Investors in KHD Humboldt Wedag International (ETR:KWG) have seen respectable returns of 31% over the past five years

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the KHD Humboldt Wedag International AG (ETR:KWG) share price is up 31% in the last 5 years, clearly besting the market return of around 6.0% (ignoring dividends).

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for KHD Humboldt Wedag International

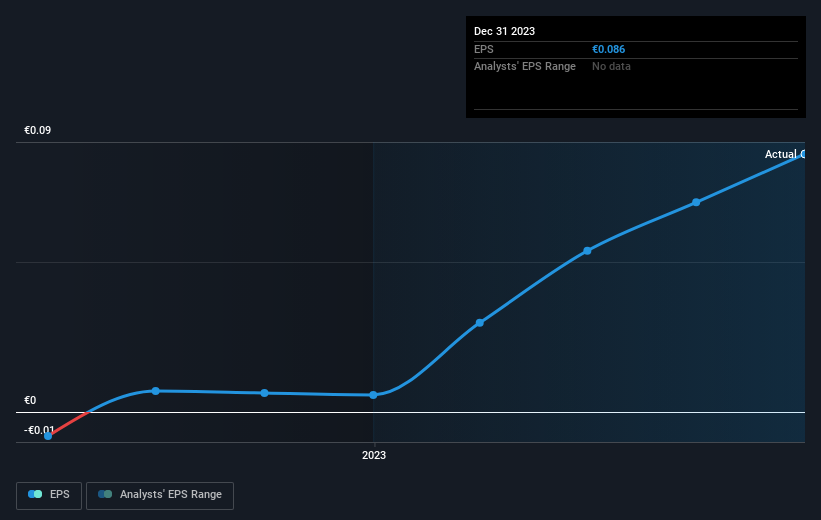

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, KHD Humboldt Wedag International became profitable. That would generally be considered a positive, so we'd hope to see the share price to rise.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on KHD Humboldt Wedag International's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

KHD Humboldt Wedag International shareholders are down 11% for the year, but the market itself is up 7.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with KHD Humboldt Wedag International .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance