Insider Sale: Sr. VP, CFO and Treasurer Lewis Fanger Sells 28,000 Shares of Full House Resorts ...

On May 21, 2024, Lewis Fanger, the Senior Vice President, Chief Financial Officer, and Treasurer of Full House Resorts Inc (NASDAQ:FLL), sold 28,000 shares of the company. The transaction was filed on May 22, 2024, as reported in the SEC Filing. This sale is part of a series of transactions by the insider over the past year, where Lewis Fanger has sold a total of 28,000 shares and purchased 19,500 shares.

Full House Resorts Inc, a company engaged in the ownership, leasing, development, and management of casinos and related hospitality and entertainment facilities in regional U.S. markets. Based in Las Vegas, Nevada, Full House operates five casino properties in Mississippi, Colorado, Indiana, and Nevada.

On the date of the sale, shares of Full House Resorts Inc were priced at $5.11. The company's market cap was approximately $174.919 million.

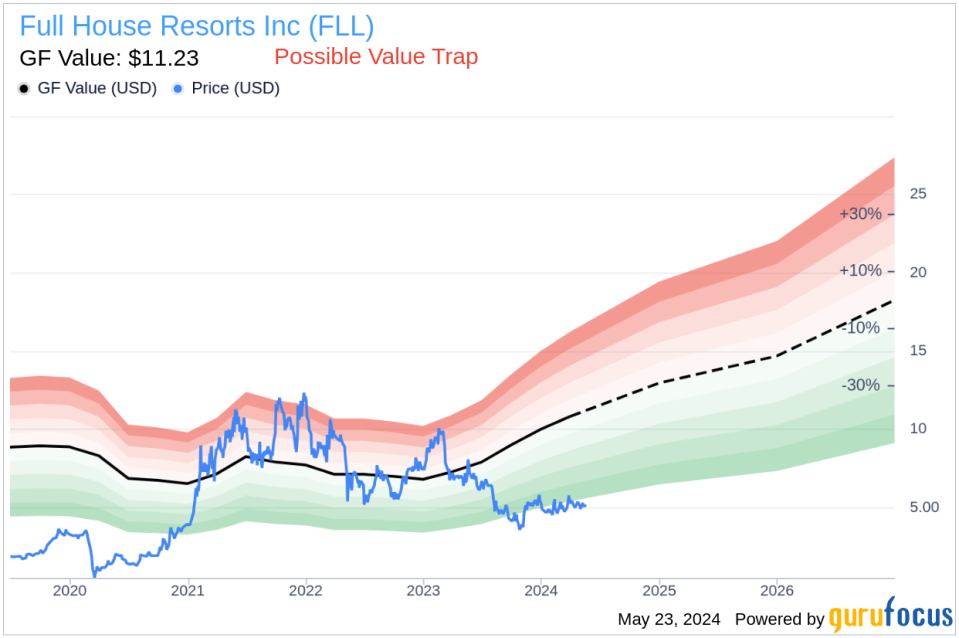

Analyzing the valuation metrics, Full House Resorts Inc has a GF Value of $11.23, indicating a price-to-GF-Value ratio of 0.46. This suggests that the stock might be undervalued.

The valuation of Full House Resorts Inc is influenced by historical multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow. These are adjusted by GuruFocus based on the companys past performance and expected future business outcomes.

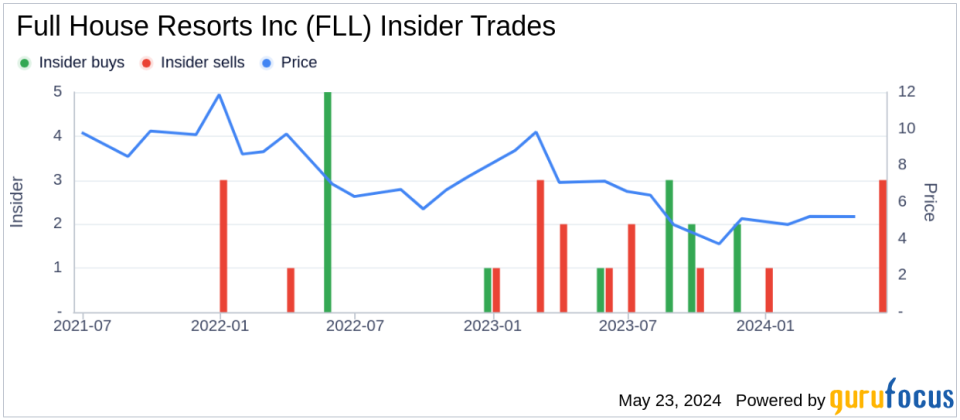

The insider transaction history for Full House Resorts Inc shows a balanced activity over the past year, with 7 insider buys and 7 insider sells.

The GF Value assessment suggests caution, as the stock is currently considered a Possible Value Trap, indicating that potential investors should think twice.

This sale by the insider might reflect personal financial management decisions rather than a commentary on the company's future prospects. Investors are advised to consider the broader context of the company's financial health and market conditions when interpreting insider behaviors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance