La-Z-Boy's (NYSE:LZB) Q1: Strong Sales, Stock Jumps 12.9%

Furniture company La-Z-Boy (NYSE:LZB) reported Q1 CY2024 results exceeding Wall Street analysts' expectations , with revenue down 1.4% year on year to $553.5 million. It made a non-GAAP profit of $0.95 per share, down from its profit of $0.99 per share in the same quarter last year.

Is now the time to buy La-Z-Boy? Find out in our full research report.

La-Z-Boy (LZB) Q1 CY2024 Highlights:

Revenue: $553.5 million vs analyst estimates of $516.4 million (7.2% beat)

EPS (non-GAAP): $0.95 vs analyst estimates of $0.70 (36.4% beat)

Q1'24 revenue guidance of $485 million at the midpoint, 2.0% above analyst estimates (operating margin percentage in line)

Gross Margin (GAAP): 43.4%, down from 46.2% in the same quarter last year

Free Cash Flow of $37.26 million, similar to the previous quarter

Market Capitalization: $1.44 billion

Melinda D. Whittington, President and Chief Executive Officer of La-Z-Boy Incorporated, said, “We are pleased with our strong finish to the fiscal year as fourth quarter results exceeded expectations. Wholesale unit volumes improved in the quarter and recovery from weather and related disruptions in January also provided a tailwind. The industry continues to grapple with higher for longer interest rates and housing turnover near 30-year lows negatively impacting store traffic. However, our execution is the strongest it has ever been, including conversion rates at all-time highs and average ticket and design sales trending up for the year. We expect industry fundamentals to remain volatile for the near term, but remain confident in our ability to outperform the market and gain share longer term. Our first quarter is off to a good start and we are encouraged by our solid Memorial Day results as we believe our assortment and best-in-class motion offerings are resonating with consumers in the marketplace.”

The prized possession of every mancave, La-Z-Boy (NYSE:LZB) is a furniture company specializing in recliners, sofas, and seats.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

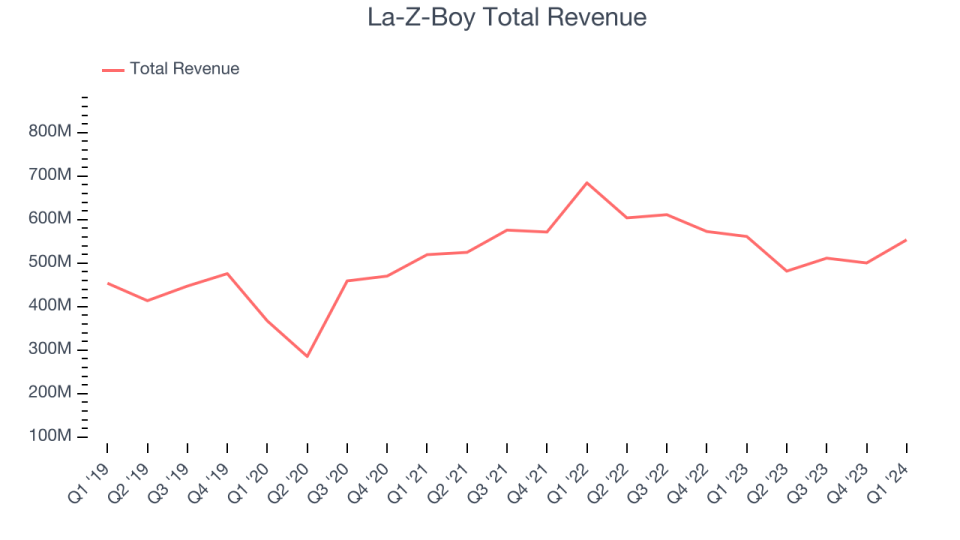

Sales Growth

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Sadly, La-Z-Boy's sales grew at a weak 3.2% compounded annual growth rate over the last five years. This shows it failed to expand its business in any major way.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. La-Z-Boy's history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 6.8% annually.

We can better understand the company's revenue dynamics by analyzing its most important segments, Wholesale and Retail, which are 63.3% and 36.7% of core revenues. Over the last two years, La-Z-Boy's Wholesale revenue (sales to retailers) averaged 8.6% year-on-year declines. On the other hand, its Retail revenue (direct sales to consumers) averaged 5.1% growth.

This quarter, La-Z-Boy's revenue fell 1.4% year on year to $553.5 million but beat Wall Street's estimates by 7.2%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

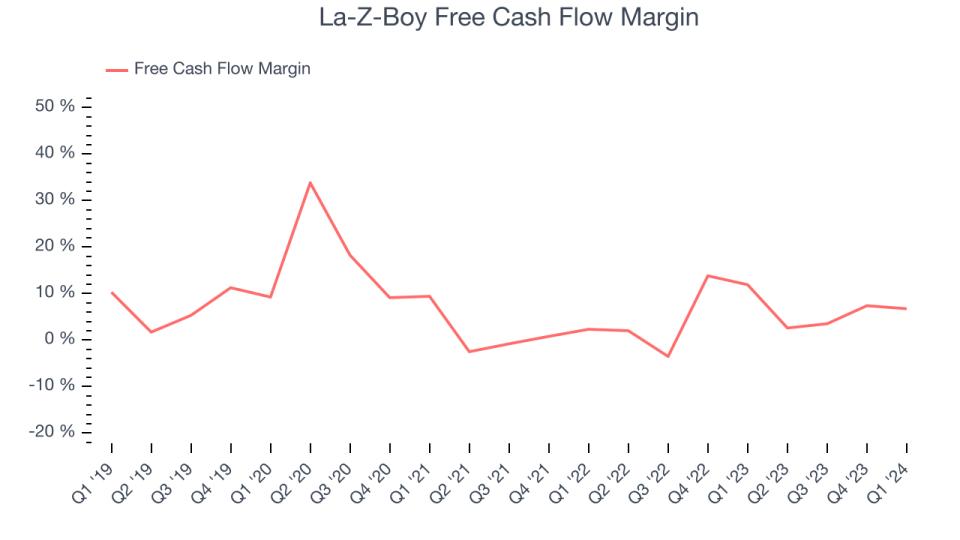

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

La-Z-Boy has shown weak cash profitability over the last two years, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin averaged 5.5%, subpar for a consumer discretionary business.

La-Z-Boy's free cash flow clocked in at $37.26 million in Q1, equivalent to a 6.7% margin. The company's margin regressed as it was 5.2 percentage points lower than in the same quarter last year, but we wouldn't read too much into it because working capital needs can be seasonal and cause short-term swings. Over the next year, analysts' consensus estimates show they're expecting La-Z-Boy's free cash flow margin of 5.1% for the last 12 months to remain the same.

Key Takeaways from La-Z-Boy's Q1 Results

We were impressed by how significantly La-Z-Boy blew past analysts' EPS expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. Looking ahead, the company guided next quarter's revenue above expectations and added that "Our first quarter is off to a good start and we are encouraged by our solid Memorial Day results as we believe our assortment and best-in-class motion offerings are resonating with consumers in the marketplace". Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 12.9% after reporting and currently trades at $38.47 per share.

La-Z-Boy may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance