Jacobs (J) to Refurbish UK Nuclear Research Laboratories

Jacobs Solutions Inc. J has secured a contract from the UK's government-owned National Nuclear Laboratory for various infrastructure renewal projects. The contract is estimated at $12 million (£10 million) with an initial one-year contract term. It also has an option for three additional one-year extensions.

The contract will help the UK's advanced nuclear research and development capability to remain topnotch.

Under the contract, Jacobs’ scope of work includes design, build and refurbishment work at the Windscale and Central Laboratories at Sellafield in Cumbria, a specialist analytical services and process chemistry facility in Preston and a test-rig center in Workington.

The Dallas, TX-based leading providers of professional, technical and construction services will support requirements definition; project specification; concept, preliminary and detailed design; procurement and installation.

Contract Wins & Solid Backlog Bode Well

The efficient project execution is one of the main characteristics driving Jacobs’ performance over the last few quarters. The company’s ongoing contract wins are a testimony to this fact. At the fiscal third-quarter end, it reported a backlog of $28.1 billion, up 10.4% year over year. This indicates consistent solid demand for Jacobs' consulting services. Of this backlog, the Critical Mission Solutions segment accounted for $10.2 billion, up from $9.57 billion reported a year ago, which provided strong visibility into the base business.

The company’s overall 18-month qualified new business pipeline of more than $25 billion remains robust. This segment is benefiting from well-funded government and cyber programs, U.S. Department of Defense or DoD, mission-IT, space, nuclear and 5G-related projects.

The People & Places Solutions (P&PS) segment backlog at the quarter end was $17.5 billion, up from $15.6 billion a year ago. The P&PS segment’s overall sales pipeline has increased as life sciences and electronics customers have moved forward with the previously paused projects.

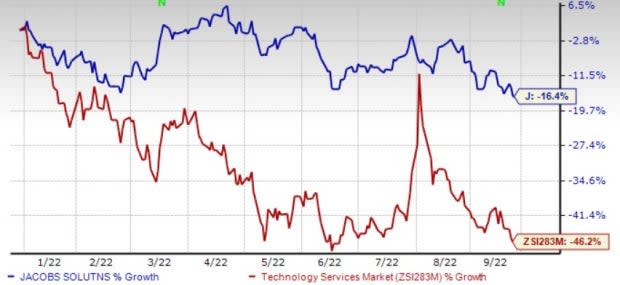

Image Source: Zacks Investment Research

J’s shares have broadly outperformed the Zacks Engineering - R and D Services industry this year. Earnings estimates for fiscal 2022 suggest 10.3% year-over-year growth.

Zacks Rank

Jacobs currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some Better-Ranked Stocks in the Construction Sector

Arcosa, Inc. ACA, currently sporting a Zacks Rank #1, is a manufacturer of infrastructure-related products and services, serving construction, energy and transportation markets.

ACA’s expected earnings growth rate for 2022 is 19.7%. The Zacks Consensus Estimate for current-year earnings has improved to $2.31 per share from $2.08 over the past 30 days.

United Rentals, Inc. URI, presently sporting a Zacks Rank #1, has been benefiting from a broad-based recovery of activity across its end markets served. Higher margins from rental revenues and used equipment sales are added benefits.

The Zacks Consensus Estimate for URI’s 2022 earnings rose to $31.73 per share from $31.66 in the past 30 days. The estimated figure suggests 43.8% year-over-year growth.

Dycom Industries, Inc. DY is benefiting from the higher demand for network bandwidth and mobile broadband, extended geography, proficient program management and network planning services. Dycom expects considerable opportunities across a broad array of customers.

Dycom’s, currently sports a Zacks Rank #1, earnings for fiscal 2023 are expected to grow 142.1%. The Zacks Consensus Estimate for DY’s 2022 earnings rose to $3.68 per share from $3.28 in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Arcosa, Inc. (ACA) : Free Stock Analysis Report

Jacobs Solutions Inc. (J) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance