Intuitive Surgical (ISRG) Hits 52-Week High: What's Driving It?

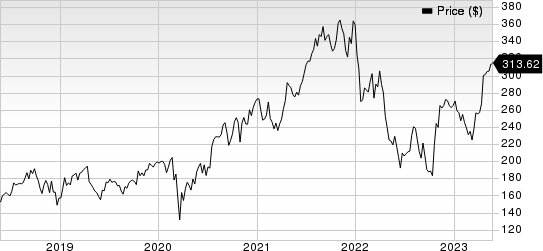

Intuitive Surgical’s ISRG shares reached a new 52-week high of $317.81 on May 22, before closing the session at $313.62.

So far this year, this Zacks Rank #3 (Hold) stock has risen 18.2% compared with the industry’s 3.9% growth.The S&P 500 composite rose 10.3%.

ISRG has a long-term earnings growth rate of 13%. The company has a favorable price-to-sales ratio of 4.6 compared with the industry’s 8.2.

Image Source: Zacks Investment Research

In the last reported quarter, Intuitive Surgical’s revenues and earnings surpassed the Zacks Consensus Estimate by 6.9% and 6.4%, respectively. It delivered a trailing four-quarter average earnings surprise of 1.86%.

ISRG is witnessing an upward trend in its stock price, prompted by continued demand for its robot-based da Vinci surgical system. The company shipped 312 da Vinci Surgical Systems in first-quarter 2023 compared with 311 in the prior-year quarter.

The recent FDA approval expanding the use of da Vinci surgical system to include simple prostatectomy is likely to bring additional revenues going forward. However, rising costs and expenses amid inflationary pressure are hurting margins.

Let’s delve deeper.

Strength in Robotics: Intuitive Surgical’s robot-based da Vinci surgical system enables minimally-invasive operation and reduces the trauma associated with open surgery. The system is powered by robotic technology that has exposed the company to medical mechatronics, robotics and artificial intelligence (AI) for the healthcare space.

ISRG has also launched da Vinci X, an upgrade to its flagship Vinci Xi technology.

Progress on the AI Front: We are upbeat about the growing adoption of minimally-invasive robot-assisted surgeries, self-automated home-based care, the use of information technology for quick and improved patient care, and the shift of the payment system to a value-based model. These indicate the high prevalence of AI in the MedTech space.

Per Intuitive Surgical’s management, the rise of medical mechatronics, powerful computing, improved sensing, microfabrication and molecular imaging has enabled new approaches to old problems.

AI has been enhancing ISRG’s product portfolio with clinical applications, diagnostic support, operational efficiency, electronic health record systems, practice workflows and supply chain management.

Strong Q1 Results: Intuitive Surgical’s solid first-quarter 2023 results buoy optimism. The company’s displayed strong segmental performance during the quarter. It also witnessed growth in da Vinci procedure volume.

Downsides

Risk of Procedure Adoption: Intuitive Surgical faces the risk of adoption of its procedures. This is because adoption growth takes time, as each procedure needs to gain credibility.

Furthermore, the wide use of the company’s products requires the training of surgical teams. Market acceptance could be delayed by the time required to complete such training.

Stiff Competition: Since the launch of its flagship device, the da Vinci System, in 2000, ISRG enjoyed a monopoly in the market for robotic abdominal surgery. However, after the regulatory approval of Transenterix's surgical robot for abdominal surgery in 2017, competition intensified.

Intuitive Surgical, Inc. Price

Intuitive Surgical, Inc. price | Intuitive Surgical, Inc. Quote

Key Picks

Some better-ranked stocks from the broader medical space are Merit Medical Systems MMSI, West Pharmaceutical Services WST and Perrigo PRGO, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Merit Medical Systems has an estimated long-term growth rate of 11%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 20.22%.

So far this year, MMSI’s shares have gained 18.9% compared with the industry’s 8.7% growth.

West Pharmaceutical Services has an estimated long-term growth rate of 6.3%. Its earnings surpassed estimates in three of the trailing four quarters and missed the same once, the average surprise being 13.61%.

So far this year, WST’s shares have gained 49.1% compared with the industry’s 8.7% growth.

Perrigo’s earnings are expected to improve 24.2% in 2023. The strong momentum is likely to continue in 2024 as well. PRGO’s earnings surpassed estimates in two of the trailing four quarters and missed the same twice, the average negative surprise being 0.79%.

The company has lost 1.9% so far this year against the industry’s 4.8% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Perrigo Company plc (PRGO) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance