Light on Leverage, Heavy on Advantages

When most investors think of leveraged exchange traded funds, they think of sexy and sometimes controversial double- and triple-leveraged funds.

The ProShares UltraPro Short QQQ ETF (SQQQ) , Direxion Daily Financial Bull 3X Shares (FAS) and the Direxion Daily Gold Miners Bear 3X Shares (DUST) are popular examples.

In January, Direxion, the second-largest issuer of inverse and leveraged ETFs, introduced four new ways for investors to add some pep to their portfolios without the volatility associated with double- and triple-leveraged. The so-called lightly leveraged ETFs are leveraged to the tune of 1.25, not the double or triple leverage investors have become accustomed to. [A Conservative Way to ETF Leverage]

Those ETFs are the Direxion Daily S&P 500 Bull 1.25 Shares (LLSP), Direxion Daily Small Cap Bull 1.25X Shares (LLSC), Daily FTSE Developed Markets Bull 1.25X Shares (LLDM) and the Direxion Daily FTSE Emerging Markets Bull 1.25X Shares (LLEM) .

These new products offer advantages, including a significant reduction in the negative effects of daily compounding over longer periods, allowing for longer holding periods for the investor. But wait. There’s more.

Direxion’s lightly leveraged ETFs have the potential to offer significant outperformance of their non-leveraged counterparts. Back-tested results provided to ETF Trends by the issuer confirm as much. Dating back to the first quarter of 1995, a 1.25 times leveraged version of the S&P 500 has outperformed the non-leveraged equivalent by almost 40 basis points per quarter, according to Direxion data.

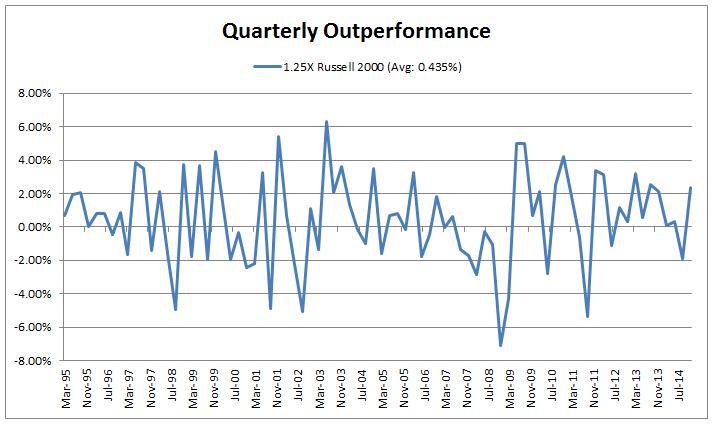

From the first quarter of 1995 through the end of 2014, a span of 80 quarters, a 1.25x leveraged version of the S&P 500 in about 60 of those 80 quarters. The difference is even more pronounced with small-caps where the 1.25x leveraged version of the Russell 2000 outperforms its unleveraged counterpart by nearly 44 basis points per quarter, according to Direxion data.

If LLSC, the lightly-levered small-cap ETF, had been around since 1995, it would have outpaced the traditional Russell 2000 in nearly two-thirds of the quarters through the end of last year. [A Gentler View of Leveraged ETFs]

Chart Courtesy: Direxion

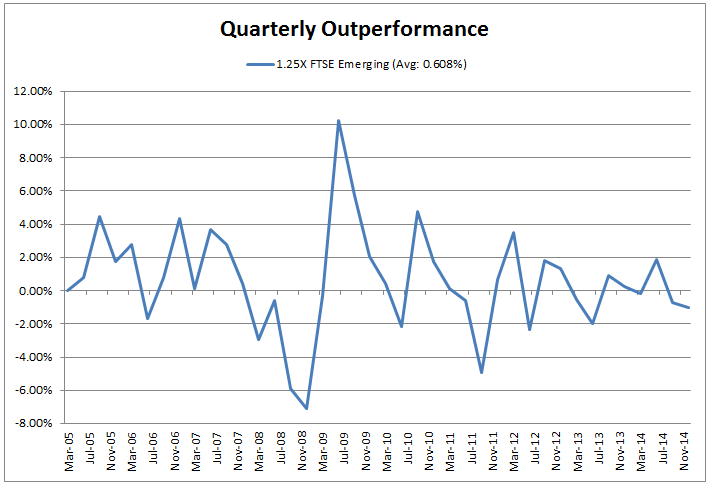

The outperformance offered by lightly-leveraged ETFs is not confined to U.S. boarders. Direxion’s backtested results of 1.25x leveraged versions of the FTSE Developed ex North American Index and the FTSE Emerging Markets Index date back to March 2005 and the results are solid.

Applying 1.25x times leveraged to the FTSE Developed ex North American Index, the benchmark for the Vanguard FTSE Developed Markets ETF (VEA) , results in quarterly outperformance of almost 25 basis points. The advantage is even wider when adding that extra bit of leverage to the FTSE Emerging Markets Index. In that instance, a 1.25x leveraged version of that index delivered quarterly outperformance of almost 61 basis points, according to Direxion data.

Chart Courtesy: Direxion

Yahoo Finance

Yahoo Finance