Supermarket wars to intensify with Lidl's £500m investment spree

Bad news for Tesco (TSCO.L) — the discount supermarket wars show no signs of slowing down.

Lidl on Wednesday announced plans to open 40 new stores in London as part of a £500m expansion plan that will create around 1,500 jobs.

The major investment will take place over the next five years, and includes the creation of Lidl’s first central London store in Tottenham Court Road.

“Our £500m investment reflects the scale of opportunity we have to bring our quality produce to even more of the capital’s communities, at prices that make it affordable to everyone,” Lidl’s UK chief executive Christian Hartnagel said.

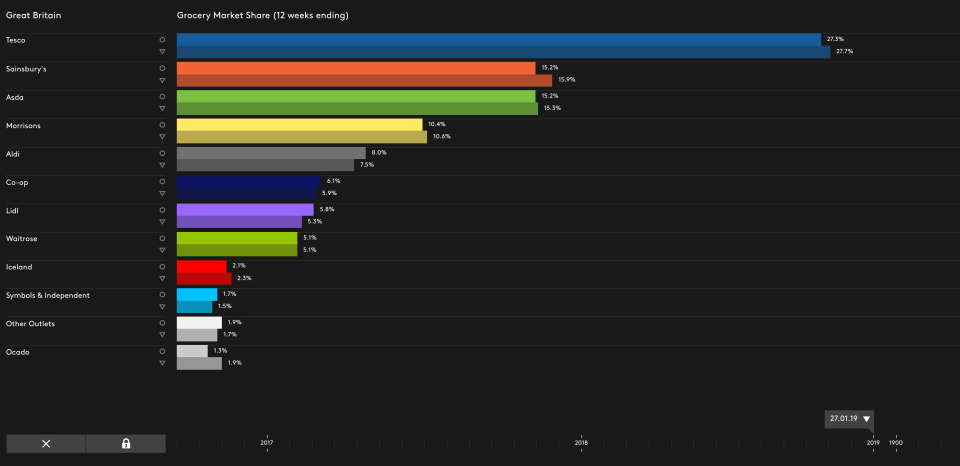

The investment is bad news for the UK’s traditional “Big Four” supermarkets — Tesco, Sainsbury’s (SBRY.L), Asda, and Morrisons (MRW.L). The group have battled for years against the seemingly inexorable rise of German discounters Aldi and Lidl.

It is particularly bad news for Tesco, which has been losing ground to Aldi and Lidl despite efforts to compete through its own discount chain Jack’s. Jack’s launched in September but has had little impact on the supermarket landscape so far.

“The tough retail environment appears to have been borne out by the latest Kantar data, which showed that the UK’s number one supermarket share dropped to 27.3% at the end of last month from 27.7% a year ago,” Michael Hewson, chief market analyst at CMC Markets, said.

“Once again this has been due to the discounters Aldi and Lidl eating into its market share, with the Co-op also staging a comeback.”

Tesco reports first quarter trading numbers and hosts its annual general meeting with shareholders on Thursday. Hewson said that tomorrow’s numbers are likely to show “be a reminder that the tough retail environment is likely to remain a drag on profit margins over the next few months.”

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

'Untold damage' from Brexit sparks 'extraordinary' drop in UK car production

SoulCycle CEO 'very bullish' on London as first UK studio opens

Crypto will 'fundamentally transform human interaction,' says premier of Bermuda

Government scheme to help small businesses 'at risk of failure'

Crypto business 'gutted' by regulation and millions in legal fees

Yahoo Finance

Yahoo Finance