Investors in Lumen Technologies (NYSE:LUMN) have unfortunately lost 50% over the last five years

Generally speaking long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. For example the Lumen Technologies, Inc. (NYSE:LUMN) share price dropped 68% over five years. That's an unpleasant experience for long term holders. And some of the more recent buyers are probably worried, too, with the stock falling 55% in the last year. Shareholders have had an even rougher run lately, with the share price down 45% in the last 90 days.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

View our latest analysis for Lumen Technologies

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Lumen Technologies moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

The revenue decline of 0.7% isn't too bad. But if the market expected durable top line growth, then that could explain the share price weakness.

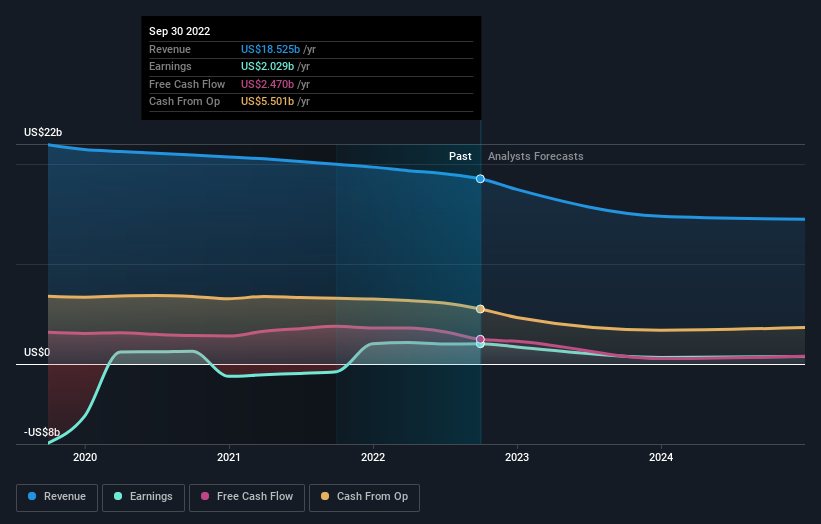

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Lumen Technologies stock, you should check out this free report showing analyst profit forecasts.

What About The Total Shareholder Return (TSR)?

We've already covered Lumen Technologies' share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Lumen Technologies shareholders, and that cash payout explains why its total shareholder loss of 50%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While the broader market lost about 19% in the twelve months, Lumen Technologies shareholders did even worse, losing 52%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Lumen Technologies (of which 2 are a bit unpleasant!) you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance