Join Canada’s own Warren Buffett on his acquisition gravy train

Whether managing a business or an investment portfolio, success boils down to the effectiveness of capital allocation. Allocating capital to high-return opportunities is the engine that powers “compounding” – the money-making magic that over time creates vast fortunes and was famously described by Albert Einstein as the “eighth wonder of the world”.

Few allocate capital as effectively as Mark Leonard, the founder of Canadian software conglomerate Constellation Software. The proof is in the gains he has delivered to shareholders. Since the shares’ listing on the Toronto Stock Exchange in 2006, they have delivered a 290-fold return.

Unfortunately, the shares are out of reach for many British investors. Few online stockbrokers offer them, with the notable exceptions of Interactive Investor and Barclays Smart Investor, which both provide access to Canadian shares.

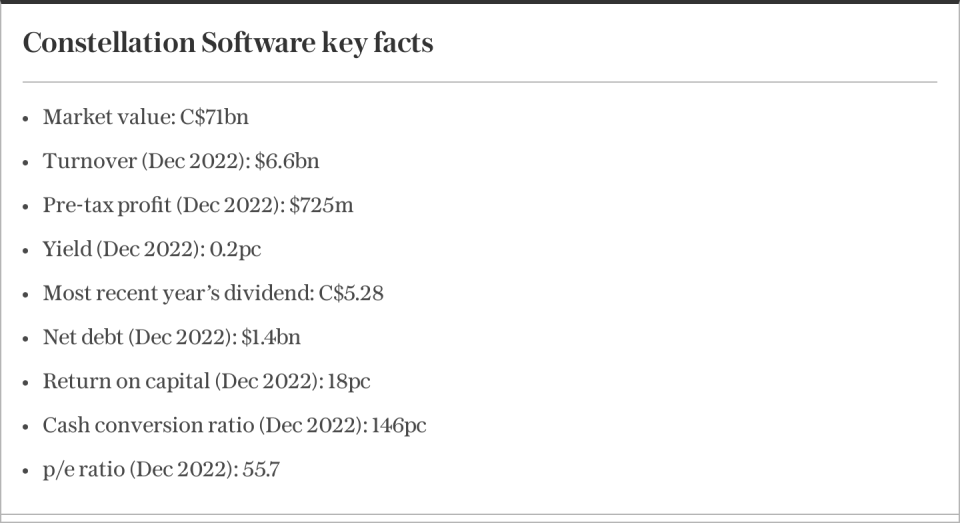

A chunky share price – at 3,349 Canadian dollars, one Constellation Software share costs £1,970 – also presents practical issues.

Questor would not normally recommend a share with such limited accessibility to readers. But we will make an exception in this case not only because of Constellation Software’s remarkable investment credentials but in the hope that other brokers may follow suit in allowing access to the shares.

Constellation Software’s backing from some of the world’s best fund managers adds further weight to the investment case. Four of these professional investors, each among the top-performing 3pc of the 10,000 equity fund managers tracked by the financial publisher Citywire, have bought shares in the Canadian business.

The company receives an AA rating – just below a top AAA rating – from Citywire Elite Companies, which rates companies on the basis of their backing by the best-performing fund managers.

Crucial to Constellation’s investment appeal is its founder and president, who can be regarded as near equal parts investor and entrepreneur.

Leonard’s track record at the helm of the business has drawn comparisons with legendary American investor Warren Buffett and his Berkshire Hathaway investment vehicle.

Before setting up Constellation Leonard worked in the venture capital industry. While doing so he discovered that few businesses could match the attractions of small, niche-focused software businesses.

These types of company often have oligopoly or monopoly positions because their markets are too small to accommodate many rivals. Meanwhile, the business-critical nature of their products and the time and expense involved in switching to rival software foster life-long customers, reliable revenues and formidable pricing power.

While acquirers normally have to pay a premium for such qualities, this area is something of an exception, as the small size of these businesses limits competition to acquire them. That means Constellation has historically been able to pick up companies at prices that allow it to generate a high rate of return on its investments.

The cash generated from these small businesses has provided the firepower to buy more and more of them, compounding value for shareholders in the process.

But this business model, effective though it has proven, raises two questions: how can such a large and disparate group of businesses be effectively managed? And can Constellation keep up its acquisition standards?

The answer lies in focusing on the measures that really matter to compounding: “return on invested capital”, cash generation and growth.

Constellation applies strict criteria to its acquisitions, requiring them to generate a high “internal rate of return”, a favourite measure of private equity investors. The businesses it acquires are then paid bonuses based on their ability to hit targets for return on invested capital.

However, as Constellation has grown, from a business worth C$387m at its 2006 flotation to C$71bn today, that has necessitated some changes.

In early 2021 Leonard lowered the return required on bigger deals in a bid to become more competitive with private equity and other acquirers at the larger end of its market. The criteria for smaller deals remained unchanged.

Leonard was persuaded by the argument from a board director that even though they would generate a lower return than Constellation’s smaller acquisitions, these larger deals would represent a better use of capital than paying out the cash it was struggling to deploy as special dividends.

Given the company’s acquisition record, investors have agreed, sending the shares to new record highs. Some of the world’s best performing fund managers are placing their faith in Leonard to continue to deliver, and this column does too.

Questor says: buy

Ticker: TSE: CSU

Share price at close: C$3,348.61

Algy Hall is investment editor of Citywire Elite Companies

Read the latest Questor column on telegraph.co.uk every Monday, Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance