Should Investors Buy Disney Stock After Earnings?

There were quite a few things to like about Disney’s DIS fiscal third-quarter results on Wednesday which sent shares higher before cooling off in Friday’s trading session.

Eight months into long-term CEO Bob Iger’s return there are signs that Disney is turning things around in a bid to get back to its days of glory and stable growth.

Q3 Results: Disney posted mixed quarterly results with sales of $22.33 billion slightly missing estimates of $22.43 billion but earnings of $1.03 per share beat Q3 estimates by 4%.

Year over year Q3 sales were up 4% while earnings decreased -5% from the prior-year quarter. Still, the earnings beat was reassuring attributed to Disney’s Parks & Experiences segment while the company aims to strengthen its media assets. Notably, Disney’s Parks segment revenue rose 12% to $8.32 billion with net income up 11% to $2.42 billion.

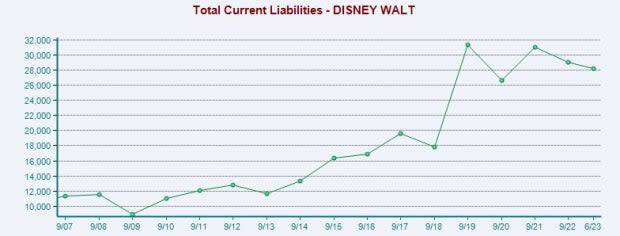

Image Source: Zacks Investment Research

Cost Cutting: Bob Iger stated Disney’s quarterly results were reflective of the company’s unprecedented transformation to restructure, improve efficiencies, and restore creativity to the center of its business.

Iger elaborated that this is creating a more cost-effective, coordinated, and streamlined approach to Disney’s operations and has put the company on track to exceed its initial goal of $5.5 billion in savings while improving direct-to-consumer operating income by roughly $1 billion.

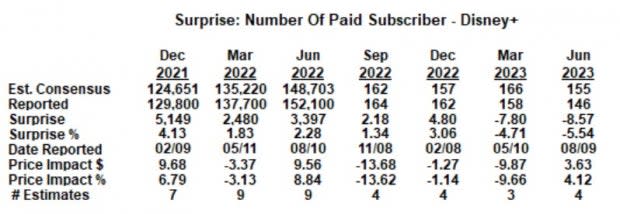

Image Source: Zacks Investment Research

Streaming Wars: Regarding streaming subscribers in Disney’s Direct-to-Consumer Segment, Disney+ had 146 million users during Q3 which was down -7% from a year ago and missed estimates by -5%.

However, Disney stated it would raise prices on ad-free streaming plans and crack down on password sharing similar to Netflix NFLX. This seemed to appease investors and Disney is still ahead of other rivals such as Paramount PARA and Warner Bros. Discovery WBD in regards to subscribers.

Paramount+ had 61 million subscribers following its most recent quarter with Warner’s Max subscribers at 95.8 million (merger of Discovery+ and HBO Max). Furthermore, Disney’s total subscribers including ESPN+ and Hulu stood at roughly 219.6 million users placing the company firmly in the second position behind Netflix’s 238.4 million users.

Image Source: Zacks Investment Research

Sports Betting: Other favorable news included Disney announcing it would sell exclusive rights to its ESPN Bet trademark to Penn Entertainment PENN for $1.5 billion. Penn will pay the sum out in installments over the next 10 years.

Takeaway

With Bob Iger at the helm of Disney again, the company appears to be making the right steps to get back to prominence and currently lands a Zacks Rank #3 (Hold). Overall the company’s Q3 report was favorable and while there may be better buying opportunities ahead holding Disney shares could still be rewarding.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Warner Bros. Discovery, Inc. (WBD) : Free Stock Analysis Report

PENN Entertainment, Inc. (PENN) : Free Stock Analysis Report

Paramount Global (PARA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance