Investigation closed: SEC clears Ethereum

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

In a significant turn of events, the U.S. Securities and Exchange Commission (SEC) has closed its investigation into Ethereum 2.0, opting not to pursue any enforcement actions. This development has been hailed as a major victory for Ethereum developers and the broader cryptocurrency community.

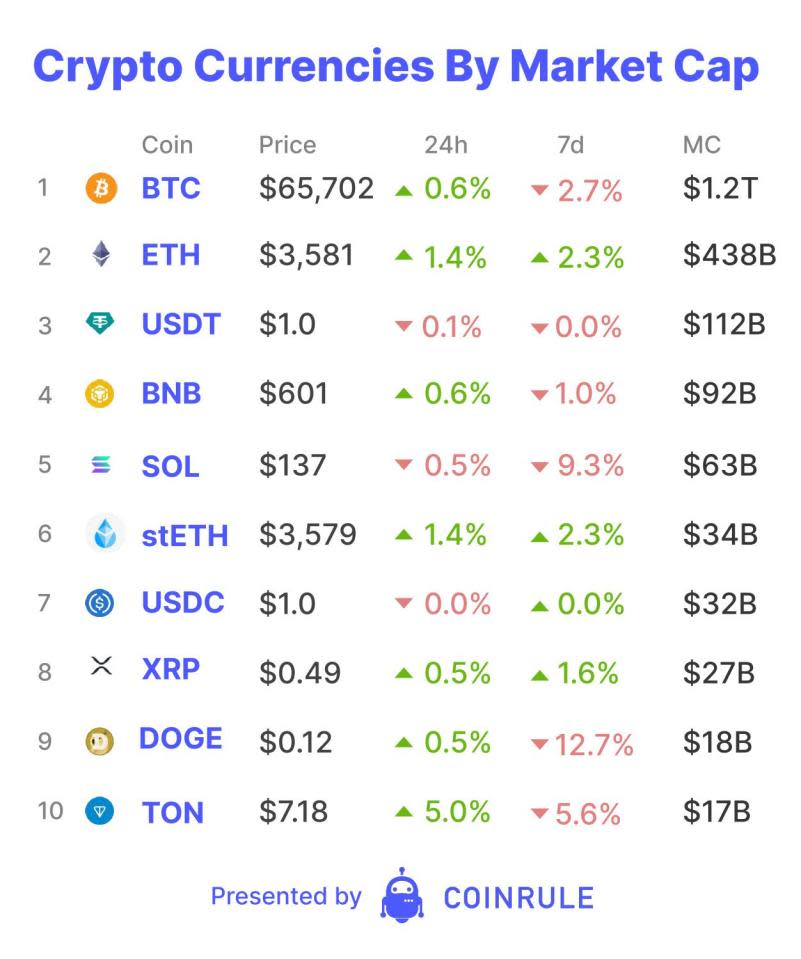

This decision follows the SEC’s recent approval of Ethereum-based exchange-traded funds (ETFs). In a letter sent earlier this month, ConsenSys, a leading blockchain technology company, argued that the approval of these ETFs implied Ethereum should not be classified as a security. The company behind the MetaMask Ethereum wallet had urged the SEC to close the investigation based on this premise. The SEC’s decision to stand down has led to a significant impact on Ether (ETH). Its price saw a surge, breaking $3,500 in the minutes after the announcement, showing renewed market confidence.

This closure of the investigation marks the end of a contentious chapter in Ethereum’s history. The SEC had previously considered ETH a commodity but changed its position, leading to regulatory uncertainty and a lawsuit from ConsenSys. The lawsuit, filed in April 2024, aimed to halt the SEC’s investigation, arguing that Ethereum is a commodity and should not be under SEC jurisdiction.

Consensys views the SEC’s latest decision as the beginning of a new era. In a recent blog post, the company declared: “Today’s development marks the beginning of a new path forward.” This outcome is a testament to Consensys’ persistent efforts, including legal battles, to protect the Ethereum ecosystem. However, despite this victory, Consensys has stated it will continue its lawsuit against the SEC, alleging regulatory overreach.

The SEC’s regulatory approach has been a point of discussion within the cryptocurrency community. While the Ethereum investigation has ended, other regulatory threats persist. For instance, the SEC has issued a Wells notice to Uniswap, indicating potential enforcement action. Similarly, Coinbase faces ongoing legal battles, and the XRP community continues to criticize the SEC for its perceived bias following Ethereum’s favorable treatment.

The crypto industry remains at odds with regulatory bodies, seeking clearer rules and fair treatment. The SEC’s recent decision is a positive step, but the journey toward regulatory harmony is far from over. As the landscape evolves, both crypto developers and regulators will need to work together to put in place a balanced framework that fosters innovation while ensuring compliance.

The views and opinions expressed in this article are those of the authors and do not represent those of City AM, its affiliates, or employees.

Yahoo Finance

Yahoo Finance