Lindsay (NYSE:LNN) Reports Sales Below Analyst Estimates In Q2 Earnings, But Stock Soars 14.8%

Agricultural and farm machinery company Lindsay (NYSE:LNN) fell short of analysts' expectations in Q2 CY2024, with revenue down 15.4% year on year to $139.2 million. It made a GAAP profit of $1.85 per share, improving from its profit of $1.53 per share in the same quarter last year.

Is now the time to buy Lindsay? Find out in our full research report.

Lindsay (LNN) Q2 CY2024 Highlights:

Revenue: $139.2 million vs analyst estimates of $144.4 million (3.6% miss)

Announced multi-year supply agreement to provide irrigation systems and other technology to a customer in the Middle East and North Africa (MENA) region, project valued at $100+ million (largest in Lindsay's history)

Operating income: $19.9 million vs analyst estimates of $17.5 million (13.7% beat)

EPS: $1.85 vs analyst estimates of $1.17 (57.8% beat)

Gross Margin (GAAP): 33.4%, up from 32.3% in the same quarter last year

Free Cash Flow of $25.76 million is up from -$21.57 million in the previous quarter

Market Capitalization: $1.25 billion

“Market conditions in our irrigation segment continue to weigh on farmer sentiment, resulting in demand softness. In North America, high precipitation levels and wet field conditions across the Midwest contributed to lower sales of irrigation equipment and replacement parts during our third quarter," said Randy Wood, President and Chief Executive Officer.

A pioneer in the field of center pivot and lateral move irrigation, Lindsay (NYSE:LNN) provides a variety of proprietary water management and road infrastructure products and services.

Agricultural Machinery

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

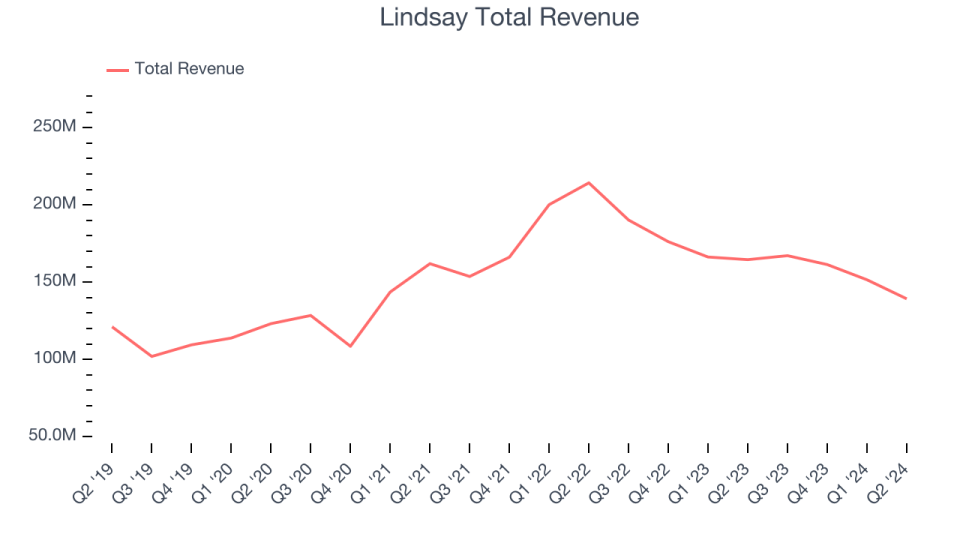

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Unfortunately, Lindsay's 5.9% annualized revenue growth over the last five years was sluggish. This shows it couldn't expand its business in any major way.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Lindsay's history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 8.2% annually. Lindsay isn't alone in its struggles as the Agricultural Machinery industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, Lindsay missed Wall Street's estimates and reported a rather uninspiring 15.4% year-on-year revenue decline, generating $139.2 million of revenue. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

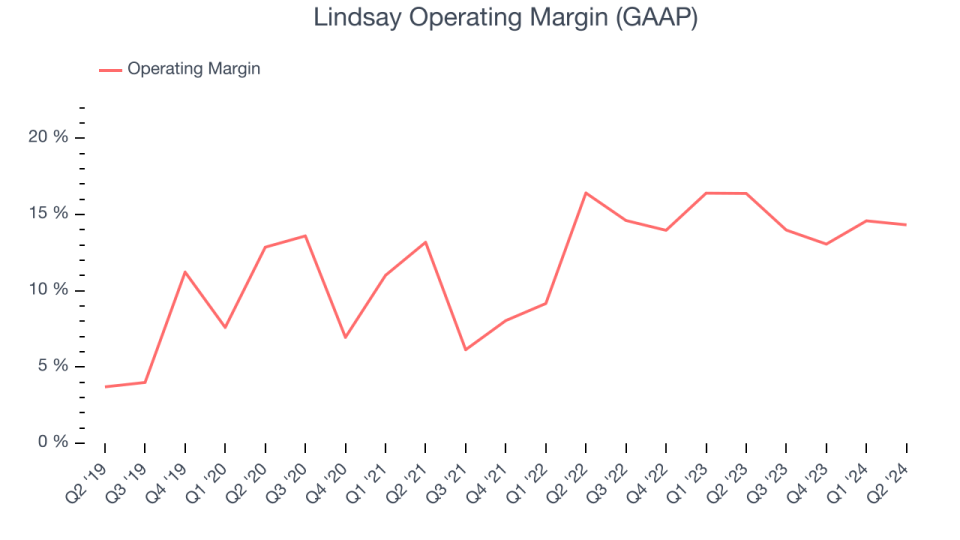

Operating Margin

Lindsay has been an efficient company over the last five years. It demonstrated it can be one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.2%. Furthermore, Lindsay's operating profitability was impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it's a show of strength if they're high when gross margins are low.

Analyzing the trend in its profitability, Lindsay's annual operating margin rose by 4.9 percentage points over the last five years, showing its efficiency has improved.

In Q2, Lindsay generated an operating profit margin of 14.3%, down 2.1 percentage points year on year. Conversely, the company's gross margin actually rose, so we can assume its recent inefficiencies were driven by increased general expenses like sales, marketing, and administrative overhead.

EPS

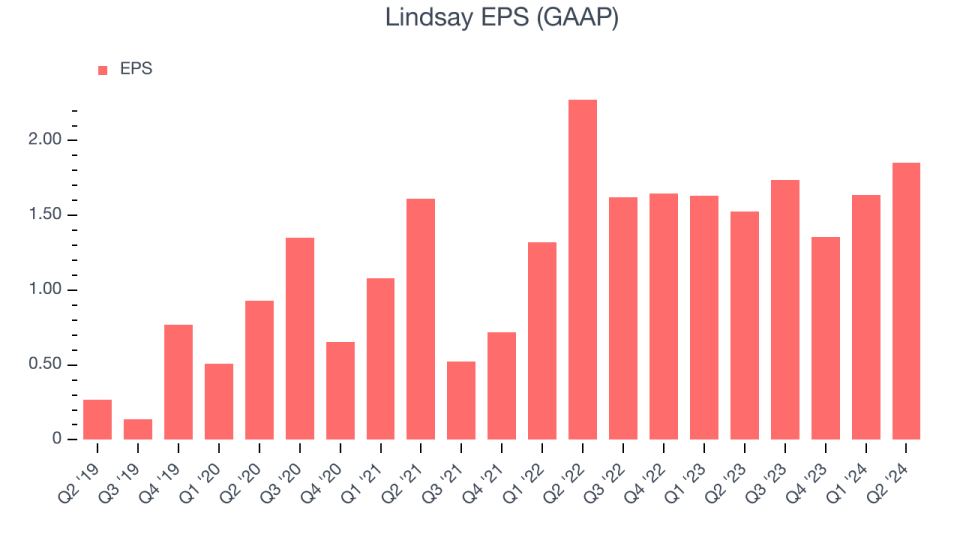

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Lindsay's EPS grew at an astounding 66% compounded annual growth rate over the last five years, higher than its 5.9% annualized revenue growth. This tells us the company became more profitable as it expanded.

We can take a deeper look into Lindsay's earnings to better understand the drivers of its performance. As we mentioned earlier, Lindsay's operating margin declined this quarter but expanded by 4.9 percentage points over the last five years. This was the most relevant factor (aside from revenue) behind its higher earnings; taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For Lindsay, its two-year annual EPS growth of 16.6% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q2, Lindsay reported EPS at $1.85, up from $1.53 in the same quarter last year. This print beat analysts' estimates by 57.8%. Over the next 12 months, Wall Street expects Lindsay to perform poorly. Analysts are projecting its EPS of $6.58 in the last year to shrink by 19.9% to $5.27.

Key Takeaways from Lindsay's Q2 Results

We were impressed by how significantly Lindsay blew past analysts' EPS expectations this quarter, driven by operating margin outperformance versus Wall Street's estimates. Additionally, the company announced a significant customer win (the largest contract signed in history, in fact). Overall, we think this was a really good quarter that should please shareholders. The stock traded up 14.8% to $130 immediately following the results.

Lindsay may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance