June 2024 Insight Into Three Swedish Stocks Trading Below Estimated Value

As global markets exhibit mixed signals with some regions showing growth while others face economic slowdowns, the Swedish stock market presents unique opportunities for investors looking for value. In such a landscape, identifying stocks that trade below their estimated intrinsic values could offer potential for substantial returns.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

Name | Current Price | Fair Value (Est) | Discount (Est) |

Björn Borg (OM:BORG) | SEK54.90 | SEK102.16 | 46.3% |

Arcoma (OM:ARCOMA) | SEK18.00 | SEK35.84 | 49.8% |

Boule Diagnostics (OM:BOUL) | SEK10.60 | SEK21.00 | 49.5% |

Biotage (OM:BIOT) | SEK155.80 | SEK297.39 | 47.6% |

Nordic Waterproofing Holding (OM:NWG) | SEK161.00 | SEK296.94 | 45.8% |

Net Insight (OM:NETI B) | SEK4.93 | SEK9.85 | 50% |

Nolato (OM:NOLA B) | SEK56.95 | SEK111.50 | 48.9% |

MilDef Group (OM:MILDEF) | SEK69.60 | SEK132.41 | 47.4% |

Humble Group (OM:HUMBLE) | SEK10.42 | SEK19.62 | 46.9% |

Gigasun (OM:GIGA) | SEK3.85 | SEK7.51 | 48.7% |

We'll examine a selection from our screener results

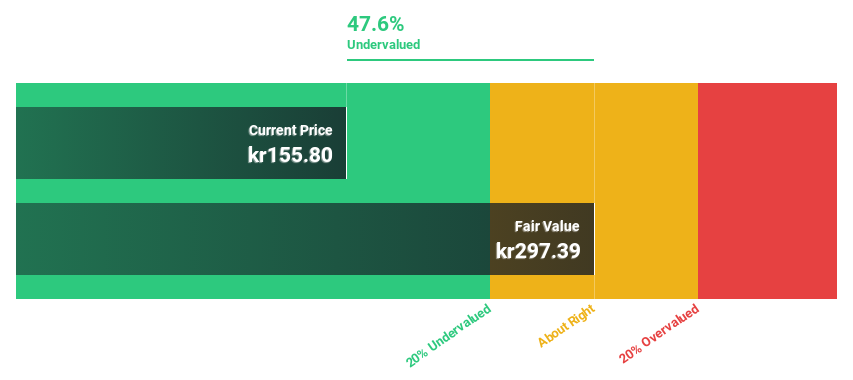

Biotage

Overview: Biotage AB (publ) specializes in providing solutions and products for drug discovery and development, analytical testing, as well as water and environmental testing, with a market capitalization of SEK 12.47 billion.

Operations: The company generates SEK 1.98 billion in revenue from its healthcare software segment.

Estimated Discount To Fair Value: 47.6%

Biotage, priced at SEK 155.8, is significantly undervalued based on a DCF valuation of SEK 297.39, trading 47.6% below its estimated fair value. Despite a recent dip in net income and EPS as reported in Q1 2024 results, Biotage's earnings are expected to grow by approximately 20% annually over the next three years, outpacing the Swedish market's average. Revenue growth projections also exceed market trends at an annual rate of 11.2%, highlighting potential for appreciation despite current financial inconsistencies.

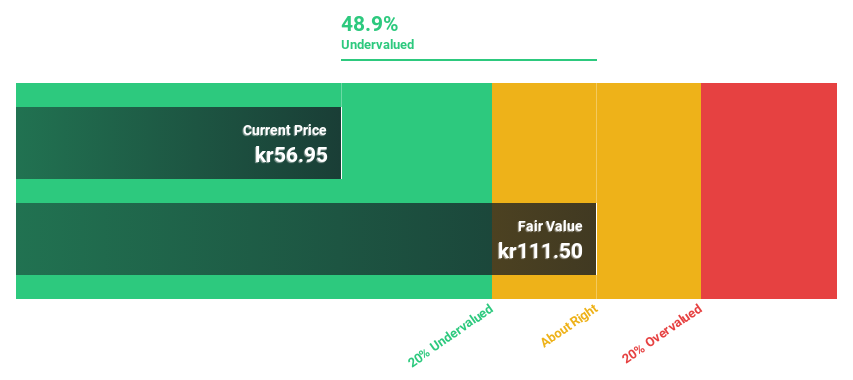

Nolato

Overview: Nolato AB specializes in developing, manufacturing, and selling plastic, silicone, and thermoplastic elastomer products across various sectors including medical technology, pharmaceuticals, consumer electronics, and automotive. The company operates globally with a market capitalization of SEK 15.34 billion.

Operations: The revenue for the Medical Solutions segment is SEK 5.34 billion.

Estimated Discount To Fair Value: 48.9%

Nolato is currently trading at SEK 56.95, well below the DCF valuation of SEK 111.5, indicating a significant undervaluation. Despite a dividend cut to SEK 1.50, recent financials show robust earnings growth with net income rising to SEK 162 million from SEK 136 million year-over-year and sales slightly down at SEK 2,442 million from SEL 2,476 million. The company's earnings are expected to grow by about 22.7% annually over the next three years, outperforming the Swedish market forecast of 14%. Additionally, revenue growth is anticipated at an annual rate of approximately 6.1%, surpassing the market average of just under two percent.

The growth report we've compiled suggests that Nolato's future prospects could be on the up.

Dive into the specifics of Nolato here with our thorough financial health report.

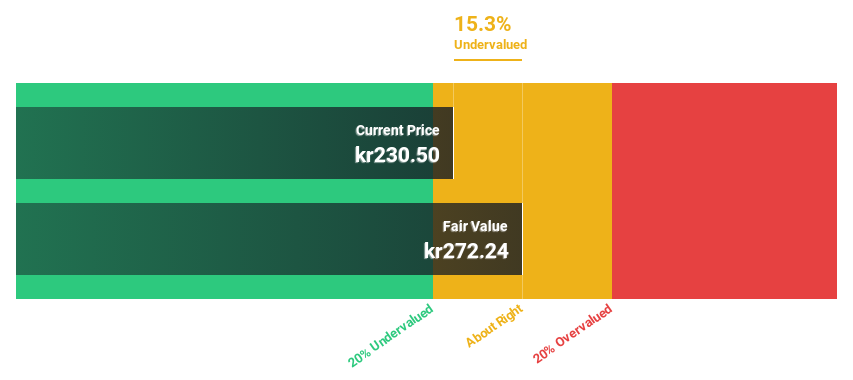

Yubico

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 19.85 billion.

Operations: The company generates SEK 1.93 billion from its Security Software & Services segment.

Estimated Discount To Fair Value: 15.3%

Yubico, priced at SEK 230.5, is below the estimated fair value of SEK 272.24, reflecting a modest undervaluation. The company's revenue and earnings are expected to grow by 23.2% and 43.4% annually, outpacing the Swedish market averages significantly. Despite this growth potential, Yubico faces challenges such as a decrease in profit margins from last year and substantial shareholder dilution over the past year. Recent product enhancements aim to bolster its market position by meeting enterprise security needs more effectively.

Taking Advantage

Take a closer look at our Undervalued Swedish Stocks Based On Cash Flows list of 48 companies by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BIOT OM:NOLA BOM:YUBICO

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance