Lennar (LEN) Earnings and Revenues Beat in Q1, Shares Rise

Lennar Corporation’s LEN shares gained 3.5% after the company reported better-than-expected results in first-quarter fiscal 2020 (ended Feb 29, 2020). This marks the fourth consecutive quarter of an earnings beat. The results mainly benefited from solid demand for new homes, depicting healthy housing market fundamentals.

However, Stuart Miller, Executive Chairman of Lennar stated, “With a near shutdown of large portions of our national economy, we are all stretching our minds to understand the parameters of the rapidly evolving landscape, while we contemplate what the future holds.”

Nonetheless, he added that the company remains focused on managing the inflow, and especially the outflow, of cash to maintain a strong foundation. The company’s liquidity and strong balance sheet will likely help it to absorb the shock the economy is dealing with at this time.

The company reported quarterly earnings of $1.27 per share, handily surpassing the Zacks Consensus Estimate of 83 cents by 53%. Also, the reported figure jumped 71.6% from 74 cents reported in the year-ago quarter. The upside was mainly driven by higher deliveries and continued operating leverage, backed by technological efforts.

Revenues of $4.51 billion topped the consensus estimate of $4.38 billion by 2.9%. The reported figure also increased 16.5% year over year.

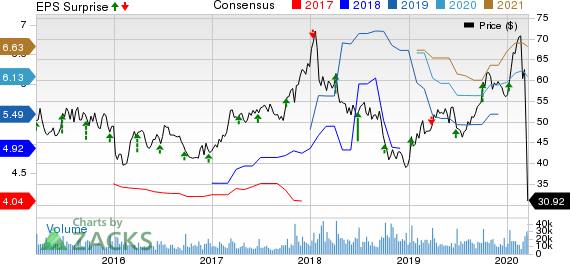

Lennar Corporation Price, Consensus and EPS Surprise

Lennar Corporation price-consensus-eps-surprise-chart | Lennar Corporation Quote

Segment Details

Homebuilding: Revenues at the segment totaled $4.17 billion, up 15.1% from the prior-year quarter. The upside was backed by higher number of homes delivered. Within the Homebuilding umbrella, home sales contributed $4.14 billion to total revenues, up 14.8% from a year ago, and land sales accounted for $26.9 million, up 94.9%.

Home deliveries during the reported quarter increased 17% year over year to 10,321 units, buoyed by higher number of homes delivered across all regions served.

The average sales price of homes delivered was $401,000, reflecting a 2.2% year-over-year decline owing to continued shift to the entry-level market.

New orders grew 18.3% from the year-ago quarter to 12,376 homes. Potential value of net orders also increased 20.4% year over year to $5 billion.

Backlog at the end of the fiscal first quarter increased 2.2% from a year ago to 17,632. Potential housing revenues from backlog also improved 0.7% year over year to $7.16 billion.

Homebuilding Margins

Gross margin on home sales was 20.5% in the quarter, up 40 basis points (bps). The upside can be attributed to its efforts toward reducing construction costs.

Selling, general and administrative or SG&A expenses, as a percentage of home sales, improved 30 bps to 9.2% on better operating leverage owing to higher deliveries.

Operating margin on home sales also improved 80 bps year over year to 11.4% in the quarter.

Financial Services: The segment’s revenues increased 38.6% year over year to $198.7 million in the reported quarter. Operating earnings came in at $58.2 million, up from $21.8 million a year ago on a strong mortgage business.

Lennar Multi-Family: Revenues of $132.6 million at the segment increased 36.2% from the prior-year quarter. However, the segment generated operating earnings of $1.8 million in the quarter, down from $6.8 million in the year-ago quarter.

Lennar Other: The segment’s revenues totaled $1.9 million, down 46.9% from $3.6 million a year ago. Operating earnings were $0.9 million during the quarter, down from $3.1 million in the comparable period of 2019.

Financials

Lennar had homebuilding cash and cash equivalents of $785 million as of Feb 29, 2020, down from $1.2 billion as on Nov 30, 2019. Net homebuilding debt was $7.33 billion as of Feb 29, 2020, compared with $6.58 billion as on Nov 30, 2019. Net debt-to-capital ratio at the end of the fiscal first quarter was 31.4% compared with 29.2% at fiscal 2019-end.

During the fiscal first quarter, the company repurchased 4.4 million shares of common stock for $288.4 million.

Fiscal 2020 Guidance Suspended

Lennar’s fiscal first-quarter results exceeded the company’s expected metrics and the company remains on track to lift its guidance for the year. It has also been focusing on reducing land spend and land holdings to boost cash flow and fortify balance sheet. However, in view of the widespread shutdowns in the wake of the coronavirus pandemic, Lennar has decided to suspend the guidance for now.

Zacks Rank & Stocks to Consider

Currently, Lennar carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader construction sector are D.R. Horton, Inc. DHI, Meritage Homes Corporation MTH and M.D.C. Holdings, Inc. MDC, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings for D.R. Horton, Meritage Homes and M.D.C. Holdings are expected to increase 22.4%, 6.7% and 15.1%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance