Saudi Arabia Builds Bet on Asia Tech With $2 Billion Lenovo Deal

(Bloomberg) -- Lenovo Group Ltd. plans to sell $2 billion worth of zero-coupon convertible bonds to Saudi Arabia’s sovereign wealth fund, part of a broader strategic pact with the tech-hungry kingdom.

Most Read from Bloomberg

Key Engines of US Consumer Spending Are Losing Steam All at Once

GameStop Shares Surge as Gill’s Reddit Return Shows Huge Bet

Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money

Homebuyers Are Starting to Revolt Over Steep Prices Across US

AMLO Protege Sheinbaum Becomes First Female President in Mexico

Lenovo said it will issue bonds to Alat, an investment firm wholly owned by the Public Investment Fund, at an initial conversion price of HK$10.42 per share. That’s a roughly 12% discount to Lenovo shares’ closing price the previous day, near a nine-year-high for the stock. Lenovo’s shares were down around 2% Wednesday.

As part of the agreement, the Beijing-based maker of PCs and artificial intelligence servers plans to build a research and development center in Riyadh and expand production capacity in the region. Upon maturity, the converted notes would represent about 12% of Lenovo’s current capital, or near 11% of the enlarged capital when the conversion happens.

The PIF’s requirement that Lenovo build infrastructure in the kingdom is part of a broader push to make Saudi Arabia more competitive in the global race to dominate advanced technologies, especially artificial intelligence. That quest for a tech edge is fueling a rivalry between the US and China that’s drawing in other nations, especially in the Gulf region.

Lenovo remains the only major global PC brand that uses in-house production capacity, making it an attractive choice for Alat, said UOB Kay Hian analyst Johnny Yum in a note to investors. At the same time, the CB issuance gives Lenovo strategic investors that can help it extend its footprint in rapidly expanding markets in Middle East and Africa, he said. “The high income Middle Eastern countries are also putting huge investments into the buildout of AI infrastructures,” he said.

Led by Crown Prince Mohammed bin Salman and backed by the PIF, Alat plans to invest $100 billion by 2030 in industrial heavyweights that pledge to set up operations in the kingdom and hire locally. It’s looking to entice investment in data centers, AI companies and semiconductor manufacturing in the country and boost the its regional tech leadership.

Over the last decade, Saudi-backed funds have been beefing up investments in Asian tech firms. The PIF, which is one of the largest investors in Japan’s Nintendo Co., has announced a partnership with Chinese surveillance equipment maker Dahua Technology and is in talks to back the payments startup Airwallex.

Such talks with Chinese firms are drawing scrutiny from the US, which sees the Middle East as a possible conduit of technology to Beijing. The head of Alat said this month it would divest from China if it were asked to do so by the US.

Separately, Lenovo said it’s proposed issuing 1.15 billion three-year warrants at a price of HK$1.43 each to raise additional funds. That issue will be under a specific mandate, it said in a filing.

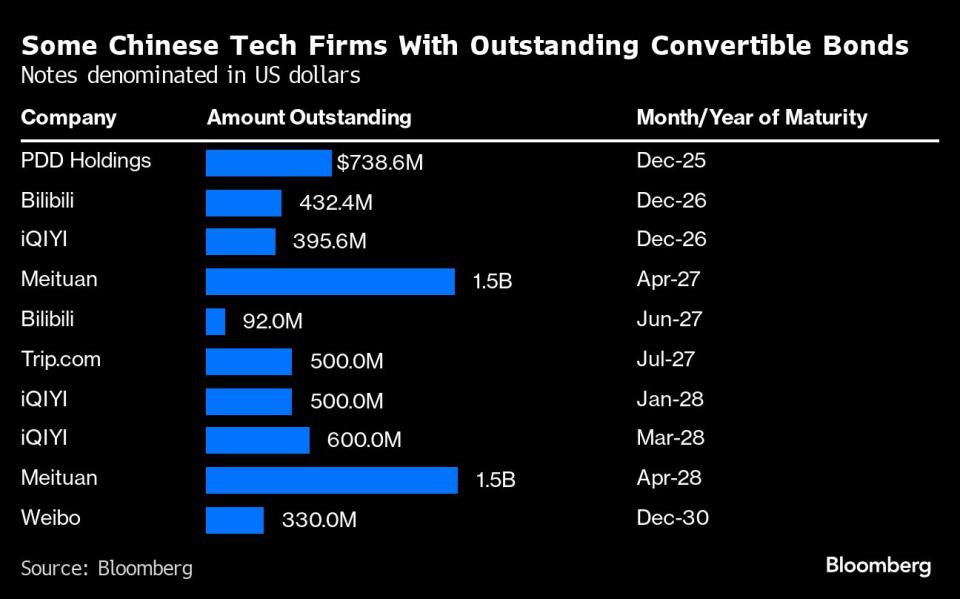

Lenovo is the latest Chinese tech firm to seek funding via a convertible issue within a matter of days. It pushes the amount of money raised by Asian firms through the instrument this month to a record of about $9 billion, considering notes denominated in US dollars, according to data compiled by Bloomberg.

Convertibles are popular during times of higher borrowing costs because the hybrid notes’ equity component typically means interest rate payments are lower than regular debt. They allow companies to borrow at lower rates than regular debt — in some cases for free.

The notes also give investors the chance to profit from a rise in the underlying share price, which is attractive in volatile markets.

What Bloomberg Intelligence Says:

Lenovo’s proposed $2 billion convertible bond (CB) issuance to Saudi Arabia’s sovereign wealth fund offers inexpensive funding for expanding into the Middle East and Africa. It plans to build a new PC and server manufacturing facility in the Kingdom of Saudi Arabia. The new CB has a zero-percent coupon while its 3-year straight bond yield is around 5.8%.

-Cecilia Chan, Bloomberg Intelligence

Alibaba Group Holding Ltd. last week sold $4.5 billion in debt that can be turned into equity, a record for convertibles denominated in dollars by an Asian company, with part of the proceeds to be used to buy back shares. That came just days after rival online retailer JD.com Inc. sold a total of about $2 billion of such notes.

Lenovo reported its third straight quarter of net income on a recovery in PC sales and booming investment in servers and other networking equipment to support artificial intelligence. But it logged an operating loss on a shortage in supplies of AI accelerators.

Lenovo’s interest expense of 56% of profit before tax is “quite high,” said Ke Yan, head of research at DZT Research in Singapore. The funds raised from the bond issue would pay down some debts and lift the bottom line at a higher percentage than the resulting dilution, he said.

“It’s giving up a 12% stake eventually, getting funding now, and getting strategic help,” said Vey-Sern Ling, managing director at Union Bancaire Privee.

--With assistance from Shikhar Balwani and Andrew Monahan.

(Updates with background on the PIF’s investment push in the fourth paragraph)

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

The Budget Geeks Who Helped Solve an American Economic Puzzle

Israel Seeks Underground Secrets by Tracking Cosmic Particles

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance