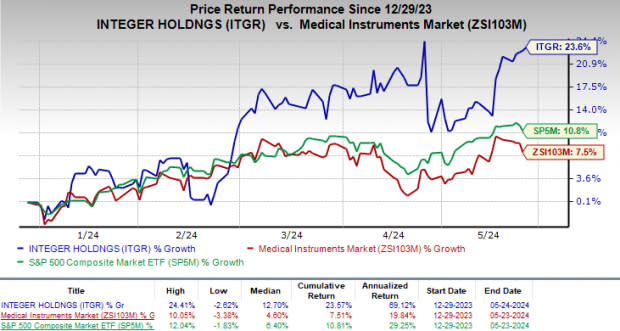

Integer Holdings (ITGR) Gains 23.6% YTD: What's Driving the Stock?

Integer Holdings ITGR witnessed strong momentum year to date. Shares of the company have gained 23.6% compared with 7.5% growth of the industry in the same time frame. The S&P 500 Composite has risen 10.8% during the same period.

With healthy fundamentals and strong growth opportunities, this Zacks Rank #3 (Hold) company appears to be a solid wealth creator for its investors at the moment.

Plano, TX-based Integer Holdings manufactures and develops medical devices and components primarily for original equipment manufacturers.

Integer Holdings operates through two segments — Medical Sales and Non-Medical Sales. Medical Sales has three sub-segments — Advanced Surgical, Orthopedics and Portable Medical (AS&O); Cardio and Vascular (C&V); and Cardiac Rhythm Management & Neuromodulation (CRM&N).

Image Source: Zacks Investment Research

Catalysts Driving Growth

Integer Holdings is witnessing an upward trend in its stock price, prompted by its execution of manufacturing excellence initiatives, an improved supply chain, and a direct labor environment. The optimism led by a solid first-quarter 2024 performance and its strength in Medical sales are expected to contribute further.

Investors seemed to be optimistic about Integer Holdings’ stable footing in the cardiac, neuromodulation, orthopedics, vascular and advanced surgical markets. Its primary customers include large, multi-national original equipment manufacturers and their affiliated subsidiaries.

Per the management, Cardiac Rhythm Management (CRM) and Neuromodulations trailing four-quarter sales have increased 12% year over year, primarily driven by double-digit CRM growth from strong customer demand and double-digit neuromodulation growth from emerging PMA customers. The Cardio and Vascular product line sales in the last four quarters increased 18% year over year. The uptick is driven by strong customer demand and sales from the InNeuroCo and Pulse acquisitions.

Integer Holdings exited the first quarter of 2024 with better-than-expected results. The strong year-over-year top-line and bottom-line performances were impressive and have aided in surging the stock’s price.

Integer Holdings generated a gross profit of $109.8 million in the first quarter, up 13.6% year over year. The gross margin in the reported quarter expanded 96 basis points (bps) to 26.5%. Adjusted operating profit totaled $47.2 million, reflecting a 32.1% uptick from the prior-year quarter. Adjusted operating margin in the first quarter expanded 195 bps to 11.4%. The expansion of both margins bodes well for the stock and has contributed to raising the price of the stock.

Risk Factors

Sales of Integer Holdings’ products into the energy market depend upon the condition of the oil and gas industry. Currently, oil and natural gas prices have been subject to significant fluctuation. Per management, a change in the oil and gas exploration and production industry or a reduction in the exploration and production expenditures of oil and gas companies could cause the company’s energy market revenues to decline significantly.

A Look at Estimates

Integer Holdingsearnings per share (EPS) in 2024 and 2025 are expected to grow 14.1% and 15.4% to $5.33 and $6.155 on a year-over-year basis, respectively. The Zacks Consensus Estimate for EPS has declined 4 cents for 2024 and increased a cent for 2025 in the past 30 days.

Revenues for 2024 and 2025 are anticipated to rise 10% and 7.4% to $1.76 billion and $1.89 billion, respectively, on a year-over-year basis.

Integer Holdings Corporation Price

Integer Holdings Corporation price | Integer Holdings Corporation Quote

Stocks to Consider

Some better-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, Ecolab ECL and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank of 2 (Buy), reported first-quarter 2024 adjusted EPS of $2.14, beating the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 5.9%.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.7%.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, beating the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance