Japan’s Firms Trim Spending, Reflecting Headwinds to Growth

(Bloomberg) -- Japanese companies trimmed capital investment in the first quarter, a result that likely indicates revised data due next week will continue to show the economy contracted in the period.

Most Read from Bloomberg

Key Engines of US Consumer Spending Are Losing Steam All at Once

Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money

Homebuyers Are Starting to Revolt Over Steep Prices Across US

AMLO Protege Sheinbaum Becomes First Female President in Mexico

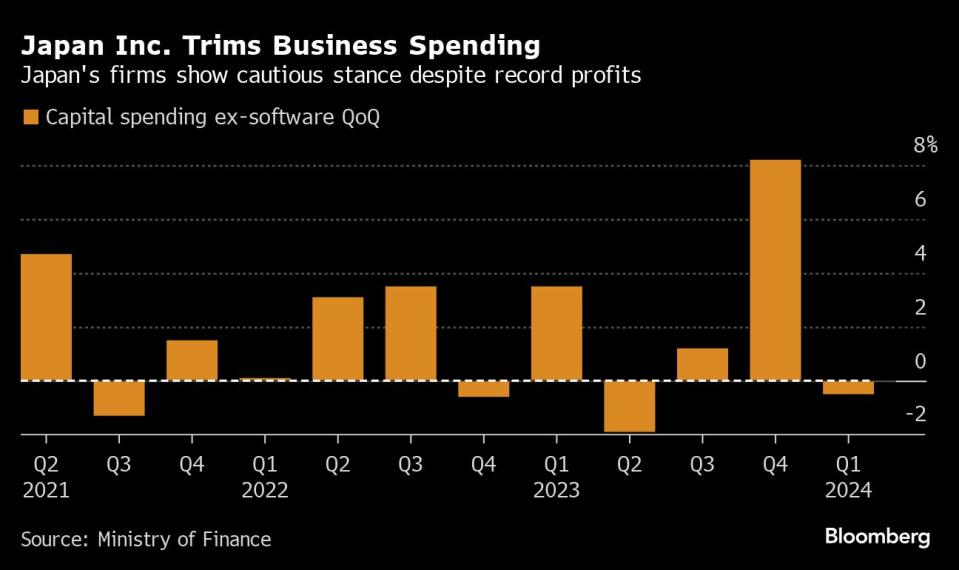

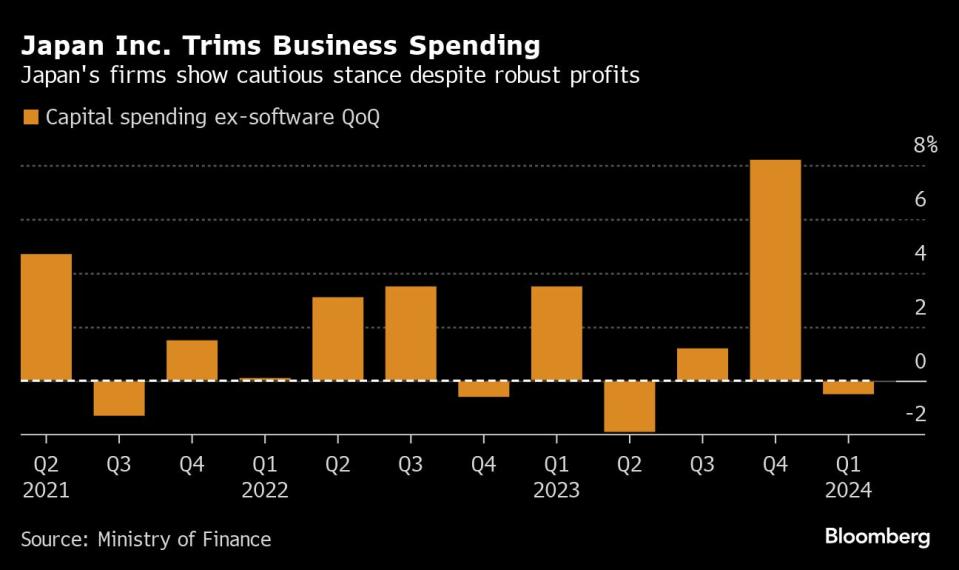

Capital expenditures on goods excluding software fell 0.5% in the three months through March from the previous quarter following a surge in spending at the end of last year, the finance ministry reported Monday. Manufacturers led the decline, cutting spending by 3% from the prior quarter, while service-sector firms boosted spending a tad. From a year earlier, overall outlays rose a weaker-than-expected 6.8%.

The fall in outlays came despite continued strength in corporate earnings. Profits jumped 15.1% from a year earlier, almost double the consensus estimate, and marking the fifth quarter of gains. Sales advanced by 2.3%.

The data will feed into revised gross domestic product figures for the period due on June 10, days before the Bank of Japan’s next policy decision. The initial results showed GDP contracted at an annualized pace of 2% after a flat reading for the previous quarter, with capital outlays sliding 0.8%. That outcome stretched the streak of quarters without economic growth to three.

The revised data will probably confirm the economy was in contraction during the period, according to Takeshi Minami, economist at Norinchukin Research.

“The numbers are down after surprisingly strong results in the previous quarter,” Minami said. “Still, they are not that bad and it’s true that companies have to invest in various areas like digital and green transformations and they are seeing a rise in resources to do so.”

Weak corporate investment bodes ill both for the economy and the central bank as it indicates companies are concerned about persistent inflation and uncertainties in the global economy.

“Companies are cautious about the timing for making investments,” Minami said. “They recognize shipments from Japan to other nations won’t rise, and they also find it hard to invest at home because consumption is weak.”

The cautious stance stands in contrast to the March decision by many large companies to offer workers the biggest wage increases in three decades this fiscal year. The pay hike deal reached between companies and the nation’s largest umbrella group for unions was a key factor behind the central bank’s historic interest rate hike that month.

Now policymakers are attempting to discern if more companies have shaken off their long-held tendency to channel earnings into savings in order to prepare for downturns. After two years of inflation that matched or exceeded the BOJ’s 2% inflation target, authorities are hopeful that a virtuous cycle in which companies boost pay while passing on rising costs to consumers via price hikes will kick into gear.

The BOJ is monitoring progress over this shift particularly among service companies, which have traditionally resisted pressure to raise prices out of fear of losing market share to competitors.

There are some optimistic signs. Overall, Japanese companies plan to increase their capital investment in the fiscal year that started in April, while some small service companies plan otherwise, according to the BOJ’s Tankan survey. Capex plans tend to be revised higher as the year progresses.

Meanwhile, speculation is growing that the BOJ may raise interest rates again in coming months as the weak yen is expected to boost import prices for food, materials and energy.

Corporate investment is likely to keep increasing, as businesses cope with demands related to labor shortages, digitalization and decarbonization, the BOJ said in its quarterly outlook in April.

--With assistance from Erica Yokoyama.

(Updates with economist’s comments)

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

The Budget Geeks Who Helped Solve an American Economic Puzzle

Israel Seeks Underground Secrets by Tracking Cosmic Particles

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance