June 2024 Insight Into US Growth Companies With High Insider Ownership

As of June 2024, the U.S. stock market presents a mixed landscape, with sectors like technology experiencing fluctuations amid broader economic uncertainties. In this context, growth companies with high insider ownership can offer investors potential stability and alignment of interests between shareholders and management. In times of market volatility, companies where insiders hold a significant stake may be perceived as having more skin in the game, potentially leading to more prudent management and long-term strategic focus.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Duolingo (NasdaqGS:DUOL) | 15% | 48% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.8% | 84.4% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Underneath we present a selection of stocks filtered out by our screen.

Taboola.com

Simply Wall St Growth Rating: ★★★★☆☆

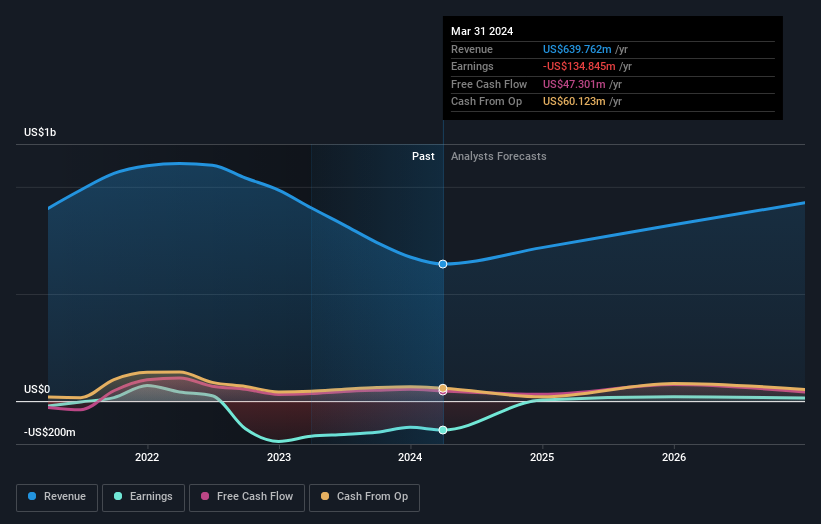

Overview: Taboola.com Ltd. operates a global artificial intelligence-driven algorithmic engine platform, with operations spanning from Israel to the United States and several European countries, and has a market capitalization of approximately $1.14 billion.

Operations: The primary revenue stream, totaling $1.53 billion, is generated from advertising.

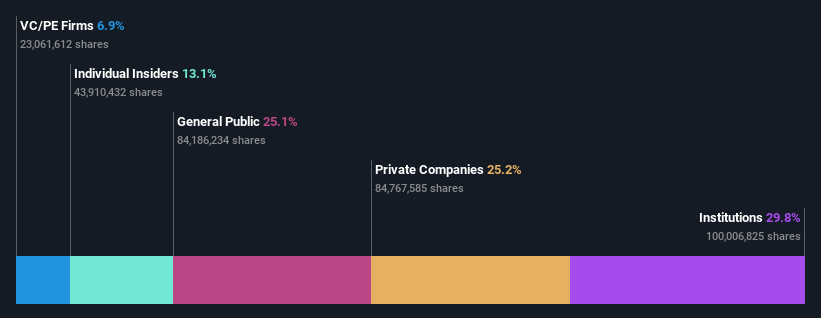

Insider Ownership: 13.1%

Revenue Growth Forecast: 14.5% p.a.

Taboola.com, a growth company with significant insider ownership, is actively expanding its partnerships and product offerings. Recently, it partnered with Foundry to enhance user engagement across global digital properties using Taboola's advanced content recommendation tools. Financially, Taboola expects substantial revenue growth in 2024, projecting between US$1.89 billion and US$1.94 billion for the year. Despite a net loss in Q1 2024, its strategic initiatives like Taboola Select target high-value advertisers seeking premium placements and optimized campaign performance.

Click here and access our complete growth analysis report to understand the dynamics of Taboola.com.

LendingTree

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LendingTree, Inc. operates an online consumer platform in the United States that connects borrowers with multiple lenders, facilitating a range of loan and credit options; the company has a market capitalization of approximately $0.52 billion.

Operations: The company generates revenue primarily from three segments: Home ($130.52 million), Consumer ($250.69 million), and Insurance ($258.40 million).

Insider Ownership: 18.1%

Revenue Growth Forecast: 11.1% p.a.

LendingTree, a company marked by recent executive reshuffles, has shown a commitment to strategic growth and data-driven decision-making with the expansion of roles in its analytics and corporate strategy sectors. Financially, the firm raised its revenue forecasts for Q2 and full-year 2024 following an underwhelming performance in Q1. Despite these optimistic projections and leadership enhancements aimed at boosting shareholder value, LendingTree's share price remains volatile, reflecting investor caution amid these transitions.

SmartRent

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SmartRent, Inc. is an enterprise real estate technology company offering management software and applications to various stakeholders in the housing industry, with a market capitalization of approximately $472.28 million.

Operations: The company generates its revenue primarily from electronic security devices, totaling $222.25 million.

Insider Ownership: 11.8%

Revenue Growth Forecast: 17.3% p.a.

SmartRent, a firm in the smart home technology sector, recently appointed Frank Martell to its board, enhancing its leadership with his extensive experience in real estate analytics. The company is launching innovative products like Alloy Deadbolt to streamline operations and reduce costs for property owners. Despite a low forecasted Return on Equity of 8.5% in three years, SmartRent's revenue is expected to grow at 17.3% annually, outpacing the US market average of 8.6%.

Click to explore a detailed breakdown of our findings in SmartRent's earnings growth report.

Our valuation report here indicates SmartRent may be undervalued.

Key Takeaways

Click through to start exploring the rest of the 182 Fast Growing US Companies With High Insider Ownership now.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:TBLA NasdaqGS:TREE and NYSE:SMRT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance