K-Bro Linen Leads Three TSX Dividend Stocks To Consider

As the first half of 2024 closes, the Canadian market has shown resilience with a solid performance, particularly benefiting from its more traditional sectors despite a lower exposure to technology compared to its U.S. counterparts. This backdrop sets an intriguing stage for investors looking at dividend-paying stocks, which can offer both stability and potential income in a well-rounded portfolio given current economic conditions.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.83% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.13% | ★★★★★★ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.43% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.37% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.29% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.80% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 8.89% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.57% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.16% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.22% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

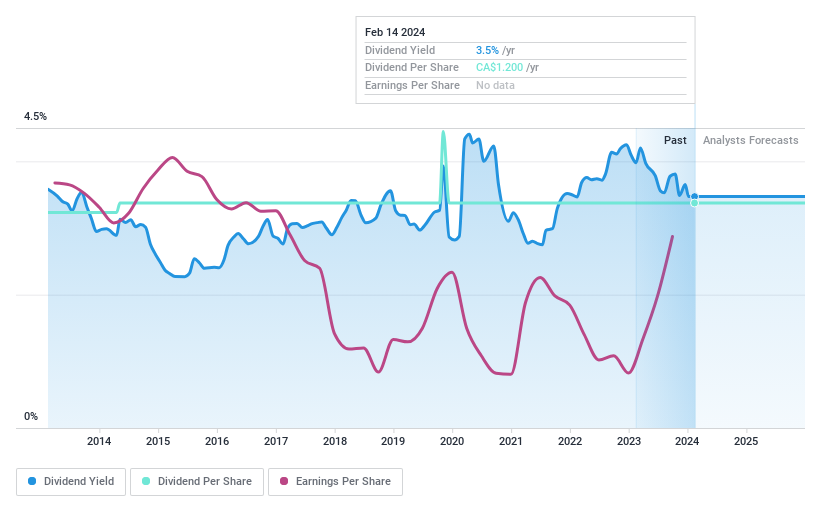

K-Bro Linen

Simply Wall St Dividend Rating: ★★★★★☆

Overview: K-Bro Linen Inc. operates in Canada and the United Kingdom, offering laundry and linen services to healthcare institutions, hotels, and other commercial organizations, with a market capitalization of approximately CA$354.92 million.

Operations: K-Bro Linen Inc. generates CA$330.33 million in revenue primarily from its laundry and linen services catered to the healthcare and hospitality sectors.

Dividend Yield: 3.5%

K-Bro Linen maintains a consistent dividend, recently declaring CAD 0.10 per share for June, reflecting ongoing commitment despite modest yield (3.48%) relative to top Canadian dividend stocks. The company supports dividends with a sustainable payout ratio of 73.2% and cash payout ratio of 38.5%. Additionally, K-Bro has demonstrated shareholder confidence through an active share repurchase program, cancelling significant shares to potentially enhance shareholder value, though its recent earnings show slight declines year-over-year.

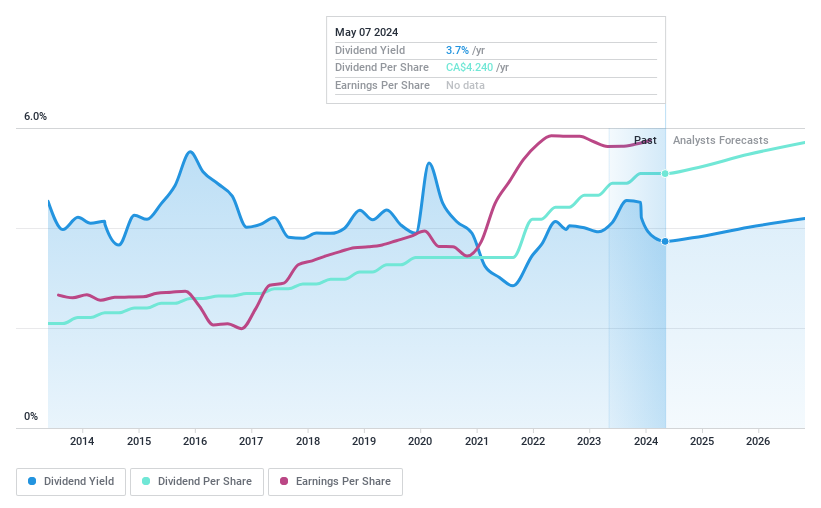

National Bank of Canada

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada offers a range of financial services to various clients including individuals, businesses, and governments both domestically and internationally, with a market capitalization of approximately CA$37.52 billion.

Operations: National Bank of Canada generates revenue through three main segments: Wealth Management (CA$2.61 billion), Personal and Commercial Banking (CA$4.33 billion), and Financial Markets (CA$2.76 billion), along with contributions from U.S. Specialty Finance and International operations totaling CA$1.16 billion.

Dividend Yield: 4%

National Bank of Canada has shown a steady dividend growth over the past decade, with a recent increase to CA$1.10 per share for Q3 2024, signaling reliability. Despite trading 41.5% below estimated fair value and offering a lower yield (3.97%) compared to top Canadian payers, its dividends are well-covered by earnings with a payout ratio of 42.5%. Recent capital raising through private placements and equity offerings totaling nearly CA$1 billion may support future financial flexibility but raises questions on strategic allocations given the substantial shelf registration of CA$12 billion for unspecified debt securities.

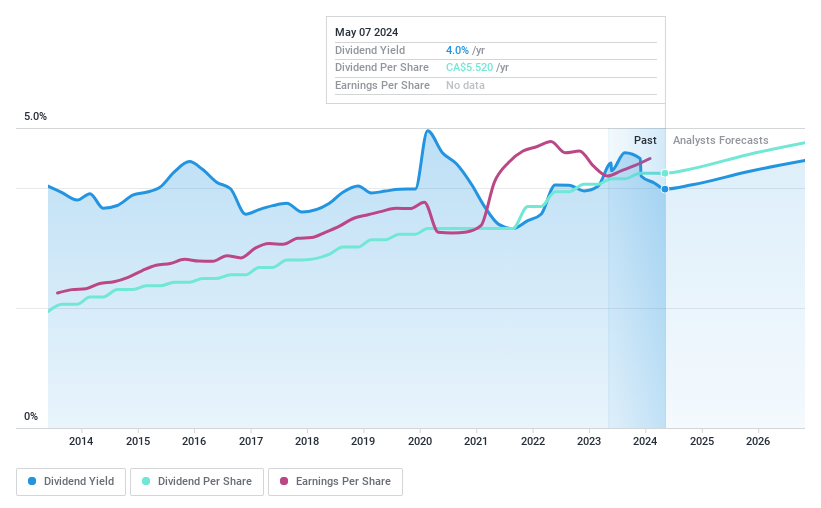

Royal Bank of Canada

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada, with a market capitalization of CA$210.95 billion, operates globally as a diversified financial services company.

Operations: Royal Bank of Canada generates revenue through various segments, including Personal & Commercial Banking (CA$20.92 billion), Wealth Management (CA$17.47 billion), Capital Markets (CA$10.70 billion), and Insurance (CA$5.91 billion).

Dividend Yield: 3.8%

Royal Bank of Canada's recent activities include multiple fixed-income offerings, totaling significant amounts in various currencies, aimed at bolstering its financial structure. Notably, the bank issued €1 billion in green bonds and completed several other offerings ranging from $1.187 million to $3 million, primarily consisting of senior unsecured notes with varying coupon rates. These strategic moves demonstrate RBC's focus on maintaining a robust capital base and liquidity profile. However, despite these efforts, RBC's dividend yield stands at 3.8%, which is lower compared to the top quartile of Canadian dividend payers at 6.56%. The dividends are currently covered by earnings with a payout ratio of 50%, suggesting sustainability but highlighting potential concerns over growth compared to peers.

Where To Now?

Click through to start exploring the rest of the 30 Top TSX Dividend Stocks now.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:KBL TSX:NA and TSX:RY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance