Isa allowance 2024-25: Limits and regulations

An individual savings account, better known by the acronym “Isa”, allows you to save or invest for the future free of tax.

This means that any interest or investment income earned by the account is not taxed, making it a very efficient way to put money aside for a rainy day.

However, there are limits in place to prevent the cost to the Exchequer spiralling too high, and it is important to understand them before opening an account.

Breaching these limits could lead to a good deal of hassle, so it is good to be aware of what they are and how they work.

This guide will explain how the Isa allowance works – and how to avoid breaching it:

What is an Isa allowance?

While Isas work like ordinary savings accounts in most ways, the amount you can save into them is limited. This means that you cannot transfer savings into the account purely to avoid tax without limit.

It is important to note that the Isa allowance applies to the tax year and not the calendar year, and so your limit refreshes each April.

The limit also applies across all of your Isas; you do not get a new limit for each one. This means that all of your Isa savings in a single year will be added up when it comes to working out whether you have exceeded the allowance.

While it used to be the case that you could only pay into one of each type of Isa in each tax year, this rule was abolished in April 2024 giving savers greater flexibility. Types of Isas include a cash Isa, stocks and shares Isa, lifetime Isa and innovative finance Isa.

What is your Isa allowance for 2024-25?

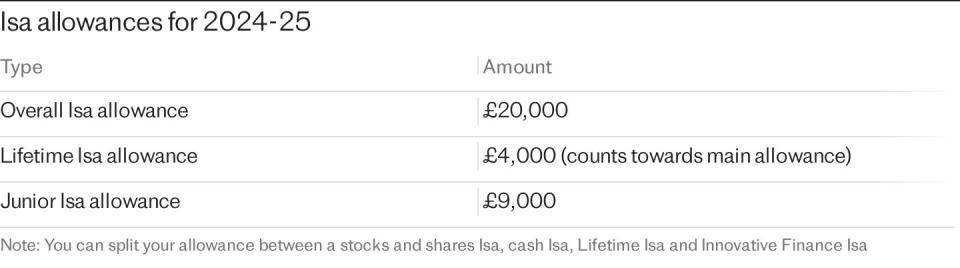

The maximum amount you can save into Isas in a single tax year is £20,000. This amount can be paid entirely into one Isa or into several.

For example, you could make contributions worth £12,000 into a cash Isa, £4,000 into a stocks and shares Isa, and £4,000 into a lifetime Isa. This adds up to a total of £20,000 which is in line with the annual limit.

One exception is the lifetime Isa. These accounts are designed specifically for those saving for a first home or for retirement and they come with a 25pc bonus from the Government. This has its own additional annual limit of £4,000, which still counts towards your overall Isa allowance.

You can also open a junior Isa on behalf of your child which will allow you to save an additional £9,000 a year. This is on top of your existing £20,000 Isa allowance.

The Government is also exploring the possibility of creating a new Isa, the Great British Isa that will give savers an additional £5,000 allowance to invest in UK stocks.

How much can you put in an Isa?

The maximum amount you can save into an Isa each year is £20,000, but this can also be split across several different types of Isas.

The maximum amount you can put into a lifetime Isa is £4,000 a year. Opening a junior Isa for a child will allow you to save an additional £9,000.

These limits apply to each tax year and refresh on April 6.

How to maximise your Isa allowance

Isas are one of the most tax-efficient ways to save. Any savings interest or investment income earned in the accounts is free from all tax, including income tax, dividend tax and capital gains.

This means it is very important to maximise your allowances – if you can afford to.

There are several ways to do this. If you have a lump sum to save or invest, then make sure you do so before the end of the tax year, but only up to the Isa allowance.

For example, if you had £40,000 to save, you could put £20,000 into your Isa before the tax year ends and then put the remainder in the account a few days later when the new tax year begins. This means you are able to save the full £40,000 free of tax.

With a stocks and shares Isa, you also do not need to invest the money straight away. You can pay in cash before the end of the tax year to make use of the allowance, hold it in cash and drip feed your investments throughout the year, a process known as “pound cost averaging”.

And remember, that families can combine allowances to save up to £58,000 a year free from tax for a family of four. Both adults benefit from the general £20,000 Isa allowance, but both children can also have a junior Isa to save a further £9,000 each.

FAQs

How does the Isa allowance work?

The Isa allowance limits how much you can save into Isas in a single tax year. The current allowance is £20,000, which can be paid into a single account or split across several Isas.

Can unused Isa allowance be carried forward?

No, you cannot. Unlike some other allowances, the Isa allowance is a “use-it-or-lose-it” limit meaning you are not able to carry forward any unused allowance to future tax years.

What was the impact of Brexit on Isa allowances?

Although some experts feared that the Government may engage in a post-Brexit tax raid on Isas and abolish or lower the allowance, this has not happened yet. However, the allowance has not been increased since 2017, meaning inflation has reduced the amount which can be saved in real terms since Brexit.

Do any Isas have different allowances?

Yes, some different types of Isas have different limits. The lifetime Isa has an annual limit of £4,000. This counts towards your overall allowance. The junior Isa has an annual limit of £9,000, which is in addition to your overall allowance.

What happens if you breach your allowance?

If you breach your allowance you should contact HM Revenue and Customs (if you do not, it will contact you) and it can start the process of “repairing” the Isa.

Any contributions made after the breach will not be included in the Isa tax wrapper, meaning any savings interest or investment growth you earned on that money will be taxable.

This doesn’t necessarily mean you’ll end up with a tax bill; it depends on whether you breach your tax-free allowances.

Yahoo Finance

Yahoo Finance