Labour’s £8.6bn in tax rises are tip of the iceberg, economists warn

Labour will raise taxes by £8.6bn to fund its spending pledges – but this could be just the tip of the iceberg, economists have warned.

Unveiling the party’s manifesto at a launch in Manchester, Sir Keir Starmer promised to increase taxes on non-doms, overseas property investors and private equity bosses.

The party said it expects to raise £5.2bn by closing non-dom tax loopholes and cracking down on tax avoidance. As part of this, the party will stop current non-doms from moving their assets into offshore trusts in order to avoid paying inheritance tax, a measure Labour has previously estimated could generate £43m a year in revenue.

These proposals, it said, would help fund 40,000 more NHS operations, scans and appointments every week, as well as free breakfast clubs in every primary school.

The figures do not include Labour’s plans to scrap the Tory policy of giving non-doms a 50pc discount on foreign income brought into the UK in 2025-26. The party estimates that scrapping this will bring in a one-off £600m.

The manifesto also reaffirmed the party’s commitment to its controversial VAT raid on private schools, which it says will pull in £1.5bn for the Treasury. This money has been earmarked for hiring 6,500 teachers, opening more than 3,000 nurseries and providing mental health support in every school.

It added that a £1.2bn-a-year windfall tax on oil and gas giants would fund the creation of a new public-owned Great British Energy as well as a National Wealth Fund for investment in the party’s “growth and clean energy missions”.

In addition, the party is pledging to increase taxes for private equity executives by scrapping the so-called carried interest loophole.

However, there was no mention of increases to capital gains tax, council tax and other levies such as fuel duty, which Sir Keir Starmer and Rachel Reeves have previously refused to rule out.

It has fuelled speculation that Labour could use its first Budget to reveal further tax increases that will rake in the billions of pounds needed for its ambitious growth plans.

The Institute for Fiscal Studies think tank described the tax rises outlined in Labour’s manifesto as “trivial”, considering the large spending promises made in the document. These included slashing NHS waiting lists, stamping out crime and transforming Britain into a clean energy superpower – all pledges that the think tank said would require “big spending”.

It added that, if the economy fails to grow at the anticipated pace, “taxes will rise” under a future Labour government.

Paul Johnson, director of the IFS, said: “This is a manifesto that promises a dizzying number of reviews and strategies to tackle some of the challenges facing the country.

“But delivering genuine change will almost certainly also require putting actual resources on the table. And Labour’s manifesto offers no indication that there is a plan for where the money would come from to finance this.”

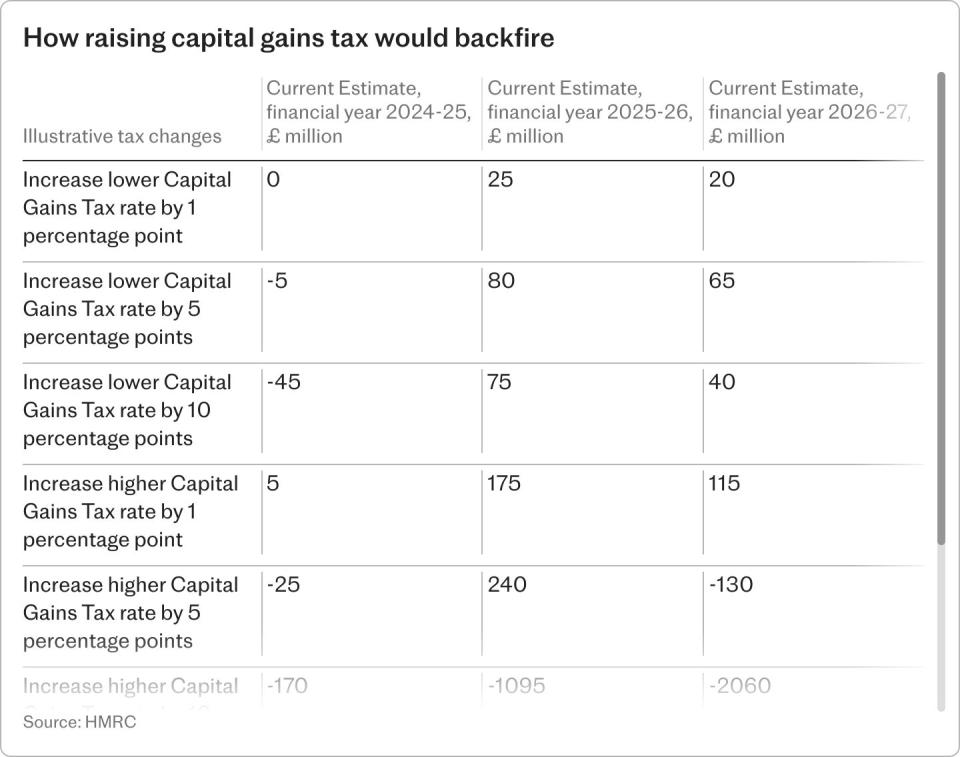

Raising capital gains, council tax or fuel duty would cost taxpayers billions extra, according to official forecasts.

Figures from HM Revenue and Customs show increasing the higher rate of capital gains tax by just one percentage point would raise £290m in the first three years, while increasing the lower rate by five percentage points would raise an additional £145m – bringing the total up to £435m.

Council tax would rise by £2.3bn next year, assuming Labour permits councils to raise town hall levies by the maximum 5pc. Council tax is currently forecast to cost households a total £46.9bn this year, according to the Office for Budget Responsibility.

Previous comments made by Ms Reeves have led to speculation the levy could be reformed if the party is voted in. Writing in a 2018 pamphlet called the Everyday Economy, the shadow chancellor said council tax is at “the very least long overdue a re-evaluation and revision of existing bands” and floated the idea of replacing it with a “property tax” on property owners. Welsh Labour is currently reviewing council tax valuations.

Sir Keir has also refused to rule out reversing the temporary 5p fuel duty freeze instigated by the Conservatives. Figures from the Office for Budget Responsibility show that the levy on petrol and diesel is expected to raise £24.7bn this year, and that removing the current 5p cut, currently in place until 2025, could raise £2.5bn in a single year.

Labour’s other tax pledges included vowing not to raise income tax, National Insurance or VAT, as well capping corporation tax at the current level of 25pc.

It is also aiming to reduce the number of foreigners buying up UK property with a one percentage point stamp duty increase for purchases of residential-property by non-UK residents. This, it says, will bring in a further £40m to fund the appointment of 300 new planning officers.

The Party said it expects to raise £5.2bn by closing non-dom tax loopholes and cracking down on tax avoidance – with the latter making up the bulk of this, at £4.8bn.

Yahoo Finance

Yahoo Finance