Leisure Products Stocks Q1 In Review: Clarus (NASDAQ:CLAR) Vs Peers

Let's dig into the relative performance of Clarus (NASDAQ:CLAR) and its peers as we unravel the now-completed Q1 leisure products earnings season.

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 16 leisure products stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 4.3%. while next quarter's revenue guidance was 3.5% below consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and leisure products stocks have had a rough stretch, with share prices down 5.5% on average since the previous earnings results.

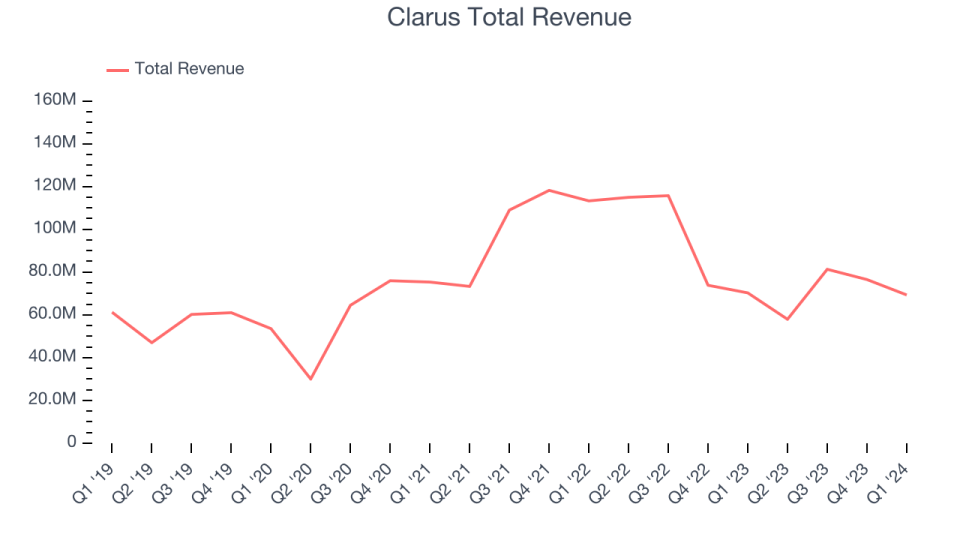

Clarus (NASDAQ:CLAR)

Initially a financial services business, Clarus (NASDAQ:CLAR) designs, manufactures, and distributes outdoor equipment and lifestyle products.

Clarus reported revenues of $69.31 million, down 1.4% year on year, topping analysts' expectations by 7.4%. It was a mixed quarter for the company. Clarus blew past analysts' revenue expectations. On the other hand, its operating margin missed and its EPS fell short of Wall Street's estimates.

Management Commentary“We entered 2024 with a strong balance sheet and an experienced leadership team focused on initiating our strategic plan for our next phase as a pure-play, ESG-friendly outdoor business,” said Warren Kanders, Clarus’ Executive Chairman.

The stock is up 1.9% since the results and currently trades at $6.28.

Read our full report on Clarus here, it's free.

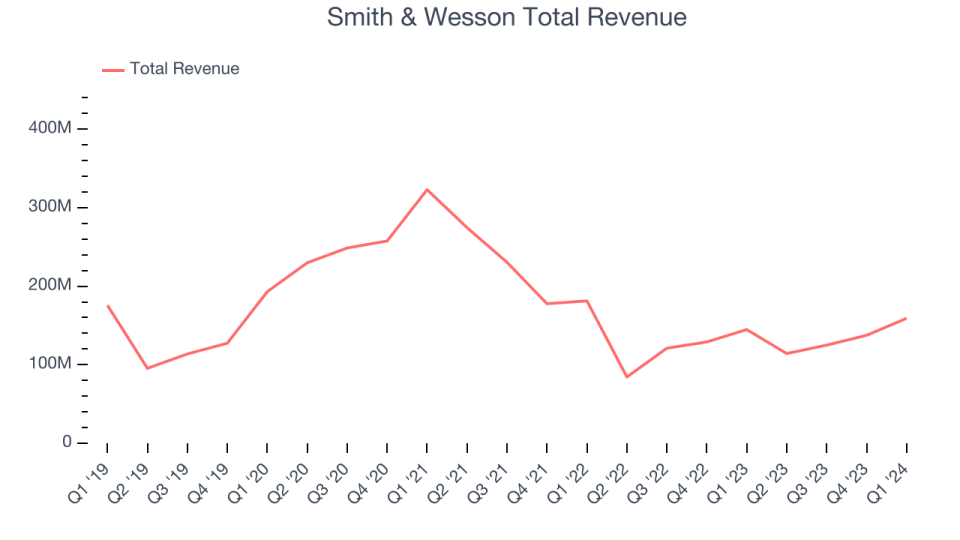

Best Q1: Smith & Wesson (NASDAQ:SWBI)

With a history dating back to 1852, Smith & Wesson (NASDAQ:SWBI) is a firearms manufacturer known for its handguns and rifles.

Smith & Wesson reported revenues of $159.1 million, up 9.9% year on year, outperforming analysts' expectations by 1.5%. It was a very strong quarter for the company, with EPS exceeding analysts' expectations.

The stock is down 12.9% since the results and currently trades at $14.29.

Is now the time to buy Smith & Wesson? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Ruger (NYSE:RGR)

Founded in 1949, Ruger (NYSE:RGR) is an American manufacturer of firearms for the commercial sporting market.

Ruger reported revenues of $136.8 million, down 8.5% year on year, falling short of analysts' expectations by 10.8%. It was a weak quarter for the company: Its revenue, operating margin, and EPS fell short of Wall Street's estimates.

Ruger had the weakest performance against analyst estimates in the group. The stock is down 10.9% since the results and currently trades at $41.3.

Read our full analysis of Ruger's results here.

Malibu Boats (NASDAQ:MBUU)

Founded in California in 1982, Malibu Boats (NASDAQ:MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Malibu Boats reported revenues of $203.4 million, down 45.8% year on year, falling short of analysts' expectations by 1.5%. It was a weak quarter for the company, with a miss of analysts' boats sold estimates.

Malibu Boats had the slowest revenue growth among its peers. The stock is up 2.7% since the results and currently trades at $33.96.

Read our full, actionable report on Malibu Boats here, it's free.

YETI (NYSE:YETI)

Founded by two brothers from Texas, YETI (NYSE:YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

YETI reported revenues of $341.4 million, up 12.7% year on year, surpassing analysts' expectations by 2.4%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates and strong earnings guidance for the full year.

YETI delivered the fastest revenue growth among its peers. The stock is up 6.8% since the results and currently trades at $37.21.

Read our full, actionable report on YETI here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance