Institutional Investors Are Divided on BOJ Bond-Buying Cuts

(Bloomberg) -- Institutional investors offered diverging opinions on how quickly the Bank of Japan should pare back its bond buying Wednesday, according to people who attended the meeting, a day after the nation’s megabanks called for sweeping cuts.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

The End of the Cheap Money Era Catches Up to Chelsea FC’s Owner

S&P 500 Spikes in Last 15 Minutes of US Trading: Markets Wrap

Life insurance firms, casualty insurers and asset managers were among the 25 participants in the hearing, according to a document seen by Bloomberg.

The discussions delivered a wide range of options, with some calling for only gradual reductions in bond purchases while others urged for all buying to stop, according to one attendee.

The central bank didn’t show a specific plan for reducing its bond purchases, the people said.

The surprising lack of consensus among institutional buyers of Japanese government bonds points to the difficulty the BOJ faces in formulating a plan that will satisfy market participants. It also increases the risk of some investors being caught out by the central bank’s final decision.

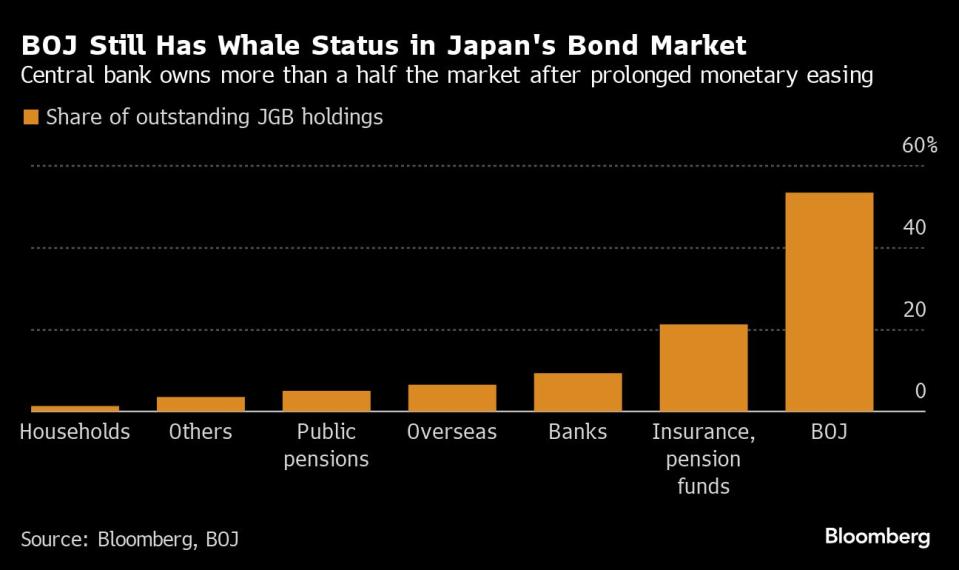

The BOJ held the meetings to give participants in the market a chance to convey their views as it assesses how quickly it can reduce its huge footprint in the bond market without causing ructions.

The hearings have helped the BOJ show it is sounding out market players, but the variance in views makes the final decision a very difficult call, according to Tomo Kinoshita, global market strategist at Invesco.

“From among those market views, for example, an entity that doesn’t hold many bonds wants the yield to go up and will want a sharp reduction, so the BOJ needs to carefully look at each position,” Kinoshita said.

That leaves open the possibilities of going hawkishly or cautiously, but likely they’ll opt for caution to begin with, he added.

The bank’s holdings of JGBs are bigger than the size of Japan’s economy and a key reason bond players must be on a high alert for the BOJ’s next move. The central bank will unveil its plans to pare its buying over the next one to two years on July 31.

The meeting on Wednesday follows hearings on Tuesday in which one of the megabanks said the BOJ should move early to make sharp cuts, while another major bank recommended an eventual reduction to monthly purchases of ¥1 trillion ($6.2 billion), according to people who attended hearings that day.

A third megabank said the buying should be halved from the current monthly level to ¥3 trillion yen, those people added.

The remarks from the major banks showed their appetite to fill the void the central bank will create as it steps back from the market. Stock prices for banks and insurance companies edged up Wednesday, partly driven by the prospect of bigger cuts to the central bank’s bond buying.

“Market players are looking more at a chance of a large reduction following the media report,” Katsutoshi Inadome, senior strategist at Sumitomo Mitsui Trust Asset Management, said.

A roundup of survey responses released by the BOJ on Tuesday also showed there is still a wide variety of views among market participants about the most appropriate pace of reductions. The central bank sounded out representatives from banks, securities firms and those buying bonds for financial institutions ahead of the hearings.

Among the answers received, respondees suggested cutting the BOJ’s monthly buying of Japanese government bonds to zero, to a range between ¥2 trillion and ¥3 trillion, and to ¥4 trillion, the roundup released by the central bank showed. The figures compare with the current monthly purchase pace of roughly ¥6 trillion.

“With the absence of a consensus, there could be some sizable market reaction to the plan when it’s released,” SMBC Nikko Securities economists led by Yoshimasa Maruyama wrote in a note. “The likelihood of a rate hike at the same meeting probably got lower.”

--With assistance from Daisuke Sakai, Hidenori Yamanaka and Sumio Ito.

(Adds comments from attendees at meeting)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance