Lockheed (LMT) Wins Contract for H-60 Helicopter Support

Lockheed Martin Corporation’s LMT Rotary and Mission Systems (“RMS”) business segment recently clinched a modification contract involving its H-60 helicopters. The award has been offered by the Naval Air Systems Command, Patuxent River, MD.

Details of the Deal

Valued at $13.2 million, the contract is expected to be completed by November 2026. Per the terms of this deal, Lockheed will deliver 105 mission computer retrofit kits, 28 flight management computer retrofit kits and 100 Lynx and 55 Redhat software licenses, all in support of the H-60 aircraft.

The contract will serve the U.S. Navy, along with the governments of Australia, Denmark and Saudi Arabia. Work related to this deal will be executed in Owego, NY.

What’s Favoring Lockheed?

As nations across the globe continue to strengthen their defense structures, spending on military arms and ammunition that boast technologically advanced features continues to increase manifold. This also includes increased investments in military helicopters that play a critical role in air warfare missions.

To this end, Lockheed’s H-60 fleet of Black Hawk military helicopters, built by its Sikorsky unit, serves the U.S. military and the armed forces of 34 other countries worldwide. Today’s Black Hawk is equipped with digital avionics, powerful GE engines, high-strength airframe structures and composite wide-chord rotor blades. It can fly higher and carry more than its predecessors.

The H-60 is a medium-sized multi-mission military aircraft being used on a large scale for infiltration and exfiltration of troops and search and rescue missions. Such remarkable features of this helicopter must have resulted in solid order flows for Lockheed, like the latest one.

Currently, 2,135 H-60 designated aircraft are in service with the U.S. Army. This reflects the solid demand that Lockheed’s H-60 helicopter enjoys in the combat helicopter market.

Growth Prospects

Rising military conflicts, terrorism, border disputes, territory invasions and violations have forced nations to increase their defense spending toward procuring combat-proven helicopters to enhance their aerial security in recent times. To this end, the Mordor Intelligence firm expects the military helicopters market to witness a CAGR of more than 2.9% during the 2024-2030 period.

Such market projection offers strong growth opportunities for Lockheed, with the company boasting a robust portfolio of combat-proven programs like Black Hawk, MH-60R Seahawk, HH-60W Combat Rescue, CH-148 Cyclone, S-97 Raider and CH-53K King Stallion heavy-lift helicopters. In 2023, Lockheed delivered 52 aircraft to government helicopter programs.

Other defense primes that may reap the benefits of a likely improvement in the military helicopter market have been discussed below.

Airbus Group EADSY: Airbus’ military helicopters are used by more than 100 armed forces worldwide. EADSY’s product portfolio includes the H135 military training, the H145M, H160M, H175M, H215M, H225M and a few more. In 2023, 52% of the Helicopters segment’s revenues came from the defense sector and it delivered 346 units.

EADSY boasts a long-term (three-to-five years) earnings growth rate of 12.4%. The Zacks Consensus Estimate for 2024 sales indicates an improvement of 9.5% from that reported in 2023.

Boeing BA: Boeing’s Defense, Space & Security segment offers a broad portfolio of combat helicopters and rotorcraft. In 2023, the segment delivered 20 CH-47 Chinook, 77 AH-64 Apache and 2 MH-139 Grey Wolf helicopters.

BA boasts a long-term earnings growth rate of 4%. The Zacks Consensus Estimate for 2024 sales indicates an improvement of 12% from that reported in 2023.

Textron TXT: Textron’s Bell offers a robust portfolio of combat-proven helicopters like the Bell 360, V-280, AH-1Z, V-22 and many more. Bell is currently working on a new rotorcraft, the Bell 360 Invictus, for the U.S. Army's Future Attack Reconnaissance Aircraft Competitive Prototype Program. The Bell unit ended 2023 with a backlog of $4.78 billion.

TXT has a long-term earnings growth rate of 10.1%. The Zacks Consensus Estimate for 2024 sales indicates an improvement of 7% from the 2023 reported figure.

Price Performance

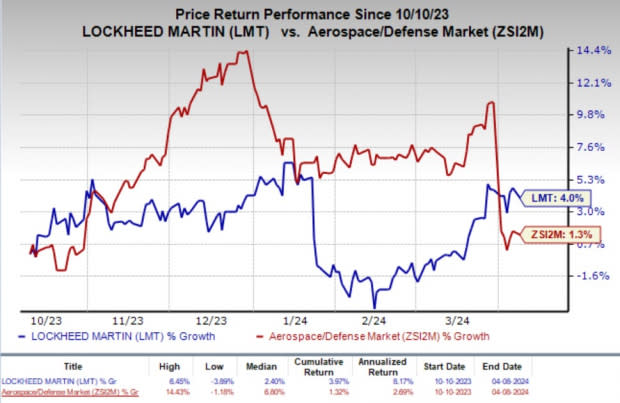

In the past six months, shares of LMT have gained 4% compared with the industry’s 1.3% rise.

Image Source: Zacks Investment Research

Zacks Rank

Lockheed Martin currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance