June Services Dividend Favorites – Prime People And More

The professional services sector tends to be highly cyclical, impacting companies operating in areas such as security, consulting and support services. Hence, considering economic volatility is crucial when thinking about a professional services company’s profitability. This impacts cash flows which in turn determines the level of dividend payout. During times of growth, these companies could provide a strong boost to your portfolio income. Today I will share with you my list of high-dividend services stocks you should consider for your portfolio.

Prime People Plc (AIM:PRP)

PRP has a sumptuous dividend yield of 6.06% and their current payout ratio is 57.37% . Although there has been some volatility in the company’s dividend yield, the DPS over a 10 year period has increased from UK£0.037 to UK£0.05. Comparing Prime People’s PE ratio against the GB Professional Services industry draws favorable results, with the company’s PE of 9.5 being below that of its industry (18.2). Interested in Prime People? Find out more here.

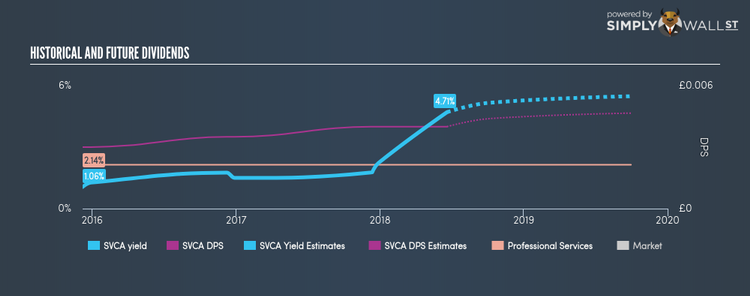

Servoca Plc (AIM:SVCA)

SVCA has a juicy dividend yield of 4.71% and is distributing 23.00% of earnings as dividends . The company’s yield puts it among good company – the top 25% of the market. Servoca is also reasonably priced, with a PE ratio of 4.9 that compares favorably with the GB Professional Services average of 18.5. More detail on Servoca here.

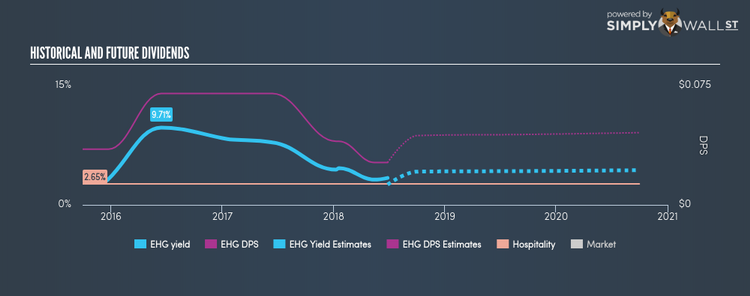

Elegant Hotels Group Plc (AIM:EHG)

EHG has a solid dividend yield of 3.39% and pays 45.67% of it’s earnings as dividends . While they aren’t amongst the top payers in the market, the fact that they are paying above the savings rate means your money may be better off invested in EHG than your bank account, permitting that the company maintains its performance. More on Elegant Hotels Group here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance