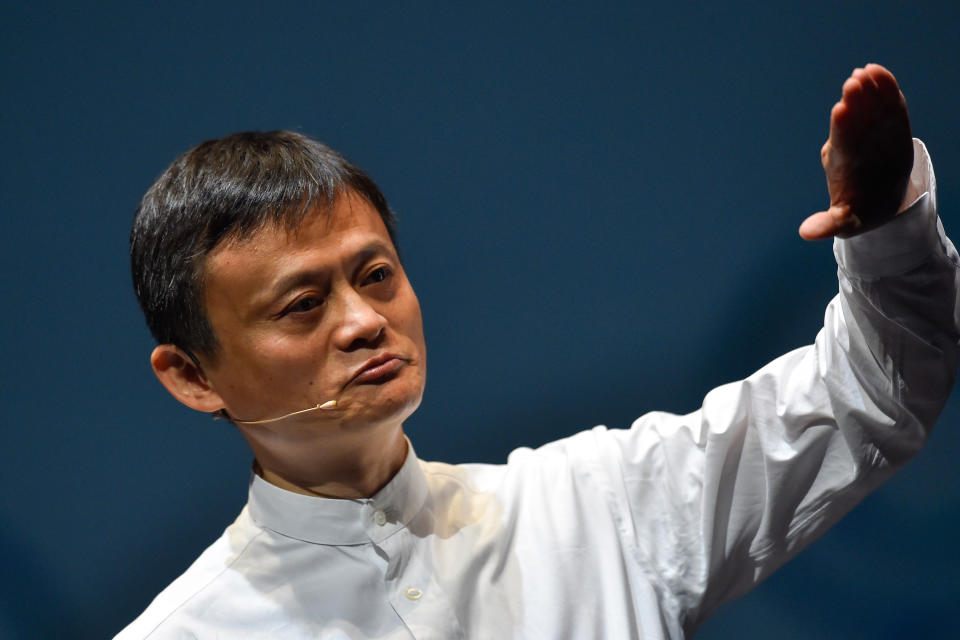

Chinese billionaire Jack Ma resigns from SoftBank amid historic losses

Chinese billionaire Jack Ma has resigned from the board of Japanese tech company SoftBank (SFTBY), the Toyko-based firm announced on Monday.

The technology group did not give a reason for Ma’s departure, apart from to say it was at Ma’s own request and he would leave on 25 June when the company holds its annual general meeting.

Ma was the co-founder and CEO of Chinese e-commerce giant Alibaba (BABA), which counts SoftBank as one of its major investors — it holds about 25% of the company. Ma resigned from Alibaba last year.

He joined SoftBank’s board in 2007, and has a close relationship with the company founder and chief executive Masayoshi Son.

SoftBank on Monday reported a 1.9tn yen (£14.7bn, $17.8bn) annual loss at its Vision Fund, and an overall operating loss 1.36tn yen for the group as a whole in the year ending March.

The historic losses for the company were driven by the Vision Fund’s loss-making investments in WeWork and Uber Technologies (UBER). Its loss from We-Work was $4.6bn (£3.8bn), and from Uber $5.2bn.

The coronavirus pandemic has hit startups in the sharing and travel sectors hard. SoftBank’s investment of around $1.5bn in hotel-booking service Oyo has also proved disappointing.

READ MORE: SoftBank-backed $10bn hotel startup Oyo axes dozens of UK staff

India-based Oyo, which is valued at $10bn has made dozens of UK staff redundant and seen the exit of its country head in recent weeks, following a period of rapid expansion.

SoftBank said its Vision Fund’s $75bn investment in 88 startups was worth $69.6bn at the end of March.

SoftBank said it plans a second share buy back of up to 500bn yen in the next year. Bloomberg News reported that SoftBank plans to fund the buybacks partially via selling stakes in Alibaba and T-Mobile US.

The company also announced three new board members on Monday, including chief financial officer Yoshimitsu Goto.

Watch the latest videos from Yahoo UK

Yahoo Finance

Yahoo Finance