Iovance (IOVA) Q2 Earnings Miss, Lifileucel BLA on Track

Iovance Biotherapeutics, Inc. IOVA incurred a loss of 63 cents per share in second-quarter 2022, wider than the Zacks Consensus Estimate of a loss of 60 cents and the year-ago quarter’s loss of 53 cents.

Without any marketed product and revenue-generating collaboration, the company did not record any revenues during the quarter.

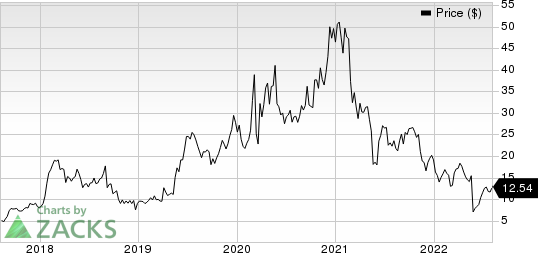

Shares of Iovance have declined 34.3% so far this year compared with the industry’s 19.7% fall.

Image Source: Zacks Investment Research

Quarter in Detail

Research & development expenses were $73.4 million, 18.2% higher than the year-ago quarter, primarily due to increased related personnel costs and facility building costs.

General and administrative expenses increased 36.4% from the prior-year quarter to $26.3 million due to an increase in related personnel costs and facility-related costs.

The company had $430.9 million in cash, cash equivalents, short-term investments and restricted cash as of Jun 30, 2022, compared with $516.0 million on Mar 31, 2022.

It expects the cash level to be sufficient to fund the current and planned operations in 2024.

Pipeline Updates

Iovance is developing its lead pipeline candidate, lifileucel, as a monotherapy for treating metastatic melanoma and metastatic cervical cancer in separate pivotal phase II studies — C-144-01 and C-145-04 — for metastatic melanoma and recurrent, metastatic or persistent cervical cancer, respectively, in previously-treated patients.

This April, the FDA provided positive feedback regarding the potency assays and assay matrix for lifileucel, concerning the treatment of melanoma. The regulatory body had previously raised concerns over the potency assays in 2020. The resolution of the potency assay-related concern was necessary prior to the submission of a biologics license application (BLA) for lifileucel.

Earlier in May, Iovance announced data from pivotal Cohort 4 of the C-144-01 study, which evaluated lifileucel in heavily pre-treated melanoma patients. Data from the study showed that patients who were treated with the therapy achieved an objective response rate (ORR) of 29%. This data was consistent with the Cohort 2 of the study, which achieved an ORR of 35%. IOVA plans to use this data to support the above BLA filing.

Following the successful pre-BLA meeting with the FDA held last month, Iovance will start a rolling BLA submission for lifileucel in melanoma later this month which is expected to be completed in fourth-quarter 2022.

Iovance has also been engaged in discussions with the FDA for lifileucel in cervical cancer. Based on these discussions, IOVA plans to reopen enrolment in Cohort 2 of the C-145-04 study. The study will enroll patients who have previously received an anti-PD-1 therapy. IOVA expects this study to support a potential BLA filing for lifileucel in cervical cancer indication.

Iovance plans to start a separate phase III study to evaluate the combination regimen of lifliecel and Merck’s MRK Keytruda (pembrolizumab) in frontline metastatic melanoma in late 2022. The combination of lifileucel and Meck’s Keytruda, which has already been evaluated in Cohort 1A of the multi-cohort phase II study (IOV-COM-202), has demonstrated an overall response rate of 67% in the given indication. This late-stage study will also serve as a confirmatory study for the pivotal Cohort 4 of the C-144-01 study.

Iovance is also evaluating another tumor-infiltrating lymphocyte (TIL) therapy, LN-145, as monotherapy for head and neck squamous cell carcinoma and non-small cell lung cancer (NSCLC) in two separate studies.

The company is also evaluating LN-145 in combination with Merck’s Keytruda or Bristol Myers’ BMY Opdivo/Yervoy in different cohorts of the IOV-COM-202 study. The study is evaluating LN-145 plus Merck’s Keytruda or Bristol-Myers’ Opdivo/Yervoy in separate cohorts in NSCLC patients.

Both Opdivo and Yervoy are two blockbuster immunotherapies marketed by Bristol Myers.

Iovance is currently undergoing preparations to start the phase I/II IOV-GM1-201 study to evaluate its new TIL candidate, IOV-4001, in patients with advanced melanoma and metastatic NSCLC in two separate cohorts.

IOV-4001 leverages the TALEN technology licensed from Cellectis S.A. CLLS to genetically knock out PD-1 in TIL cells. This license is part of a collaboration finalized between Iovance and Cellectis in 2020. Per the agreement terms, IOVA has an exclusive worldwide license to use Cellectis’ proprietary TALEN technology to develop gene-editing TIL therapies targeting cancer. In return, Cellectis will be entitled to receive potential milestones and royalty payments for products developed using the TALEN technology.

Iovance Biotherapeutics, Inc. Price

Iovance Biotherapeutics, Inc. price | Iovance Biotherapeutics, Inc. Quote

Zacks Rank

Iovance currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Cellectis S.A. (CLLS) : Free Stock Analysis Report

Iovance Biotherapeutics, Inc. (IOVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance