Lanxess AG Leads as Oakmark Intl Small Cap's Top Investment Increase in Q1 2024

Insightful Analysis of Oakmark Intl Small Cap (Trades, Portfolio)'s Latest Strategic Portfolio Adjustments

Oakmark Intl Small Cap (Trades, Portfolio), known for its strategic investments in small-cap companies, recently disclosed its N-PORT filing for the first quarter of 2024. The fund primarily targets businesses with market capitalizations not exceeding the largest cap in the S&P EPAC Small Cap Index. Oakmark's investment philosophy centers on purchasing undervalued securities and holding them until they reach their intrinsic value, reflecting a disciplined, value-oriented approach that aligns with the interests of shareholders.

Summary of New Buys

In a strategic move to diversify and strengthen its portfolio, Oakmark Intl Small Cap (Trades, Portfolio) added two new stocks in the first quarter of 2024:

Fielmann Group AG (XTER:FIE) emerged as the most significant new addition with 105,004 shares, valued at approximately 4.82 million, making up 0.35% of the portfolio.

TIS Inc (TSE:3626) was also added with 67,100 shares, representing about 0.1% of the portfolio, with a total value of approximately 1,433,490.

Key Position Increases

The fund significantly increased its holdings in several stocks, with notable emphasis on:

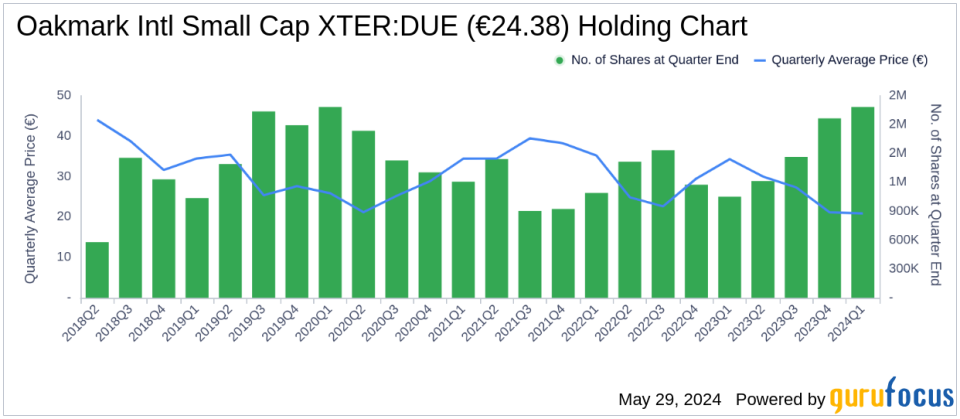

Lanxess AG (XTER:LXS), where Oakmark added an impressive 815,800 shares, bringing the total to 1,231,300 shares. This adjustment, a 196.34% increase in share count, impacted the portfolio by 1.57%, with a total value of approximately 32.96 million.

Katitas Co Ltd (TSE:8919) also saw a substantial increase of 776,700 shares, resulting in a total of 1,760,600 shares, marking a 78.94% increase in share count, valued at approximately 22.90 million.

Summary of Sold Out Positions

Oakmark Intl Small Cap (Trades, Portfolio) exited two positions entirely in this quarter:

Applus Services SA (XMAD:APPS) was completely sold off with all 1,328,700 shares liquidated, impacting the portfolio by -1.03%.

Vitesco Technologies Group AG (XTER:VTSC) also saw a complete exit with 135,873 shares sold, resulting in a -0.99% portfolio impact.

Key Position Reductions

The fund also reduced its stakes in several companies, with significant reductions in:

Konecranes Oyj (OHEL:KCR) saw a reduction of 425,000 shares, a 38.12% decrease, impacting the portfolio by -1.35%. The stock traded at an average price of 44.85 during the quarter and has seen a return of 16.02% over the past three months and 35.81% year-to-date.

Schibsted ASA (OSL:SCHB) was reduced by 539,900 shares, a 66.06% decrease, impacting the portfolio by -1.04%. The stock's average trading price was kr295.21 during the quarter, with a return of 20.05% over the past three months and 26.99% year-to-date.

Portfolio Overview

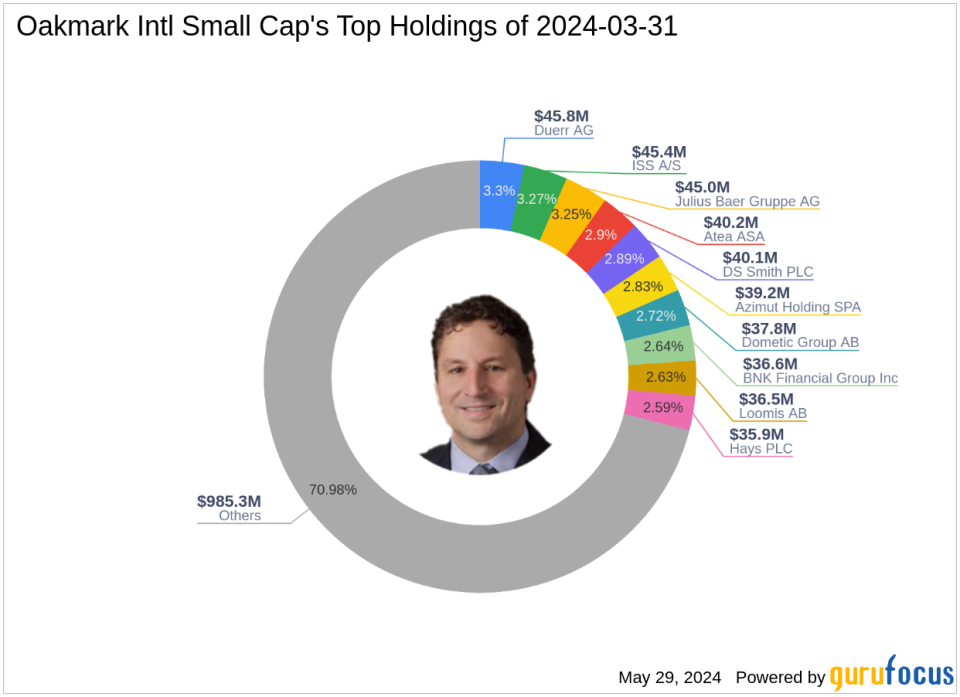

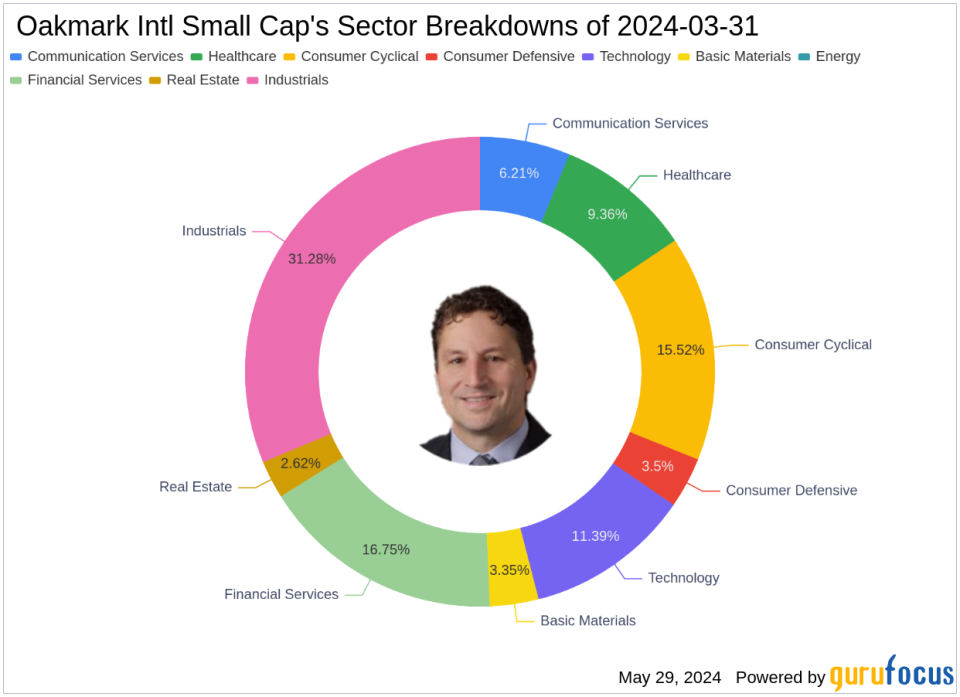

As of the first quarter of 2024, Oakmark Intl Small Cap (Trades, Portfolio)'s portfolio comprised 63 stocks. The top holdings included 3.3% in Duerr AG (XTER:DUE), 3.27% in ISS A/S (OCSE:ISS), 3.25% in Julius Baer Gruppe AG (XSWX:BAER), 2.9% in Atea ASA (OSL:ATEA), and 2.89% in DS Smith PLC (LSE:SMDS). The portfolio is predominantly concentrated in nine industries: Industrials, Financial Services, Consumer Cyclical, Technology, Healthcare, Communication Services, Consumer Defensive, Basic Materials, and Real Estate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance