June Defensive Stock Picks

If you want to avoid the risk of losing your investment you should be looking for companies that are more likely to maintain and grow their value regardless of market conditions. To do this successfully, there are certain fundamentals that you should look for, which include but are not limited to: financial health, liquidity and reliable earnings capacity. Below are a few options I am looking at: Howden Joinery Group, Bovis Homes Group and Man Group.

Howden Joinery Group Plc (LSE:HWDN)

Howden Joinery Group Plc manufactures, distributes, and sells kitchens and joinery products in the United Kingdom, France, Belgium, the Netherlands, and Germany. Started in 1995, and headed by CEO Andrew Livingston, the company provides employment to 9,000 people and with the market cap of GBP £3.20B, it falls under the mid-cap stocks category.

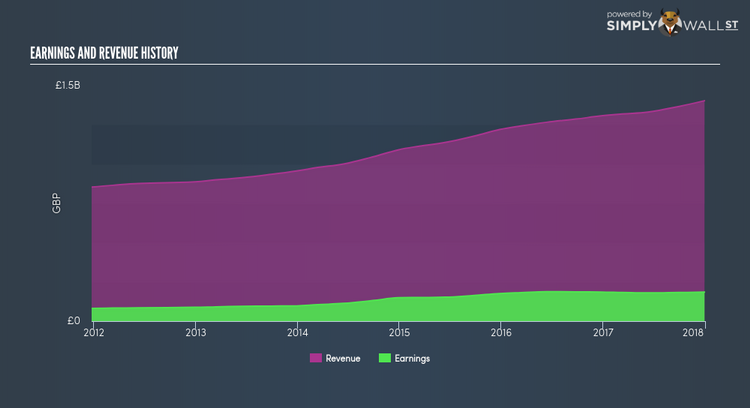

The company’s capital structureis attractive as there is no debt on the company’s books and no concerns around solvency or interest repayments. because it’s a mid-cap stock priced at UK£3.20B , investors have the added benefit of solid liquidity, enabling the stock to better withstand selling pressure during market downturns. Looking back over the past 5 years, the company has grown earnings by 15.84% annually and had a ROE of 40.73% over the past year, showing HWDN is a strong candidate for a bear market based on these defensive tenets. More on Howden Joinery Group here.

Bovis Homes Group PLC (LSE:BVS)

Bovis Homes Group PLC, together with its subsidiaries, operates as a builder of homes in the United Kingdom. Formed in 1885, and run by CEO Gerald Fitzgerald, the company employs 1,203 people and has a market cap of GBP £1.66B, putting it in the small-cap category.

BVS’s financial management makes the company a solid defensive candidate , due to high liquidity with current assets covering liabilities by 13.11x. Additionally, operating cash flow is higher than total debt by over 200%, creating greater safety for investors in a fickle market. Furthermore, at a UK£1.66B market cap , the company provides decent liquidity to investors, enabling the stock to better withstand selling pressure during market downturns. To add to this, the company has grown earnings at 22.85% annually for the past 5 years period, which demonstrates BVS has some of the necessary characteristics to maintain value during a cyclical downfall in the market. Continue research on Bovis Homes Group here.

Man Group plc (LSE:EMG)

Man Group plc provides alternative investment management services worldwide. Formed in 1783, and run by CEO Luke Ellis, the company size now stands at 1,325 people and with the stock’s market cap sitting at GBP £2.94B, it comes under the mid-cap category.

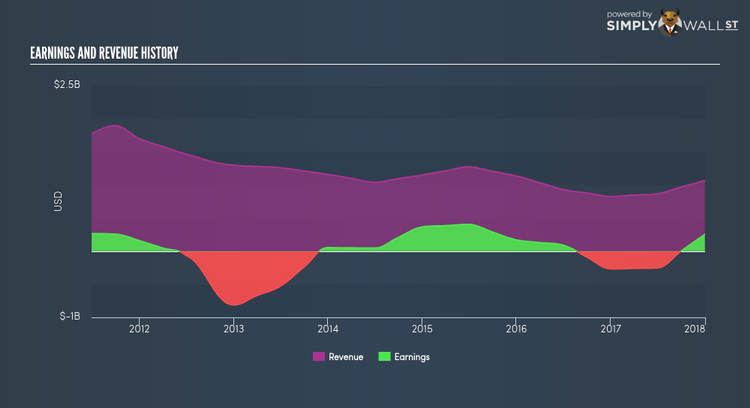

The company’s capital structureis attractive which provides a safe buffer for servicing debt if difficult conditions prevail in the market. because it’s a mid-cap stock priced at UK£2.94B and a PE multiple of 15.53x, there is a liquid market for the stock which is relatively undervalued compared to the market, which minimises the potential for rapid share price falls in down cycles. To add to this, EMG has recorded a healthy 5.63% annual growth in earnings over the past 5 years and a 8.77% ROA in the past year (beating the industry by 0.41%), which shows EMG holds many of the keys to avoiding the potentially destructive forces of a bear market. More detail on Man Group here.

For more robust companies to add to your portfolio, explore this interactive list of defensive stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance