IQVIA Holdings (IQV) Stock Up 55.4% Over a Year: Here's Why

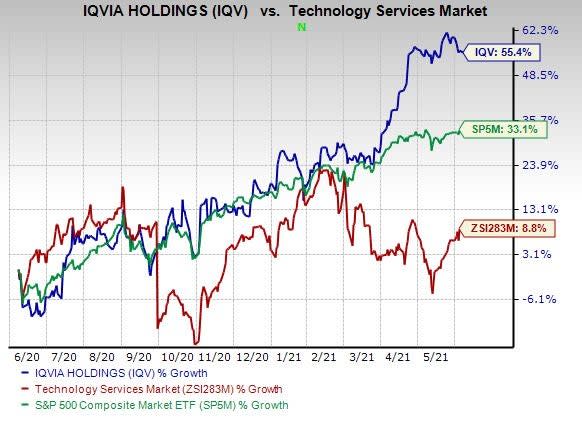

IQVIA Holdings Inc.’s IQV shares have charted a solid trajectory, appreciating 55.4% over the past year, surpassing 8.8% growth of the industry it belongs to and 33.1% rally of the Zacks S&P 500 composite.

Image Source: Zacks Investment Research

Let’s delve into the factors that have contributed to the company’s outperformance.

Consecutive Earnings & Revenue Beat

IQVIA Holdings came up with better-than-expected earnings and revenue performance in all the four quarters of 2020 as well as first-quarter 2021. The company’s bottom line continued to benefit from improvement in operational efficiency and decline in interest expenses. Strength across the Technology & Analytics Solutions segment boosted the top line.

Upbeat 2021 Guidance

IQVIA Holdings raised its 2021 guidance. Revenues are now expected within $13.2-$13.5 billion compared with the prior guided range of $12.55-$12.90 billion. The current Zacks Consensus Estimate of $13.31 billion lies within the updated guidance.

Adjusted earnings per share are now expected between $8.50 and $8.75 compared with the prior guided range of $7.89-$8.20. The current Zacks Consensus Estimate of $8.69 lies within the updated guidance.

Adjusted EBITDA is now anticipated between $2.900 billion and $2.965 billion compared with the prior guided range of $2.760-$2.840 billion.

Robust Set of Capabilities

IQVIA Holdings has a strong healthcare-specific global IT infrastructure, analytics-driven clinical development capabilities, a robust real-world solutions ecosystem, and a growing set of proprietary clinical as well as commercial applications that allow it to grow and retain relationships with healthcare stakeholders. The company’s combined offerings of research and development, and commercial services have been helping it develop trusted relationships, in turn resulting in a diversified base of more than 10,000 clients in over 100 countries.

Zacks Rank and Other Stocks to Consider

IQVIA Holdings currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other top-ranked stocks in the broader Zacks Business Services sector include Equifax EFX, Charles River CRAI and TransUnion TRU, each carrying a Zacks Rank #2.

Long-term (three to five years) expected earnings per share growth rate for Equifax, Charles River and TransUnion is projected at 14%, 15.5%, and 20.9%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Charles River Associates (CRAI) : Free Stock Analysis Report

TransUnion (TRU) : Free Stock Analysis Report

IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance