KRX Growth Companies With High Insider Ownership And 45% Return On Equity

The South Korean market has shown resilience with a modest annual increase of 5.7%, despite remaining flat over the last week, and earnings are forecast to grow by 29% annually. In this context, growth companies with high insider ownership and strong returns on equity, such as those boasting a 45% ROE, are particularly compelling for their potential alignment of management interests with shareholder gains in promising market conditions.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

SamyoungLtd (KOSE:A003720) | 25.1% | 30.4% |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

HANA Micron (KOSDAQ:A067310) | 20% | 93.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.9% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Let's uncover some gems from our specialized screener.

Daejoo Electronic Materials

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. is a company that develops and sells electronic materials across various regions including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia, with a market capitalization of approximately ₩2.14 trillion.

Operations: The company generates revenue primarily through the development, production, and sale of electrical and electronic components, totaling ₩193.79 billion.

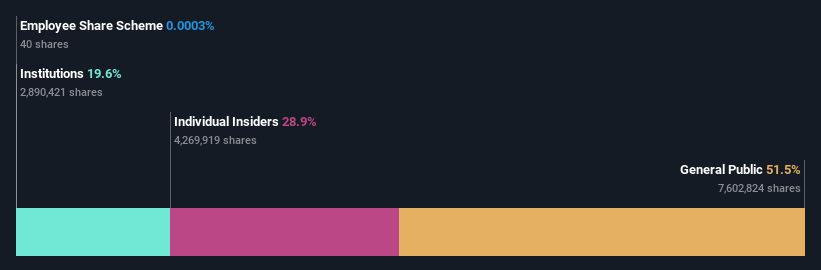

Insider Ownership: 28.9%

Return On Equity Forecast: 25% (2027 estimate)

Daejoo Electronic Materials, a South Korean company, recently raised KRW 61 billion through private placements, signaling robust investor confidence and strategic expansion efforts. Despite its high revenue growth forecast at 39% annually, surpassing the market average significantly, the firm struggles with earnings coverage for interest payments. Moreover, while earnings are expected to surge by approximately 55.8% annually over three years, Daejoo's share price remains highly volatile. This combination of aggressive growth amidst financial challenges paints a complex picture for potential investors looking at insider-owned growth entities in the region.

Devsisters

Simply Wall St Growth Rating: ★★★★★★

Overview: Devsisters Corporation is a developer of mobile games, operating both in South Korea and internationally, with a market capitalization of approximately ₩632.49 billion.

Operations: The company generates revenue from the development of mobile games across domestic and international markets.

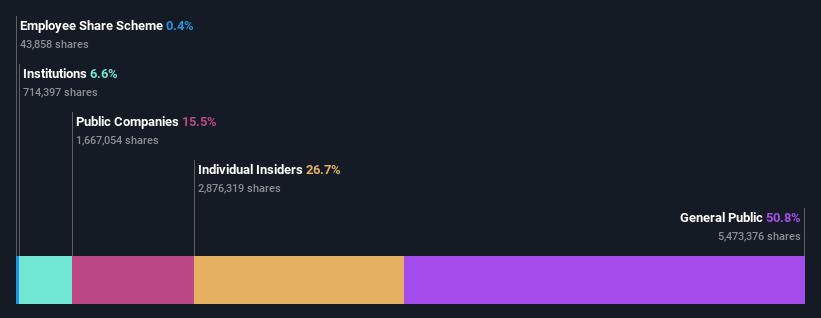

Insider Ownership: 26.7%

Return On Equity Forecast: 29% (2027 estimate)

Devsisters, a South Korean company, is poised for significant growth with revenue expected to increase by 23.7% annually, outpacing the local market's 10.5%. This firm is forecast to turn profitable within three years, with an anticipated robust Return on Equity of 29%. However, its share price has shown high volatility recently. Notably, there has been no substantial insider trading in the past three months. These factors make Devsisters a compelling yet cautious case for investors interested in growth companies with high insider ownership.

Click to explore a detailed breakdown of our findings in Devsisters' earnings growth report.

Our expertly prepared valuation report Devsisters implies its share price may be too high.

ALTEOGEN

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biopharmaceutical company engaged in developing long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of approximately ₩15.38 billion.

Operations: The company generates revenue primarily through the development of biopharmaceutical products focusing on long-acting treatments and biosimilar therapies.

Insider Ownership: 26.6%

Return On Equity Forecast: 45% (2027 estimate)

ALTEOGEN, a South Korean biotech, is trading at ₩68.1% below its estimated fair value, signaling potential undervaluation. The company recently became profitable and is forecasted to see earnings grow by 73.06% annually over the next three years, significantly outpacing the local market's growth of 28.9%. Despite high revenue growth projections of 48.3% per year, shareholder dilution occurred last year and the stock has experienced substantial price volatility recently.

Delve into the full analysis future growth report here for a deeper understanding of ALTEOGEN.

Our valuation report unveils the possibility ALTEOGEN's shares may be trading at a premium.

Summing It All Up

Discover the full array of 86 Fast Growing KRX Companies With High Insider Ownership right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A078600KOSDAQ:A194480 KOSDAQ:A196170 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance