KRX Showcases S&S Tech And Two More High Insider Ownership Growth Companies

The South Korean market has remained stable over the past week and has experienced a growth of 6.8% over the past year, with earnings expected to increase by 29% annually. In such a promising environment, stocks like S&S Tech that boast high insider ownership can be particularly appealing, as this often signals strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

HANA Micron (KOSDAQ:A067310) | 20% | 93.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.9% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Vuno (KOSDAQ:A338220) | 19.5% | 103.8% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Here's a peek at a few of the choices from the screener.

S&S Tech

Simply Wall St Growth Rating: ★★★★★★

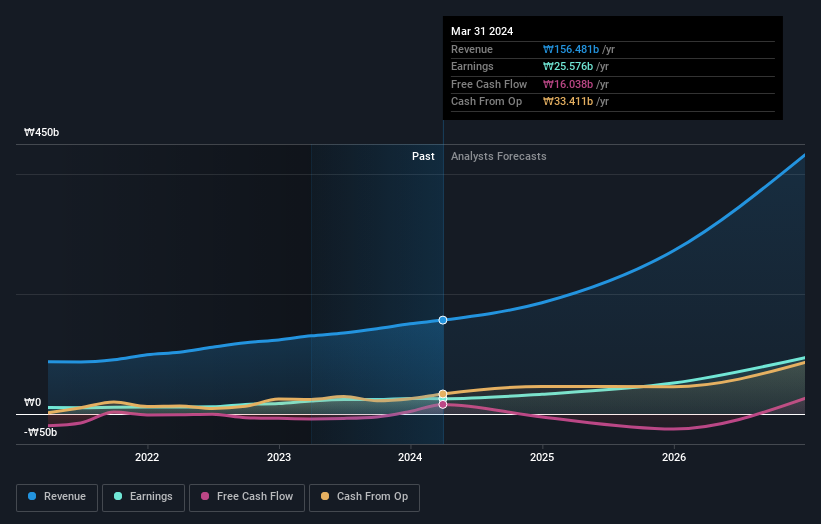

Overview: S&S Tech Corporation, which manufactures and sells blank masks globally, has a market capitalization of approximately ₩737.11 billion.

Operations: The primary revenue streams for the company are derived from its subsidiaries, with S&S Tech Co., Ltd. generating ₩148.40 billion and S&S Lab Co., Ltd. contributing ₩1.85 billion, alongside S&S Investment Co., Ltd. which adds another ₩5.74 billion in revenue.

Insider Ownership: 22.6%

Return On Equity Forecast: 21% (2027 estimate)

S&S Tech, a South Korean company, exhibits strong growth potential with its revenue and earnings forecast to expand significantly at 35.6% and 44.1% per year respectively, outpacing the domestic market averages. High insider ownership aligns management’s interests with shareholders, enhancing trust and potential for sustained growth. Despite a lack of recent insider trading activity, the anticipated high Return on Equity of 20.7% underscores robust financial health and operational efficiency.

Vuno

Simply Wall St Growth Rating: ★★★★★★

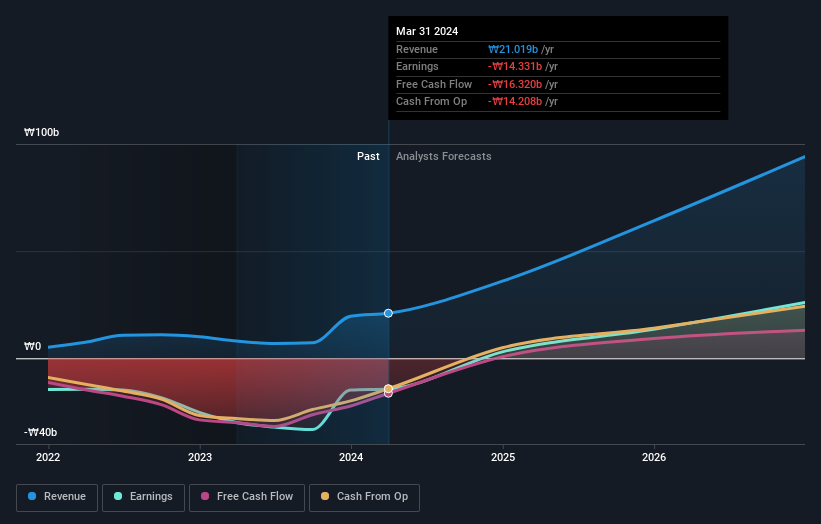

Overview: Vuno Inc. is a medical artificial intelligence (AI) solution development company with a market capitalization of approximately ₩366.65 billion.

Operations: The company generates revenue primarily from its artificial intelligence medical software production, totaling approximately ₩17.04 billion.

Insider Ownership: 19.5%

Return On Equity Forecast: 22% (2027 estimate)

Vuno, a South Korean growth company, has demonstrated substantial revenue growth potential with forecasts suggesting an annual increase of 39.3%. Despite recent share dilution and high share price volatility over the past three months, earnings are expected to surge by 103.79% annually. The company is projected to achieve profitability within the next three years, outperforming average market expectations. Recent presentations at the Macquarie Asia Conference highlight its active engagement in expanding market presence and investor relations.

Delve into the full analysis future growth report here for a deeper understanding of Vuno.

Upon reviewing our latest valuation report, Vuno's share price might be too optimistic.

Openedges Technology

Simply Wall St Growth Rating: ★★★★★★

Overview: Openedges Technology, Inc., based in South Korea, specializes in developing AI computing IP solutions and memory systems, with a market capitalization of approximately ₩445.59 billion.

Operations: The company generates revenue primarily from its AI computing IP solutions and memory systems segments.

Insider Ownership: 31.1%

Return On Equity Forecast: 48% (2027 estimate)

Openedges Technology, a South Korean company, is expected to see significant revenue growth at 49.9% annually, outpacing the local market's 10.5%. Despite a highly volatile share price recently and shareholder dilution over the past year, its Return on Equity is projected to be very high at 48% in three years. The company is also forecasted to become profitable within the same timeframe, with earnings anticipated to grow by nearly 101% per year.

Turning Ideas Into Actions

Take a closer look at our Fast Growing KRX Companies With High Insider Ownership list of 86 companies by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A101490 KOSDAQ:A338220 and KOSDAQ:A394280.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance