Kaiser Aluminum Corp (KALU) Surpasses Q1 Earnings and Revenue Estimates

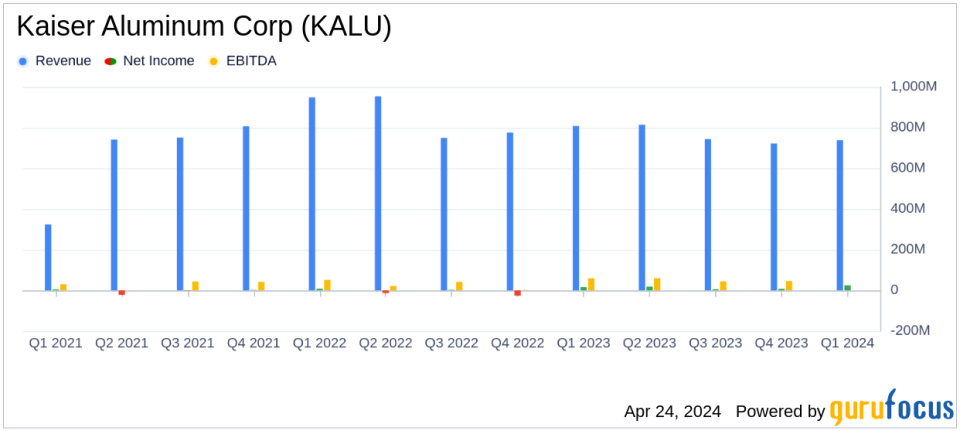

Net Sales: Reached $738 million, surpassing estimates of $696.05 million.

Net Income: Reported at $25 million, significantly exceeding the estimated $9 million.

Earnings Per Share (EPS): Achieved $1.51 per diluted share, greatly surpassing the estimated $0.57.

Adjusted EBITDA: Stood at $62 million with an EBITDA margin of 17.0%, indicating robust operating efficiency.

Cost Control: Improved cost controls and operational efficiencies noted across the company's platform.

Full Year Outlook: Maintaining the full year 2024 outlook, reflecting confidence in continued strong performance.

Dividend: Announced a quarterly cash dividend of $0.77 per share, payable on May 15, 2024, to shareholders of record as of April 25, 2024.

Kaiser Aluminum Corp (NASDAQ:KALU) released its 8-K filing on April 24, 2024, detailing its financial results for the first quarter of 2024. The company reported a net income of $25 million, translating to $1.51 per diluted share, significantly surpassing the estimated earnings per share of $0.57. Net sales reached $738 million against the anticipated $696.05 million, reflecting robust performance across its diverse portfolio.

Kaiser Aluminum Corp, headquartered in Franklin, Tennessee, is a prominent producer of semi-fabricated specialty aluminum products. The company's offerings include high-value plate, sheet, coil, extrusions, rod, bar, tube, and wire products, primarily serving the aerospace, automotive, and general engineering sectors. With the majority of its revenue generated in the United States, Kaiser Aluminum remains a key player in the metals and mining industry.

Financial Performance Insights

The first quarter results demonstrated a notable improvement in net income, which stood at $25 million compared to $16 million in the same period last year. The earnings per diluted share also saw a significant rise from $0.99 to $1.51. This increase is attributed to enhanced cost controls and operating efficiencies across the companys platform.

Adjusted net income was reported at $17 million, or $1.02 per diluted share, compared to $7 million, or $0.42 per diluted share, in the prior year, indicating effective management and operational strategies. The Adjusted EBITDA of $62 million also marked an improvement, with a margin of 17.0%, reflecting a more efficient conversion revenue process.

Operational and Market Performance

Kaiser Aluminum's operational success in the quarter was driven by increased demand in general engineering and automotive sectors, coupled with steady performance in aerospace/high strength applications. The company managed a slight increase in conversion revenue despite a modest reduction in shipments, highlighting the effectiveness of its pricing strategy and operational adjustments.

President and CEO Keith A. Harvey commented on the results, stating, "The year is off to a good start with our first quarter results surpassing our internal expectations on more normalized business conditions with improved operating efficiencies across all platforms." This statement underscores the company's resilience in navigating market fluctuations and its focus on sustainable growth.

Looking Ahead

With a solid start to the year, Kaiser Aluminum is maintaining its full-year outlook for 2024, expecting continued demand across most of its end markets. The company is well-positioned to leverage its strategic investments and operational enhancements to drive further growth and profitability.

The company's strong liquidity position, with $619 million available through cash and credit facilities, supports its ongoing capital investments and strategic initiatives aimed at long-term value creation.

Kaiser Aluminum's performance in the first quarter of 2024 not only demonstrates its operational prowess but also highlights its strategic positioning to capitalize on market opportunities. As the company continues to navigate the complexities of the metals and mining industry, its focus on cost control, efficiency improvements, and strategic growth initiatives are expected to yield positive outcomes for stakeholders.

For more detailed information about Kaiser Aluminum Corp's financial results, please visit the SEC filing.

Explore the complete 8-K earnings release (here) from Kaiser Aluminum Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance