Inspiration Healthcare Group plc's (LON:IHC) Popularity With Investors Under Threat

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

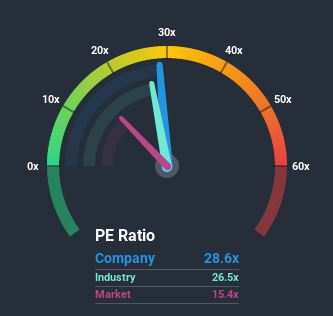

With a price-to-earnings (or "P/E") ratio of 28.6x Inspiration Healthcare Group plc (LON:IHC) may be sending very bearish signals at the moment, given that almost half of all companies in the United Kingdom have P/E ratios under 15x and even P/E's lower than 8x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Inspiration Healthcare Group's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Inspiration Healthcare Group

Does Inspiration Healthcare Group Have A Relatively High Or Low P/E For Its Industry?

We'd like to see if P/E's within Inspiration Healthcare Group's industry might provide some colour around the company's particularly high P/E ratio. The image below shows that the Medical Equipment industry as a whole also has a P/E ratio significantly higher than the market. So it appears the company's ratio could be influenced considerably by these industry numbers currently. In the context of the Medical Equipment industry's current setting, most of its constituents' P/E's' P/E's would be expected to be raised up greatly. Nonetheless, the greatest force on the company's P/E will be its own earnings growth expectations.

Want the full picture on analyst estimates for the company? Then our free report on Inspiration Healthcare Group will help you uncover what's on the horizon.

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Inspiration Healthcare Group's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 39%. Even so, admirably EPS has lifted 116% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the only analyst covering the company are not good at all, suggesting earnings should decline by 82% over the next year. The market is also set to see earnings decline 15% but the stock is shaping up to perform materially worse.

In light of this, it's odd that Inspiration Healthcare Group's P/E sits above the majority of other companies. When earnings shrink rapidly often the P/E premium shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be extremely difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Final Word

The price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Inspiration Healthcare Group's analyst forecasts revealed that its even shakier outlook against the market isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are unlikely to support such positive sentiment for long. In addition, we would be concerned whether the company can even maintain this level of performance under these tough market conditions. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Inspiration Healthcare Group (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

If you're unsure about the strength of Inspiration Healthcare Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance