June Growth Stock Picks

High-growth stocks that are financially stable are attractive for many reasons. They provide a strong upside to your portfolio, with less likelihood of downside risks compared to less financially robust companies. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good additions to your portfolio.

Quixant Plc (AIM:QXT)

Quixant Plc designs, develops, manufactures, and supplies PC based computer systems for the gaming industry worldwide. Founded in 2005, and currently headed by CEO Jonathan Jayal, the company size now stands at 176 people and with the company’s market cap sitting at GBP £280.32M, it falls under the small-cap category.

QXT’s projected future profit growth is a robust 14.73%, with an underlying 24.24% growth from its revenues expected over the upcoming years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 24.70%. QXT’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Want to know more about QXT? Other fundamental factors you should also consider can be found here.

SEC S.p.A. (AIM:SECG)

SEC S.p.A., through its subsidiaries, provides public relations, advocacy, communications, and public affairs services to corporates, trade associations, regional governments, and municipalities in Italy, Belgium, Spain, Germany, Poland, and the United Kingdom. Established in 1989, and currently headed by CEO Fiorenzo Tagliabue, the company employs 250 people and with the stock’s market cap sitting at GBP £14.79M, it comes under the small-cap stocks category.

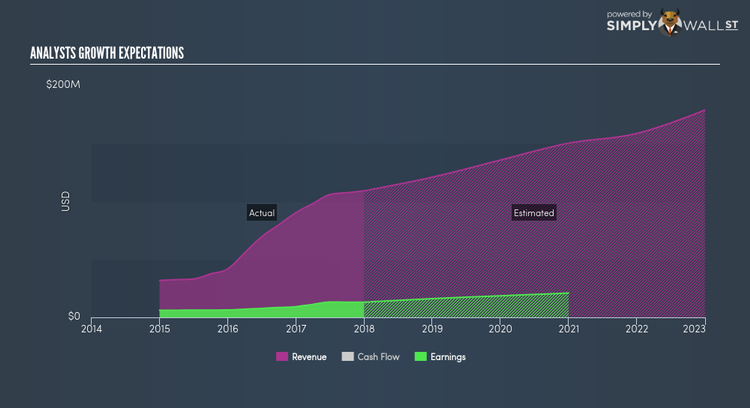

SECG’s forecasted bottom line growth is an optimistic 48.55%, driven by the underlying double-digit sales growth of 25.45% over the next few years. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of SECG, it does not appear extreme. Moreover, the substantial growth of over 100% in operating cash flows shows that a decent part of earnings is driven by robust cash generation from operational activities, not one-off or non-core activities. SECG’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add SECG to your portfolio? Take a look at its other fundamentals here.

Rathbone Brothers Plc (LSE:RAT)

Rathbone Brothers Plc, through its subsidiaries, provides personalized investment and wealth management services for private clients, charities, and trustees in the United Kingdom and Jersey. Formed in 1742, and now led by CEO Philip Howell, the company employs 1,227 people and with the company’s market cap sitting at GBP £1.39B, it falls under the small-cap stocks category.

RAT’s projected future profit growth is a robust 16.04%, with an underlying 8.08% growth from its revenues expected over the upcoming years. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of RAT, it does not appear too severe. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 21.88%. RAT ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Want to know more about RAT? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance