Kroger (KR) Q1 Earnings Beat Estimates, Identical Sales Up Y/Y

The Kroger Co. KR delivered impressive first-quarter fiscal 2024 results, with both the top and bottom lines surpassing the Zacks Consensus Estimate. The company also reported a year-over-year increase in identical sales without fuel.

Kroger's well-defined customer segmentation strategy, emphasis on value and focus on its 'Our Brands' portfolio have enabled it to effectively maintain a competitive position. The company remains committed to its core strengths, which include offering an array of fresh products, providing personalized shopping experiences and fostering a seamless digital ecosystem. These initiatives are all aimed at sustaining Kroger's positive momentum and continued growth.

Analyzing Q1 Outcome

Kroger reported adjusted earnings of $1.43 per share, which exceeded the Zacks Consensus Estimate of $1.33 but declined from $1.51 reported in the same quarter last year.

Total sales of $45,269 million came ahead of the Zacks Consensus Estimate of $45,046 million and improved from $45,165 million reported in the year-ago period. We note that identical sales without fuel rose 0.5%. Digital sales grew more than 8% during the quarter under discussion.

We note that the gross margin was 22.4% of sales. The FIFO gross margin rate, excluding fuel, shrunk 7 basis points compared to the same period last year. The adjusted FIFO operating profit came in at $1,499 million, down from $1,669 million reported in the year-ago period.

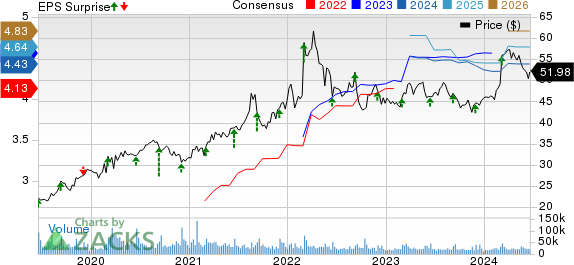

The Kroger Co. Price, Consensus and EPS Surprise

The Kroger Co. price-consensus-eps-surprise-chart | The Kroger Co. Quote

Other Financial Aspects

Kroger ended the quarter with cash of $345 million, total debt of $9,718 million and shareowners’ equity of $12,413 million. Net total debt decreased by $1,324 million over the last four quarters.

The company continues to estimate capital expenditures in the band of $3.4-$3.6 billion and expects to generate adjusted free cash flow between $2.5 billion and $2.7 billion in fiscal 2024.

Outlook

Kroger reiterated its expectation for identical sales without fuel to increase between 0.25% and 1.75% in fiscal 2024. Management continues to anticipate the adjusted FIFO operating profit in the band of $4.6-$4.8 billion compared with $5 billion reported in fiscal 2023.

The company maintained its fiscal 2024 adjusted earnings guidance of $4.30 to $4.50 per share compared with adjusted earnings of $4.76 reported in fiscal 2023.

Shares of this Zacks Rank #3 (Hold) company have dropped 8.8% in the past three months against the industry’s rise of 8.5%.

Stocks Hogging in the Limelight

Here, we have highlighted three better-ranked stocks, namely Vital Farms VITL, Sprouts Farmers Market SFM and Ollie's Bargain Outlet OLLI.

Vital Farms offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 22.5% and 59.3%, respectively, from the year-ago reported numbers.

Sprouts Farmers, the renowned grocery retailer, currently sports a Zacks Rank #1. SFM has a trailing four-quarter earnings surprise of 9.2%, on average.

The Zacks Consensus Estimate for Sprouts Farmers’ current financial-year sales and earnings implies growth of around 8% and 9.9%, respectively, from the year-ago reported numbers.

Ollie's Bargain, the extreme-value retailer of brand-name merchandise, currently carries a Zacks Rank #2 (Buy). OLLI has a trailing four-quarter earnings surprise of 10.4%, on average.

The Zacks Consensus Estimate for Ollie's Bargain’s current financial-year sales and earnings implies growth of around 7.9% and 13.1%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Kroger Co. (KR) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance