Introducing Aves One (ETR:AVES), A Stock That Climbed 38% In The Last Three Years

While Aves One AG (ETR:AVES) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 18% in the last quarter. But that doesn't change the fact that the returns over the last three years have been pleasing. To wit, the share price did better than an index fund, climbing 38% during that period.

See our latest analysis for Aves One

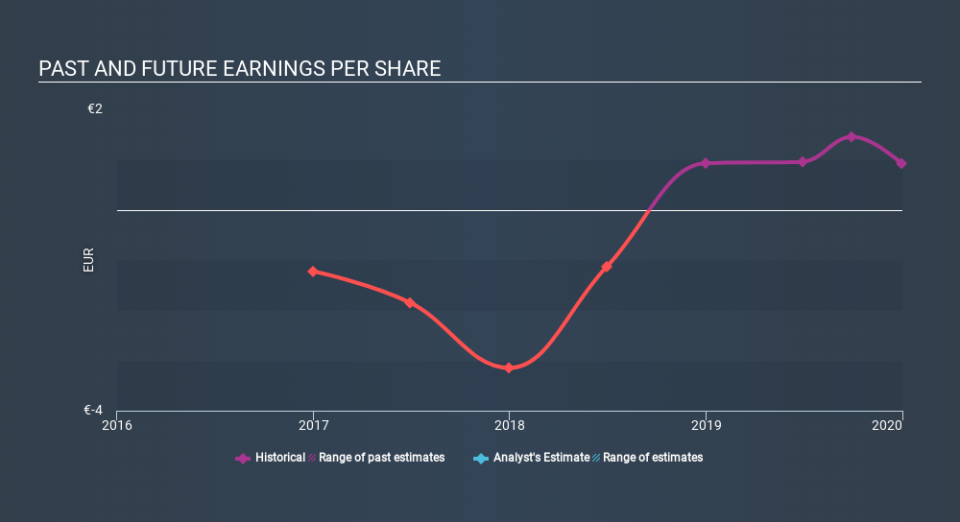

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, Aves One moved from a loss to profitability. So we would expect a higher share price over the period.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Aves One has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Aves One stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Aves One shareholders are down 19% for the year, falling short of the market return. Meanwhile, the broader market slid about 8.8%, likely weighing on the stock. Investors are up over three years, booking 11% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Aves One (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance