHNOLOGY Co., Ltd. has shown robust financial performance with a significant increase in earnings and revenue, reporting a year-over-year earnings growth of 42% and revenue rising from CNY 913.02 million to CNY 1,417.2 million in the first quarter of 2024. Analysts project the company's earnings will continue to grow at an impressive rate of approximately 25% annually, outpacing the Chinese market's expected growth. Despite these strong growth indicators, the dividend coverage by cash flows remains low at just 0.87%, suggesting potential sustainability issues for dividend payouts amidst its expansion efforts.

Click to explore a detailed breakdown of our findings in KEBODA TECHNOLOGY's earnings growth report.

Upon reviewing our latest valuation report, KEBODA TECHNOLOGY's share price might be too optimistic.

Hangzhou Bio-Sincerity Pharma-TechLtd

Simply Wall St Growth Rating: ★★★★★☆

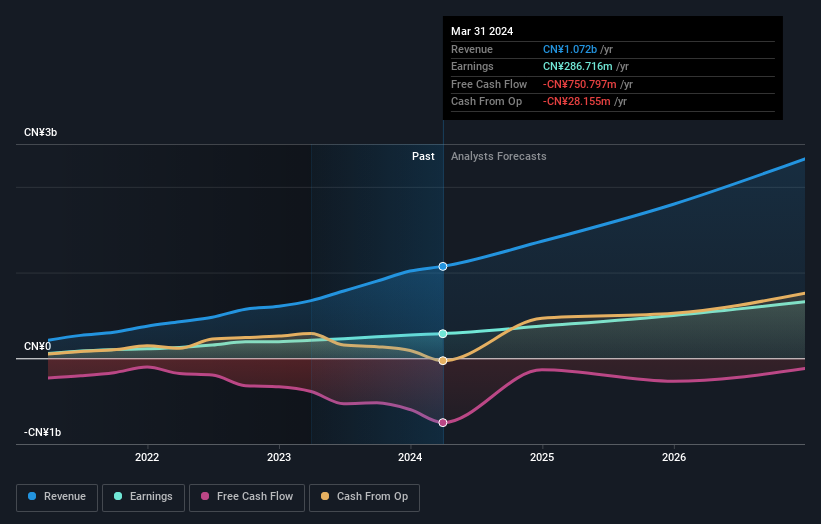

Overview: Hangzhou Bio-Sincerity Pharma-Tech Ltd, operating under the ticker SZSE: 301096, is a pharmaceutical technology company with a market capitalization of approximately CN¥6.56 billion.

Operations: The company generates approximately CN¥1.07 billion in revenue from its biotechnology segment.

Insider Ownership: 35.1%

Revenue Growth Forecast: 27.7% p.a.

Hangzhou Bio-Sincerity Pharma-Tech Co., Ltd. is experiencing robust growth with its earnings and revenue significantly increasing, as evidenced by the first quarter results of 2024 where sales rose to CNY 215.7 million from CNY 160.92 million year-over-year, and net income improved to CNY 49.82 million from CNY 35.07 million. The company's earnings are forecasted to grow at a rate of 29.5% annually over the next three years, outstripping the Chinese market's expected growth rate of 22.5%. Despite these positive indicators, it offers a lower forecasted return on equity of only about 15% in three years' time compared to industry benchmarks, which could be a concern for potential long-term sustainability and attractiveness relative to peers who might offer higher returns on equity.

Key Takeaways

Click through to start exploring the rest of the 1444 Fast Growing Companies With High Insider Ownership now.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include HLSE:BITTISHSE:603786 SZSE:301096

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance