Japan Contract Development Manufacturing Organization Market Report 2024-2030, Featuring Lonza, Recipharm, LabCorp, Catalent, WuXi AppTec, CordenPharma, Cambrex, Bushu Pharmaceuticals and Nipro

Japanese Contract Development Manufacturing Organization Market

Dublin, June 21, 2024 (GLOBE NEWSWIRE) -- The "Japan Contract Development Manufacturing Organization Market Size, Share & Trends Analysis Report by Product Type (API, Drug Product), Workflow (Clinical, Commercial), Application (Oncology, Hormonal, Glaucoma), Country, and Segment Forecasts, 2024-2030" report has been added to ResearchAndMarkets.com's offering.

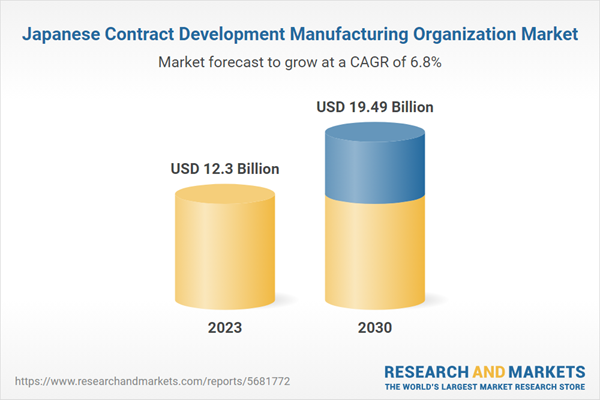

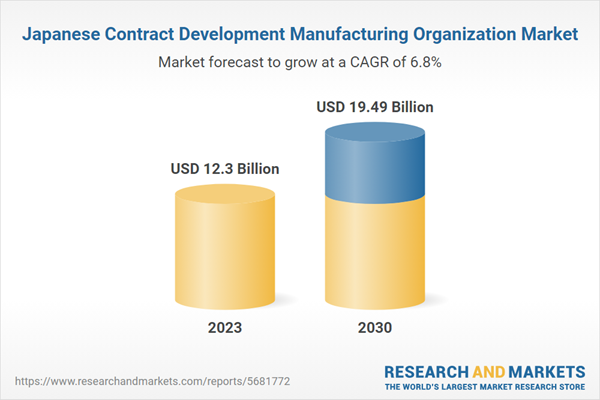

The Japan CDMO market is expected to reach USD 19.49 billion by 2030 and is projected to register a CAGR of 6.8% from 2024 to 2030.

The increasing demand for biopharmaceuticals, a high burden of diseases, and the rising geriatric population are some of the key growth drivers. Growing investments by various Contract Development and Manufacturing Organizations (CDMOs) for facility and service expansion are likely to boost the market over the forecast period.

In addition, increasing pharmaceutical R&D investments are driving the market growth. As pharmaceutical companies invest more in R&D, they may seek external expertise and resources to accelerate drug development processes. CDMOs provide specialized services in drug development, manufacturing, and testing, making them valuable partners for pharmaceutical companies looking to outsource certain aspects of their R&D activities. Several players are investing in the R&D activities of pharmaceuticals. For instance, in March 2022, WuXi AppTec launched Tetracycline-Enabled Self-Silencing Adenovirus (TESSA) technology to accelerate the production of adeno-associated viruses for drugs in cell and gene therapy.

The increase in outsourcing services by pharmaceutical companies in the pharmaceutical industry has profoundly impacted the Japan market.The trend of outsourcing activities in the pharmaceutical domain is rising as companies find value in acquiring additional competencies essential for successful drug development & commercialization. Besides providing extended expertise & assisting in improved cash flow management, outsourcing brings significant manufacturing advantages, including reducing investment risks.

Notably, regulatory authorities in Japan have accelerated approval for regenerative medical and gene therapy products. For instance, the adoption of the Pharmaceuticals and Medical Devices Act (PMD Act), 21st Century Cures Act, and PRIME (Priority Medicines) Initiative has helped the country improve access to regenerative medicines. Such initiatives by regulatory agencies are expected to improve the demand for the development and manufacturing of regenerative medicines in the country.

Japan CDMO Market Report Highlights

The active pharmaceutical ingredient (API) segment dominated the market with a share of 81.2% in 2023. The segment growth is driven by competitive drug development and growing demand for end-to-end Contract Development & Manufacturing Organization (CDMO) services. In addition, advancements in API manufacturing, growth of the biopharmaceutical sector, and the increasing geriatric population are some of the key factors propelling segment growth

Based on workflow, the commercial segment held the largest market share in 2023, attributed to robust demand for pharmaceutical products, such as biosimilar medications, generic medications, and regenerative therapies. This is where commercial CDMOs may help by providing knowledge, saving time, and being cost-effective.

Based on application, the oncology segment dominated the test type market in 2023 with a revenue share of 35.3%, owing to the high cancer burden in the country. Approval of regenerative products and virotherapy for cancer treatment can further support market growth and the segment is further driven by increasing number of cancer cases globally. In addition, increasing pharmaceutical R&D investments, patent expirations, and demand for oncology drugs & biologic innovations are the factors driving the oncology segment growth

Key Attributes:

Report Attribute | Details |

No. of Pages | 127 |

Forecast Period | 2023 - 2030 |

Estimated Market Value (USD) in 2023 | $12.3 Billion |

Forecasted Market Value (USD) by 2030 | $19.49 Billion |

Compound Annual Growth Rate | 6.8% |

Regions Covered | Japan |

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Japan CDMO Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Growing Demand for Biopharmaceutical Drugs in Japan

3.2.1.2. High Geriatric Population and Growing Disease Burden in Japan

3.2.1.3. Low Cost Associated with Outsourcing Drug Manufacturing and Development Services

3.2.2. Market Restraint Analysis

3.2.2.1. Limited Outsourcing Opted by Big Pharma Companies

3.2.2.2. Quality Issues While Outsourcing

3.3. Japan CDMO Market Analysis Tools

Chapter 4. Japan CDMO Market: Product Estimates & Trend Analysis

4.1. Definitions and Scope

4.1.1. API

4.1.2. Drug Product

4.2. Product Market Share, 2023 & 2030

4.3. Segment Dashboard

4.4. Japan CDMO Market Movement Analysis

4.5. Japan CDMO Market Size & Trend Analysis, by Product, 2018 to 2030 (USD Million)

4.5.1. API

4.5.1.1. Market Estimates and Forecast 2018 to 2030 (USD Million)

4.5.1.2. Type

4.5.1.3. Synthesis

4.5.1.4. Drug

4.5.1.5. Manufacturing

4.5.2. Drug Product

4.5.2.1. Market Estimates and Forecast 2018 to 2030 (USD Million)

4.5.2.2. Oral Solid Dose

4.5.2.3. Semi-solid Dose

4.5.2.4. Liquid Dose

4.5.2.5. Others

Chapter 5. Japan CDMO Market: Workflow Estimates & Trend Analysis

5.1. Definitions and Scope

5.2. Segment Dashboard

5.3. Japan CDMO Market Movement Analysis

5.4. Japan CDMO Market Size & Trend Analysis, by Workflow, 2018 to 2030 (USD Million)

Chapter 6. Japan CDMO Market: Application Estimates & Trend Analysis

6.1. Definitions and Scope

6.1.1. Oncology

6.1.1.1. Small Molecule

6.1.1.2. Biologics

6.1.2. Infectious Diseases

6.1.3. Neurological Disorders

6.1.4. Cardiovascular Diseases

6.1.5. Metabolic Disorders

6.1.6. Autoimmune Diseases

6.1.7. Respiratory Diseases

6.1.8. Ophthalmology

6.1.9. Gastrointestinal Disorders

6.1.10. Hormonal Disorders

6.1.11. Hematological Disorders

6.1.12. Others

6.2. Segment Dashboard

6.3. Japan CDMO Market Movement Analysis

6.4. Japan CDMO Market Size & Trend Analysis, by Application, 2018 to 2030 (USD Million)

6.4.1. Oncology

6.4.1.2. Small Molecule

6.4.1.3. Biologics

6.4.2. Infectious Diseases

6.4.3. Neurological Disorders

6.4.4. Cardiovascular Diseases

6.4.5. Metabolic Disorders

6.4.6. Autoimmune Diseases

6.4.7. Respiratory Diseases

6.4.8. Ophthalmology

6.4.9. Gastrointestinal Disorders

6.4.10. Hormonal Disorders

6.4.11. Hematological Disorders

6.4.12. Others

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, by Key Market Participants

7.2. Company/Competition Categorization

7.3. Vendor Landscape

7.4. Market Participant Categorization

Lonza

Thermo Fisher Scientific, Inc.

Recipharm AB

Laboratory Corporation of America Holdings (LabCorp)

Catalent, Inc.

WuXi AppTec, Inc.

Samsung Biologics

CordenPharma International

Cambrex Corporation

Bushu Pharmaceuticals Ltd.

CMIC HOLDINGS Co., LTD.

Nipro Corporation

Sumitomo Chemical Company, Limited

For more information about this report visit https://www.researchandmarkets.com/r/68965o

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance