JPMorgan accuses US Virgin Islands of harboring Jeffrey Epstein for two decades

By Jonathan Stempel

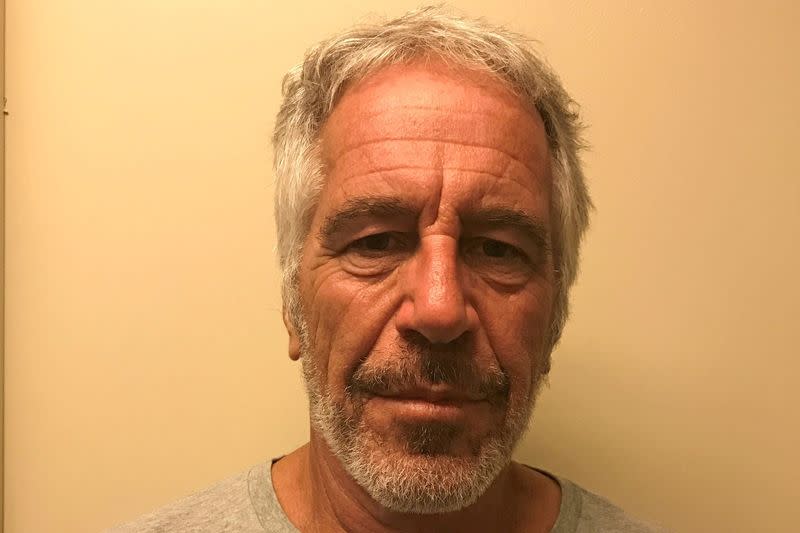

NEW YORK (Reuters) -JPMorgan Chase & Co on Tuesday sought to shift blame for failing to snuff out sex crimes committed by the late Jeffrey Epstein, accusing the U.S. Virgin Islands of harboring and shielding the disgraced financier as he abused young women and girls over two decades.

The largest U.S. bank made the accusation in a heavily redacted filing in Manhattan federal court, where the U.S. Virgin Islands is suing to hold it liable for providing banking services to Epstein from 1998 to 2013.

JPMorgan said Epstein had a "quid pro quo" relationship with the U.S. Virgin Islands' highest-ranking officials, bestowing money and favors in exchange for millions of dollars of tax incentives and looking the other way at his crimes.

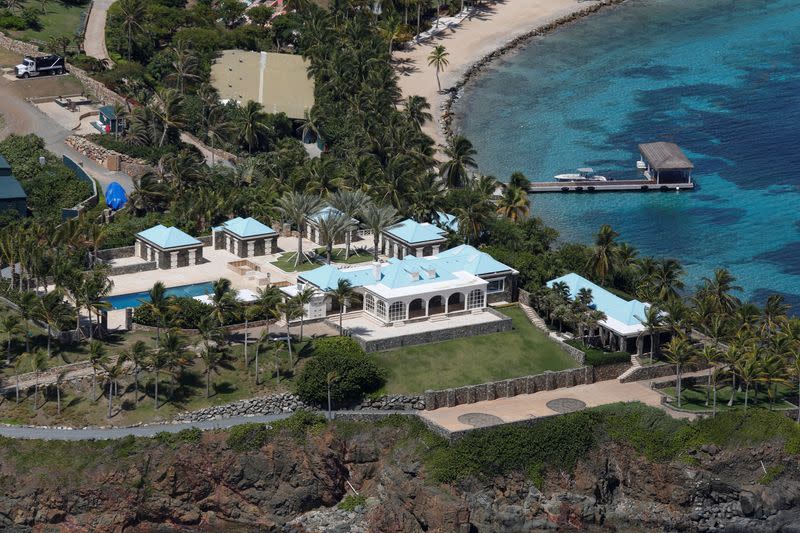

Epstein, a registered sex offender, allegedly abused women and girls on a private island he owned within the territory, and bought a second island nearby to keep people from spying on him.

JPMorgan said he also "exerted influence" over local sex offender legislation, and that inspections of his home were "cursory" at best.

"For two decades, and for long after JPMC exited Epstein as a client, the entity that most directly failed to protect public safety and most actively facilitated and benefited from Epstein's continued criminal activity was the plaintiff in this case—the USVI government itself," the bank said.

A spokesperson for the territory's attorney general's office called the filing "an obvious attempt to shift blame away from JPMorgan Chase, which had a legal responsibility to report the evidence in its possession of Epstein's human trafficking, and failed to do so."

Tuesday's filing opposed the U.S. Virgin Islands' effort to strike four JPMorgan defenses to the lawsuit that allegedly "threaten to expose" its relationship with Epstein, including that the territory had "unclean hands."

Epstein, 66, died in a Manhattan jail in August 2019 while awaiting trial for sex trafficking. New York City's medical examiner called his death a suicide.

'CLOSE TIES'

JPMorgan said Epstein had "close ties" to the territory's last three governors, including incumbent Albert Bryan.

It also said Epstein's "primary conduit" for spreading money and influence had been former First Lady Cecile de Jongh, whose husband was governor from 2007 to 2015. She did not immediately respond to an email request for comment.

According to the filing, Epstein also backed Congresswoman Stacey Plaskett, the territory's delegate to the U.S. Congress, who once worked for agency that awarded his tax benefits.

"Jeffrey Epstein's conduct was despicable," Plaskett said in a statement. "As I've stated in the past, contributions made by Jeffrey Epstein to my campaign were donated to women and children-focused non-profits in the Virgin Islands."

Bryan is scheduled to testify under oath in a June 6 deposition. The attorney general's office had no comment on his behalf.

JPMorgan also faces a proposed class action by women who say Epstein sexually abused them and that the bank should have cut ties to Epstein sooner.

The bank is separately suing Jes Staley, who once led its asset management business and had been friendly with Epstein, to have him cover its losses in the other two lawsuits.

Staley has expressed regret for befriending Epstein but denied knowing about his crimes, and accused JPMorgan of making him a scapegoat for its own supervisory failures.

The three lawsuits are scheduled for an Oct. 23 trial.

Deutsche Bank AG, where Epstein was a client from 2013 to 2018, last week settled a lawsuit by his accusers for $75 million.

The case is Government of the U.S. Virgin Islands v. JPMorgan Chase Bank NA, U.S. District Court, Southern District of New York, No. 22-10904.

(Reporting by Jonathan Stempel in New York; Editing by David Gregorio)

Yahoo Finance

Yahoo Finance