Our Take On IronRidge Resources' (LON:IRR) CEO Salary

The CEO of IronRidge Resources Limited (LON:IRR) is Vince Mascolo, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for IronRidge Resources

Comparing IronRidge Resources Limited's CEO Compensation With the industry

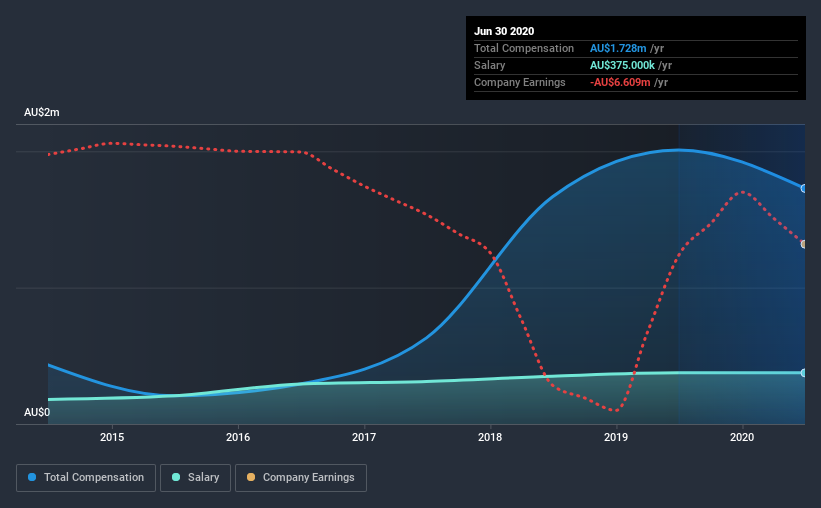

Our data indicates that IronRidge Resources Limited has a market capitalization of UK£49m, and total annual CEO compensation was reported as AU$1.7m for the year to June 2020. We note that's a decrease of 14% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at AU$375k.

For comparison, other companies in the industry with market capitalizations below UK£149m, reported a median total CEO compensation of AU$267k. Accordingly, our analysis reveals that IronRidge Resources Limited pays Vince Mascolo north of the industry median. Moreover, Vince Mascolo also holds UK£1.8m worth of IronRidge Resources stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2020 | 2019 | Proportion (2020) |

Salary | AU$375k | AU$375k | 22% |

Other | AU$1.4m | AU$1.6m | 78% |

Total Compensation | AU$1.7m | AU$2.0m | 100% |

Talking in terms of the industry, salary represented approximately 69% of total compensation out of all the companies we analyzed, while other remuneration made up 31% of the pie. In IronRidge Resources' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at IronRidge Resources Limited's Growth Numbers

Over the past three years, IronRidge Resources Limited has seen its earnings per share (EPS) grow by 17% per year. It achieved revenue growth of 226% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has IronRidge Resources Limited Been A Good Investment?

Given the total shareholder loss of 56% over three years, many shareholders in IronRidge Resources Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we noted earlier, IronRidge Resources pays its CEO higher than the norm for similar-sized companies belonging to the same industry. However, the EPS growth is certainly impressive, but it's disappointing to see negative shareholder returns over the same period. Considering overall performance, we can't say Vince is underpaid, in fact compensation is definitely on the higher side.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 6 warning signs for IronRidge Resources you should be aware of, and 3 of them are concerning.

Switching gears from IronRidge Resources, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance