Lockheed (LMT) Wins Contract to Support F-35 Jet program

Lockheed Martin Corp.’s LMT business segment, Aeronautics, recently clinched a contract involving its F-35 aircraft program. The award has been provided by the Naval Air Systems Command, Patuxent River, MD.

Details of the Deal

Valued at $31.2 million, the contract is expected to be completed by January 2025. Per the terms of the deal, Lockheed will provide production and non-recurring engineering support for landing gear design, redesign, and analysis to boost the ability to produce and deliver the F-35 landing and arresting gear system.

LMT will also offer engineering efforts for correcting component deficiencies in production line cut-in and engineering release to support all three variants of F-35 aircraft. Work related to this deal will be carried out in Fort Worth, TX.

What’s Favoring Lockheed?

Thanks to rapidly increasing global security threats, nations worldwide are reinforcing their military capabilities to strengthen their borders. In this backdrop, it is imperative to mention that technologically advanced fighter jets like F-35 play a crucial role in defending a nation’s security, with aerial strength constituting a critical part of a nation’s defense structure.

Therefore, as nations are investing heftily in their aerial arsenals, major combat aircraft manufacturers like Lockheed are witnessing a solid flow of contracts, like the latest one.

Notably, Lockheed’s F-35 program is the most lethal fighter jet in the world and delivers unrivaled advantage to its customers. Equipped with advanced sensors and communications suites, it can serve across every domain, including air, land, sea, space and cyber.

Such remarkable features must have been boosting the demand for this jet, which, in turn, has enabled Lockheed to deliver 992 F-35 airplanes to date, with 373 jets in the backlog as of Mar 31, 2024. The latest contract win is yet another testament to the solid demand that the F-35 jets enjoy in the combat jet market.

Growth Prospects

Amid the evolving dynamics of aerial warfare, technological advancements in areas such as stealth, unmanned aerial vehicles (UAVs), and artificial intelligence have significantly enhanced the capabilities and mission readiness of combat aircraft. This, along with rising defense budget from developed as well as emerging markets like Brazil and India, have been significantly fueling the demand for fighter jets. This might have prompted the Mordor Intelligence firm to project that the global military aviation market will witness a CAGR of 5.2% during 2024-2030.

Such projections indicate immense growth opportunities for prominent combat jet manufacturers like Lockheed. Notably, its Aeronautics segment is engaged in the research, design, development, manufacture, integration, sustainment, support and upgrade of advanced military aircraft, including combat and air mobility aircraft, unmanned air vehicles and related technologies. The company’s fighter jet portfolio includes C-130 Super Hercules, F-16 Fighting Falcon jet and F-16 Fighting Falcon, in addition to F-35 jets.

Peer Opportunities

LMT apart, a few other defense players that can gain from the expanding military aviation market are Airbus SE EADSY, Boeing BA and Northrop Grumman NOC.

Airbus’ military aircraft consists of A400M, C295 tactical transporter, the new-generation A330 Multi Role Tanker Transport and Eurofighter, the most advanced swing-role fighter ever conceived. The company delivered a total of 1,783 military aircraft as of Dec 31, 2023.

EADSY boasts a long-term (three-to-five years) earnings growth rate of 17.9%. The Zacks Consensus Estimate for Airbus’ 2024 sales indicates an improvement of 8.2% from the top line reported in 2023.

Boeing’s product portfolio includes a range of combat-proven aircraft like the F/A-18 Super Hornet, P-8, C-17 Globemaster III, EA-18G and a few more. In 2023, Boeing delivered 22 F/A-18s, nine F-15s, three T-7A Red Hawks and 11 P-8 models.

BA boasts a long-term earnings growth rate of 25.5%. It has a trailing four-quarter average earnings surprise of 17.83%.

Northrop Grumman has built some of the world’s most advanced aircraft, ranging from the innovative B-2 Spirit stealth bomber to the game-changing E-2D Advanced Hawkeye. The significant awards won by NOC in 2023 included $2.1 billion for F-35 programs, $1.7 billion for E-2 and $1.5 billion for Triton.

NOC boasts a long-term earnings growth rate of 8.7%. The Zacks Consensus Estimate for Northrop Grumman’s 2024 sales indicates an improvement of 4.6% from the top line reported in 2023.

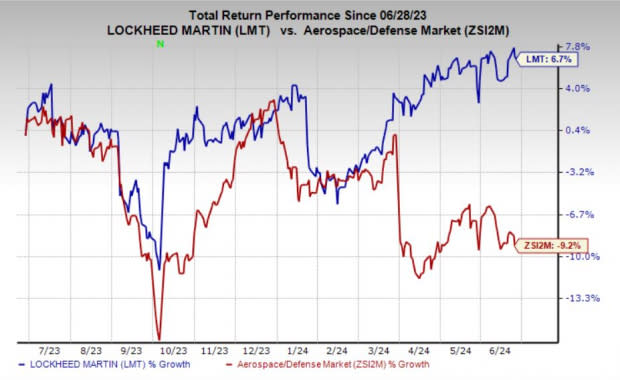

Price Performance

In the past year, shares of LMT have surged 6.7% against the industry’s 9.2% decline.

Image Source: Zacks Investment Research

Zacks Rank

Lockheed currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance