Jazz's (JAZZ) Vyxeos Gets FDA Nod for Pediatric Leukemia

Jazz Pharmaceuticals plc JAZZ announced that the FDA has granted approval to label expansion of its leukemia drug, Vyxeos, in pediatric patients aged one to 21 years. The drug is now approved to treat adult as well as paediatric patients with newly-diagnosed therapy-related acute myeloid leukemia (t-AML) or AML with myelodysplasia-related changes (AML-MRC).

The label expansion of the drug was supported by data from two single-arm clinical studies conducted separately by Children's Oncology Group and Cincinnati Children's Hospital as well as data on effectiveness of Vyxeos from previously completed clinical studies in adult patients.

The drug generated $121.1 million in sales in 2020, almost flat yearoveryear. The label expansion of the drug will likely bring additional revenues.Jazz is also evaluating Vyxeos in other AML patient populations, such as adults with standard or intermediate-risk AML, in combination with targeted AML treatments and in new inidcations (myelodysplastic syndromes, or MDS).

Shares of Jazz have gained 0.9% so far this year against the industry’s decrease of 3.5%

Apart from Vyxeos, the company has three other approved oncology drugs — Defitelio, Zepzelca and Erwinaze — in its portfolio. Although Zepzelca was approved in June 2020 as a treatment for relapsed small cell lung cancer, the drug has shown promising uptake. The drug is likely to boost the company’s oncology revenues significantly in 2021.

Meanwhile, the company is also seeking approval for its novel asparaginase, JZP-458, as potential treatment for acute lymphoblastic leukemia or lymphoblastic lymphoma.The company expects to launch JZP-458 in mid-2021, following a potential approval.

Please note that Jazz generates the majority of its revenues from its sleep franchise led by Xyrem. Meanwhile, the FDA approved Xywav, a low sodium formulation of Xyrem, in July 2020 for the treatment of cataplexy or excessive daytime sleepiness in patients with narcolepsy. Xywav recorded sales of $15.3 million in 2020. At the end of 2020, Jazz had approximately 1,900 active Xywav patients. The low sodium content of the same boosts its potential as it can cater to a greater number of patients compared to Xyrem.

We note that Jazz is intheprocess of diversifying its portfolio of drugs following the completion of acquisition of British cannabinoid drug company, GW Pharmaceuticals GWPH. The acquisition will add GW Pharmaceuticals’ lead oral solution, Epidiolex, approved for the treatment of seizures associated with two rare and severe forms of epilepsy, Lennox-Gastaut syndrome and Dravet syndrome. The acquisition thus adds a third high-growth commercial franchise to Jazz’s business.

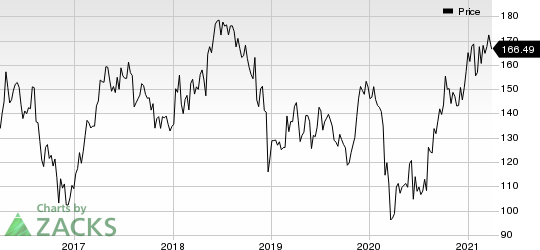

Jazz Pharmaceuticals PLC Price

Jazz Pharmaceuticals PLC price | Jazz Pharmaceuticals PLC Quote

Zacks Rank & Stocks to Consider

Jazz currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked small drugmakers include Catalent, Inc. CTLT and USANA Health Sciences USNA, both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The consensus estimate for Catalent’s 2021earningshas improved from $3.00 per share to $3.27 over the past 60 days.

USANA’s earnings estimates have risen from $5.64 per share to $6.36 per share for 2021 over the past 60 days. The stock is up 26.3% this year so far.

5G Revolution: 3 Stocks to Make Your Move

With super high data speed, it will make current cell phones obsolete and unlock the full potential of big data, cloud computing, and artificial intelligence. In the next few years this industry is predicted to create 22 million jobs and a stunning $12.3 trillion in revenue.

Today you have an historic chance to pursue almost unimaginable gains like Microsoft, Netflix, and Apple in their early phases. Zacks has released a Special Report that reveals our . . .

Smartest stock for 5G telecom

Safest investment in 5G hardware

Single best 5G buy of all!

Download now.Today the report is FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

USANA Health Sciences, Inc. (USNA) : Free Stock Analysis Report

Catalent, Inc. (CTLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance